Last week, I was the target of a ransom attack. I chose not to pay, accepting there may be consequences. I’m betting against the attackers.

Before we get into the details of the threatening attack, I need to share something else with you. It’s important, and months in the making.

2024 has been a transformational year. For me at least.

In 2023 I called it quits on several business efforts that were not working. From my perspective, things were way off track. Making that call was uncomfortable. With the benefit of hindsight, it looks like my instinct was spot on. Things played out about as I expected. That means not making the call to part ways and move on would have been a huge mistake.

That got me thinking about past instincts, decisions made, and how things worked out. Trusting an instinct takes guts. It’s uncomfortable, initially. It usually means going against the consensus.

Worse yet, people defend the consensus. Sometimes, they punish you for questioning things, or opting out of the herd. Even as the herd marches orderly towards slaughter. The reason they do this is, your compliance validated them. It reassures them.

Think about this with voting. People seem to flood conversations with antagonistic bait in the run-up to an election. We know there are inevitably about 50% who favor one side over the other. Yet people engage in tense conversation. They need to convince you to accept their way of thinking.

I’ve tested this. As an unregistered voter, my response is, “You’ve given me a lot to think about.” That prompts a firmer explanation of what I already endured. Then comes the, “You have to vote…”

But I don’t have to vote. It’s not a requirement. It’s an option. What my intellectual attacker really means is, if I come around to agree with their view of things, essentially agreeing to vote as their proxy, they’ll feel validated.

I’m Not a Proxy

While I fully expect many of you to comment below on how I should start voting…It’s merely a current events example of a theme I noticed running back to the early years of my life. In fact, as far back as I can remember.

What happened last year for me in business was the equivalent of a first officer in the right seat of a Boeing cockpit telling the left-seated captain, “We’re off course.” The captain placates the officer. Then after another warning becomes stern. Finally, unplugging the first officer’s headset microphone. That’ll shut them up.

The respectful move is to get off the plane at the next stop. Thank you, I’m moving on. Bad thinking eventually yields bad outcomes. It’s a matter of time before that captain overshoots a runway.

And it’s not personal, the captain doesn’t wake up planning to disrespect the first officer. Further, would never intentionally put the passengers in danger. But also, doesn’t take in information that disagrees with how he sees things. That’s what leads to trouble.

The more I thought about this, the more I noticed a pattern. Going back to the third grade, when our esteemed teacher Dorothy “Dottie” Alfred tossed me from class for asking why Q did not immediately precede U in the alphabet. She harped on Q always preceding U in written text, why have it 5 spots to the right on that alphabet tacked above the blackboard…

Tossed, I mean ejected, and sent for a psychological evaluation. It seems harsh, and it was. But it landed me in an alternative learning arrangement that later proved essential to success.

I tell that story in my new book, and even dug up a copy of the psych eval from 1987. It’s fun to read in light of how things worked out. I think Dottie passed away years ago. She was a heavy smoker, married to a tobacco executive.

That was a common arrangement in Wilson, NC…where I grew up. It’s an odd place. I spent the first 13 years of my life trying to escape. It was fun to return there earlier this month to investigate my quad burial plot, which I likely will not use.

A Pattern Emerges

As far back as I can remember, things played out this way. Questioning the narrative met heavy resistance. You’ll see how it ultimately left me stranded at an institutional work camp for “troubled teens” in the panhandle of Northern Idaho for thirty months. That’s right… thirty.

I didn’t want to cause problems. Even today, I don’t want other people to stop voting…I just don’t want to start. And that bothers people.

However, the twists and turns of my path tend to lead to higher ground. One by one I recount the highlights of this journey, especially in the early years. It’s clear when I trust my instinct, politely say no thank you I’ll go my own way, it’s the right move.

That’s why the book title is, Not For Sale: How To Survive and Thrive in a World That Wants to Control You.

I want to share these stories, and others, with you. While I might regret it years from now, I believe it’s the right thing to do. For me at least.

This is a vulnerable book. People in my position tend to work hard on keeping the veneer polished. It’s bad form to talk about being fired, running away, being abused, or outright failure at things we’re supposed to do well. Especially in deeply personal parts of life.

But I think you need to know where people come from, what happened, and how they got here. There might be things you don’t want to talk about, or don’t know how to talk about. Seeing how someone else navigated might change how you see your path.

I hope you’ll read my story. I also hope there’s some person in your life who’d benefit from this book, and you’ll pass it along to them. Here’s the link…

Now we’ll get back to the ransom letter I received last week.

The Ransom Letter

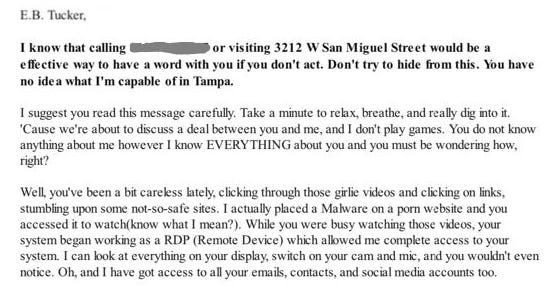

Nathalie Carbonneau says I need to send USD$2,000 worth of Bitcoin to the wallet address below. That’s if I want to avoid the humiliation of him or her sending my friends and colleagues an alleged trove of “filth” from my online viewing history.

One thing he or she is right about is $2,000 is a small price to pay for tranquility. I’m just not sure Nathalie can deliver that.

For starters, we can go out on a limb and assume Nathalie is a female. A quick search query shows the name Nathalie Carbonneau has high odds of being woman in French Canada. But let’s not assume gender, or anything these days. She identifies as a man in the letter above saying, “I’m a man of my words.”

I’ve never added an “s” to that phrase, but it does have a threatening ring to it. I too am a man of my words. Many words, all of which I mean.

People ask from time to time if I use AI tools to write. I never have, and don’t plan to.

The keyboard is a tether to the soul. Generating computer text using AI tools is what you’d expect from an extortion boiler room where Nathalie works. I write because I have things to say… That’s a motivation most people don’t understand.

However, these extortion techniques are impressive. The letter isn’t half bad. Here Nathalie says the video she has of my face while viewing “filthy” online material is, “straight fire.” That’s contemporary lingo meant to describe something as being popular on TikTok or another platform people hunch over staring at all day.

I bet this works on a lot of people. The email came from a Gmail address, and looked very normal. In fact, the TTL email filtering software let it right through.

Plus, Nathalie had the letter in PDF form…without any bizarre symbols or other common red flags. The file title was, “E B Tucker” without the periods. The E.B. needs periods to be correct.

Even the Tucker kids know this, and it’s fun to watch them print their given names and add periods at the end. I haven’t explained yet not everyone’s name has periods.

But Nathalie should know better. As you’ll see, she does use the proper presentation of my name in her salutation. Before launching into the threat.

Couple of issues here…Nathalie.

For starters, she lists an address on San Miguel Street. I did own this property for several years. But I did not live there.

My name was on the deed, and I took care of the expenses, etc. This was a way I chose to handle the ending of a relationship. As you’ll learn while reading my new book, I’m a pragmatist when it comes to leaving situations that no longer work for me.

Also, I do not live in Tampa. I did reside there at one time, and do keep some administrative function there related to back-office matters. But do not live there…which makes Nathalie’s claim of watching me view “filth” further questionable.

As for the surly resident I housed in the San Miguel Street house, she was free to view as much filth as desired. While at times disagreeable, she was a hip, open-minded person. Nathalie should notice that from all the evidence. However, I’m not sending $2,000 for her tranquility… I’ve more than done my part on that front.

The Strong Close

Every sales pitch needs a strong close. When it comes to extortion, the last line of the letter is most important.

Nathalie gives me one day to send the “Bitcoins” before unleashing her filthy trove. $2,000 technically is a fraction of a coin so I’d prefer she used the proper nomenclature.

Plus, the “Important: You got one day to…” just overall bothers me. I’m unlikely to perform the ask when anyone winds up prose that way.

It’s in line with people who send unpunctuated emails, especially all lower case. You better be too busy and important to use the shift key…and I doubt you are.

Or the people who send messages with disorganized syntax, I immediately lose enthusiasm for the spirit of their statement.

And if the stern threat isn’t enough… Nathalie encloses a photo of a house. This is a strong way to close… any suburban family man would be scrambling to enter the crypto wallet code she listed above… but not me.

Because it’s the wrong house.

My ignoring Nathalie’s threat might come back to haunt me. But I doubt it will.

I didn’t live in that house she referenced. It’s unlikely I ever used the Wi-Fi, especially to peruse the dark corners of the web…

She says she’s watching my camera, and I should cover it. But my computer doesn’t have a camera. When I videoconference, I use a tripod with a separate dedicated device. This avoids any digital interruption.

But her most important mistake was photographing the wrong house. I know because every time I went by to check on my surly tenant, I noticed that neighboring house. You’ll see in the photo it’s missing a white column, on the side with the flag.

There’s only one column at the entrance of that neighbor’s house. I always wondered what happened to the other one, and why they didn’t replace it. It’s an asymmetric feature, on an otherwise boring house.

So, Nathalie, I’m not sending you any “Bitcoins” or fraction of a Bitcoin. But I do admire your spirited attempt to extort me.

Gold Update

Gold hit an all-time high today, and last week, and several times so far this year.

More importantly, it’s one of the best-looking charts I’ve ever seen. It’s a stairway to heaven. Or maybe a stairway to a new monetary order forming right before our very eyes. We’ll only know later.

I’m not sure why people don’t see gold the way I do. I did my best to lay out the particulars of the yellow rock in my first book. It’s almost as if people didn’t read it. They wanted a way to get rich quick…and gold doesn’t do that.

It’s a get rich slow asset. That’s how I see it. And it’s the gamblers and compulsive loss-makers who seem to think I’m wrong.

Imagine if you directed a small percentage of regular earnings into gold, say even 5%. Through the ups and downs, and over say a 20-year career pushing paper at a regular job, you’d now sit on a pile of metal.

Slow and steady won that race. Your pile is ~28% more valuable today than it was at the end of 2023. That’s a decent move…and it’s not even dramatic.

It’s all about the percentages, the dollar amount tied to that percentage looks large these days…and they might get even larger.

No Shortage

Again, the gold community generally does not like me. I know that’s odd, but I’m like a preacher who says maybe the rapture approacheth…but it might be a while.

The way to build a big congregation is to promise imminent fireworks. I’m not sure about that when it comes to gold.

Here’s an example of the types of messages I get, almost daily. This one comes from TTL subscriber “S.” It’s verbose, so I’m cutting relevant parts to avoid confusion. Then we’ll discuss each. Also, I’m leaving the punctuation untouched:

“Non Western Central Banks ARE buying Physical Gold.

They ARE putting it in their vaults.

It started when the SWIFT system was weaponized against Russia.

It continues because The US administration is pressuring Europe

to confiscate Russian assets to the tune of $300 BILLION.

OK… I’m not sure what S does for work, but my suspicion is the central bank buying info comes from a combination of World Gold Council info and interviews on YouTube. Point here is, I doubt there’s been an in-vault inspection.

His comment sprung from my assertion last week that, “Nobody wants gold.” Which I hold out as true.

Recall I said maybe you do, maybe I do, but overall, people do not want gold.

Here’s some evidence… SD Bullion, online retailer of note, offered common, respected origin, 1oz coins for $30 over spot. Think about that… Gold at $2,650 and they’d sell you a coin for $2,680. There’s no way you can run a business on that margin…

Unless you buy the gold for less than spot. And that’s what dealers did for most of 2024.

Typically, the dealer buys your coins, sending them to an authorized purchaser or other form of wholesaler. Cash flow is tight in a business with ~1-2% margins.

This year, sellers overwhelmed buyers. Dealers often paid less than spot for coins… That allowed them to sell to people like you or me for a tiny margin, as SD did last week.

To be clear, this is not a statement of faith in SD Bullion. I’m a skeptic when it comes to all gold dealers, until I test them with a purchase.

The reason I post this is to suggest to S that perhaps there’s plenty of gold available.

As for the SWIFT comments… it’s complicated. The West has its agenda. If you live in the West and bet on collapse of the West, I really wonder how you reconcile the two. But I’ll wait for you to explain it to me in the comment section below.

Keep It Simple

Finally, from S, who makes reference to a hairstyle which is hard to decipher…[my comments]:

I am on my last hairstyle. [what?]

When the lockdowns were announced...

I bought some. [gold?]

I bought more. [more gold?]

This week I added some silver. [why bother?]

Have a great weekend. [thank you]

S.

OK S, please know I am not giving you a hard time… I loved the comment. And it’s perfectly in line with my divergent beliefs in the gold community.

Similar to thinking Bitcoin will not be the way I buy a sofa one day, I don’t own gold as a collapse bet.

In fact, I think gold moves up or down for reasons totally disconnected from physical market demand. The tail truly wags the dog.

Ounces traded in the futures market largely never face delivery. The futures volume is mammoth… many days it’s 30-50% of annual mine supply…in a day. Not one of those full COMEX bars stands for delivery.

And supply is fine…for now. Argentina just sent a large portion of its gold hoard to London to fill the gap. A little bit goes a long way to cooling pressure in the financialized gold market.

Let me just save us all some time and suggest this is Argentina playing ball with the Western system. Bars fed into the system form the base of leverage, and keep the futures market flexible.

S and the other gold bugs can direct comments below. But I am not on my last hairstyle. In fact, I plan to have several more of them allowing McKenna, my new hairdresser, to style according to the times.

Portfolio Review

22% in just over two weeks isn’t bad. Our latest pick is the result of good chart reading, and patience. Once our limit buy order hit, it took off, as we predicted.

While I liked what I saw on the screen, I needed to see, touch, and feel the product first-hand.