Jean Barnes had a preoccupation with death.

She lost her father as a child. My guess is that shaped how she lived her next 90 years. She was a meticulous planner, and a shrewd investor.

One afternoon in the mid-1980s she called to schedule a visit with my mother. That set off a frantic effort to prepare the house. Essentially, rid the place of any evidence children lived there.

My sisters and I watched with excitement from the upstairs window as her pristine Buick sedan inched up the driveway. She drove so rarely the car barely needed an oil change during 30 years of ownership.

Dressed in Sunday church clothes, made up, and heavily perfumed, she entered the sitting area. Shooed off on arrival, we did our best to eaves drop. The visit lasted about 15 minutes, then she left without much of a goodbye.

My mother looked rattled. It’s one thing to take a formal visit from your mother-in-law. It’s another when she leaves behind a photograph.

Tacked to our yellow fridge, this photo had our attention. We wanted to know why Mimi left a 5x7 matte print of herself in a noticeably formal outfit. Confused, likely disturbed, my mother told us, “This is how she wants to be buried.”

Long-Term Planner

Jean lived another roughly 30 years. I’m not sure how they dressed her for her funeral. I did not attend. We weren’t close.

What I do know is, she didn’t die unprepared.

Back in January 2003, she called me for a similar visit to the one I witnessed 15 years prior. Fresh out of college, my first job wasn’t much fun. I’d take any reason to check out for a few minutes.

She arrived at my office. After a brief salutation, I went in for the requisite cheek kiss. It’s required as part of the matriarchal greeting procedure, even though neither party seemed to enjoy it in our case. Plus, her heavy application of perfume before disembarking the Buick meant I needed to hold my breath on approach.

She tells me to take a seat. Then begins explaining she has a gift for me. It’s hard to follow, and feels awkward.

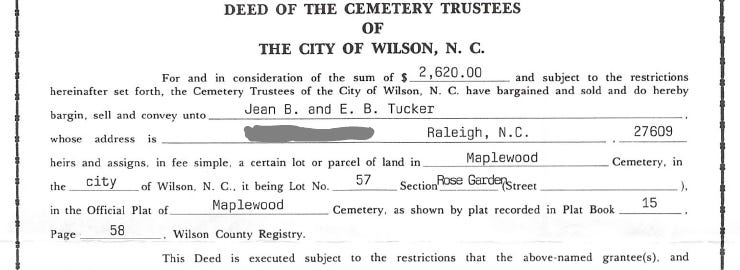

Mimi concludes the brief meeting by handing me an envelope. She explains there’s a deed inside. It’s a joint tenants claim to several cemetery plots. She goes on to say I should hold onto the deed, put it somewhere safe, etc., etc. I thanked her, and followed the instructions.

I didn’t think about it again for 22 years…until last week. While rummaging through a safe in search of a Cuban gold coin, I found the deed.

Investigate My Gravesite

I’m not planning on dying anytime soon… But if I do, it’s nice to know there’s somewhere to put me.

And not just me. Turns out, I own enough space for four people. It’s a quad-plot. Room for myself and three guests to spend eternity together.

Alternatively, I could take final rest in the position of da Vinci’s Vitruvian man with arms and legs fully outstretched. It’s nice to have options.

The deed makes clear I own the four plots.

As for the exact location, I had to go investigate for myself.

Maplewood Cemetery opened in 1876. Heather, the manager, tells me there are Confederate War veterans buried there. Several years ago, protestors rallied for removal of those grave markers. She’s relieved that’s behind them now.

She explains my plots are in the Rose Garden. I didn’t see any roses in the area, but this is an older part of the cemetery. Plus, two of my four plots are “road facing.” This evidently boosts the value.

Secondary Market for Cemetery Plots

Cemetery plots are real property.

Unlike other types of property, there’s no annual county tax due. That means once you purchase the plots, they’re yours forever.

People used to buy them grouped together. Families figured they could control where they’d end up. It seemed prudent to have the space secured before you need it. But that was the old days.

Heather tells me there’s low demand for plots today. She’s sold 10 this year…a record low.

“People like being cremated…it’s cheaper.”

Plus, there’s plenty of space. Maplewood has several large sections of freshly mowed grass ready for headstones…if demand picks up.

She says my sites could fetch ~$1,800 each. That’s roughly three-times what Mimi paid for them in 2003. The two roadside spaces might sell, good luck with the two interior spaces.

The cemetery does not help resellers. They only handle the initial sale, and grounds maintenance…forever. She advises if I’d like to sell, place an add in the newspaper.

She seemed unfamiliar with websites like Plot Brokers or Grave Solutions. There is a fairly robust secondary market for burial plots. You can search for available plots or list unwanted plots.

Try it Out

When I found the deed, I thought I’d sell these plots. I spent the first 15 years of my life trying to get out of Wilson, NC. The last thing I want to do is rest there forever.

However, I thought I should at least check out the plots before listing them.

This large chunk of grass is all mine. Maplewood will keep it manicured until I need it. Most likely, I’ll end up somewhere else. But it’s nice to know it’s there just in case.

A quick note on the shirt I’m wearing above. The Tucker kids advised I not wear it warning, “People will think you’re from Florida.” Which is sound advice. But my tennis partner David produces this and other prints you’ll rarely see on anyone else. He brought over a heap of samples last weekend. The company is B Fresh Gear. If you want to wear something your kids advise against, check it out.

Permanent Vs. Paper

I’m not sure the cemetery plots will be a big winner for me. But I think I’ll hang on to them anyway.

As Heather described the current pricing for plots, it sounded like the way private equity prices its assets. The listed price of fresh plots is $1,800 but the secondary market is opaque. Sometimes they sell for much less there. Heather pleads ignorance and keeps the official price at $1,800. She’s not the only one. This is the new way of pricing things.

We pride ourselves in having a free market. The premise is we have price discovery. That’s when buyers and sellers freely enter so many transactions we get an accurate price at all times. It’s like a pulse reading. And we do less of it these days.

Almost as if instead of reading your pulse, the nurse decides you look like a 55 so we’ll write that in the pulse section of your chart. It means you never get an accurate reading. It means you never spot the person who’s a few hours away from cardiac arrest.

Ignoring or abandoning accurate pulse readings means you never face the hard choices needed to avoid problems, like cleaning up your diet or dropping weight. Ignorance is bliss.

And it’s the approach we take with everything now. We feel rich if we believe the price of things.

We increasingly price everything the way the Maplewood Cemetery prices plots. There’s the listed price, and whatever you do off the books is your business.

The Private Equity Effect

I hear a lot of people talking about private equity. Most do not understand how it works.

Private equity is the house-flipper of the business world.

House-flippers buy with the intention of quickly improving the appearance, and reselling. They don’t think like an owner. They don’t choose quality repair materials like an owner. And they’re not prepared to make sacrifices to defend ownership through hard times.

That’s why the 2008 mortgage mess turned into the tidal wave of foreclosed property. The hairdressers who bought condos no-money-down never intended to live in them. It took several years to find more sophisticated house-flippers to buy the boarded-up shacks at pennies on the dollar. I know because I was one of them.

And just like the flippers of the 2000s, the private equity hounds buying pool cleaning companies today have no passion for cleaning pools. They plan to innovate, automate, consolidate, and liquidate.

The issue is, their lot is the only buyer. Private equity selling to private equity is the only way out. That’s why they need help from the Fed. And they’ll soon get it.

These flippers value the EBITDA (earnings before interest, taxes, debt service, and amortization) of a business. Pool company has $2 million revenue, and $200k of EBITDA.

An individual investor with cash saved up to buy a pool company might pay $300k for that business. That’s an 18-month grind to earn back the purchase price…likely working at the pool company.

The private equity troop has no intention of skimming leaves from the waterline. They offer 5-times EBITDA or $1 million for the business. The current owner’s head spins around.

With access to a large amount of borrowed funds, these finance alchemists figure they’ll buy up every pool cleaner in the tricounty area. They’ll fire most of the administrative staff using one office to run the business.

Within weeks, they’ll conduct a private valuation of their new business factoring in the intention to scale it up to a blah, blah, blah. With the new valuation in hand, they’ll take out a huge loan securitized by the newly combined business. This loan fully repays the investment firm for its initial gamble.

However, it saddles the new firm with heavy interest payments. The old owners didn’t read the fine print requiring they “earn out” the balance of the big million-dollar payday that headlined the buyout offer. And that’s difficult with the place gutted.

The only hope for the newly amalgamated American Pool Pros is a cheaper source of funding. Lower interest rates give the firm a chance to refinance the blob of debt casting a shadow over the pool trucks. This is the equivalent of house-flippers hoping a new FHA mortgage rebate might help them ditch the house they wish they never bought. They just want it to be someone else’s problem.

Why Gold is at All-Time Highs

Like Ray Bradbury’s description of the “parlor walls” in Fahrenheit 451, central planners know they need to disorient you to keep you calm. To keep you believing the pile of stuff you shed sweat to earn is worth what you think it is.

The “Fed News” tab on the Bloomberg has at least 400 articles per day. It shows 20 per page. After 20 pages, I can’t accurately look for yesterday’s articles.

These amount to carefully curated messaging. They manage belief by delicately balancing our natural impulses of fear, hope, and greed.

It’s propaganda in the purest sense. Edward Bernays called it managing consent. In fact, he invented the technique.

Free markets don’t need carefully curated headlines. They rely instead on investors and then speculators to take things too far. When the dumb money dries up, the market craters. Picky investors stand by waiting for a price they can live with. That’s the old way…

And it’s too messy. Too hard to control. It seems like we decided two decades back we’d manage, massage, and contain this market force. So far, it works.

We’re a nation of speculators. Mesmerized by chance to hit it big, we want action. At the same time, we fear calamity. When I listen to people, they express fear we’re in for a huge crash. Shortly after, they’ll want to know what I think is hot to buy right now.

I understand why they think this way. There’s no helping them. If I stared at the parlor wall all day watching 400 headlines roll by I’d feel just like them. But I don’t. In today’s postscript, I’ll tell you why.

But first, we’ll look at the gold chart. It tells us all we need to know.

Subscriber O. Otte commented last issue:

“I like hearing what you say about Gold. It’s always nice when you can share your latest insight on it.”

Gold sits comfortably at an all-time high. $2,510 as I type. That’s ticking up and likely will finish the day around $2,525.

I say that because of the pattern of trading. Not the chart… merely the action paired with the headlines.

The price quoted above is for spot gold, physical gold. The action however is in the futures market. That’s paper gold. And paper gold sets the price of real gold.

Nobody wants real gold. Sure, maybe you do. But you’re the only one.

I don’t know one professional institutional fund manager in New York sitting on physical gold. Not one.

They might have an option trade, a swap, or a synthetic long on gold…but not one vaults the metal.

The reason is, it’s deemed a waste of capital. It ties up money that could be used for some other quick flip trade.

I get that… and I’m not saying they’re wrong. However, that collective approach to gold ownership is why we have this event at 8:30 AM New York time almost daily.

It’s why we see 23,000,000 ounces of paper gold trade in these spikes at the bottom of the chart below. It’s the chart of the current active futures contract. That is a synthetic bet on the price of gold in December.

Meanwhile, on the same day, a mere 53 contracts for physical gold change hands. That’s the September gold futures contract which delivery-minded buyers might use.

Paper rules, and it’s cheap. The 100-ounce futures contract costs a mere ~$11,000 to hold. That means it only ties up ~$110 per ounce. Plunk down $110 and capture the benefit of gold moving from $2,509 up to $2,525 today…then sell and recover your $110 plus the difference.

Better yet, calculate the best price for an option on the right to do that in say November, or December. Buy that for pennies, capture the move back up in gold this afternoon following the 8:30 AM liquidation, and you’d turn dimes into dollars.

This is how the gold market works.

Since nobody wants physical gold, there’s no problem.

Gold bugs say eventually people will…and could be true. But it’s not material. A few pallets here and there, a few coins in your safe, it’s dead money…and few have the patience.

Finally, for those gold bugs, just remember when you see headlines like this… the system you fight might outlast your ideology.

Fresh supply in London vaults ready to be hypothecated. That means lent out, margined, re-margined, and otherwise tethered to a long string of paper gold trades nobody intends to own. It’s the acorn with an oak on top. In simple terms, it’s the reason why the gold price won’t advance higher with a lurch.

However, the gold chart going back to when central planners put us on this paper path might be the best looking chart I’ve ever seen. I wonder if Jean Barnes would be a buyer, and patient holder. I bet so.

Let’s get into the portfolio now. We had a limit buy order triggered right where we expected…and we need to update the situation.

Portfolio Update