What you can’t see is the guy with a machine gun standing 4 feet to the left.

He’s locked inside the vault with us. His colleague is on the other side of the caged door armed with the same equipment.

I didn’t count how many of them there were in total but my feeling was you’d be Swiss cheese before getting close enough to find out.

We’re holding “Good Delivery” bars. That’s what the London Bullion Market Association (LBMA) calls them. They’re roughly 400 troy ounces. The weight can vary. It’s the purity, form, and refiner who produced them the LMBA cares about. Good Delivery bars are the only ones accepted by the London exchange for settling trades.

It’s important to get the gold lingo right. A gold troy ounce is not the same as an ounce of USDA prime beef. That’s 28 grams. The gold ounce is 31.1 and some change. An important distinction.

The same goes for a tonne of gold. That’s 1,000 kilograms. A short ton of potatoes weighs 907 kilograms, or 2,000lbs.

Let’s not get off topic. The point is, I’m holding ~$800,000 worth of gold.

Holds Up Under Pressure

I’m in this vault because of the man standing to my left. He’s one of the best gold dealers I know. By best I mean most trustworthy. He’s also fun to talk to. I’m including his contact information in the Trustee Portfolio this week. Be sure to tell him he looks great in the picture.

He invited me to see one of the largest private vaults in the country. I’ve been to the New York Fed vault. I’ve seen safe rooms, bank vaults, and secure distribution facilities, but this one stood out. I couldn’t say no to the invitation.

What fascinates me about gold today is how misunderstood it is. In the picture, the three of us have a combined ~$2.4 million worth of gold in our hands. Outside of theft, that $2.4 million has no enemies.

Every other asset in the world has an enemy to worry about. For instance, if you have a rental house, your tenant needs to pay on time. If you own a stock, you count on company management to turn a profit and avoid poor decisions. Every asset is someone’s liability. Except gold.

That’s the whole point of owning a little gold. It’s a cellar to hide in during a monetary tornado.

The Fed’s Money Tornado

The Fed turned us into credit junkies. All of us. Now it’s turning off the supply.

After more than 20 years of using more debt to fix every problem, our economy is credit-dependent. It means access to debt determines asset values.

Prior to this radical money experiment, we largely had a market-based system. Workers saved a portion of their income turning them into investors. Companies earned the trust of investors in turn using those investment dollars to grow. If things got out of hand, we had a recession. Stronger hands prevailed and those companies took market share when the dust settled.

The key to this market system was investment capital. The value of hard-earned savings. Thrifty choices turned into capital. Investors didn’t let that capital stray too far. They remembered how difficult it was to earn.

That all stopped around 2000. We entered the age of easy money.

Consulting giant McKinsey & Company has a report on wealth growth since 2000. It shows how wealth outpaced GDP growth by a factor of roughly 4-to-1.

What this means is asset values surged while the engine of the economy barely grew. Imagine owning a Honda Civic and adding accessories thinking it makes the car nicer. Sound system, wheels, spoiler, lights, horns, and eventually you can barely recognize it. But under the hood, it’s an aging Civic.

Worldwide GDP stands at ~$97 trillion today. Asset values at over ~$500 trillion. Liabilities matching.

Without continuous quantities of cheap debt, this system stops working.

This affects all of us. Think about it in the context of your home. Most houses appreciated at a modest pace in the 1980s and 90s. Where I lived at that time, values grew around 3% per year. That roughly matched the pace of GDP growth.

Then in 2000, tech stocks crashed. We had a recession. The Fed cut rates to artificially low levels to soften the blow. This changed the way homes appreciate.

Say your home had a value of $200,000 in the 1990s. You carried a mortgage with a rate of 6% and hoped to pay it off some day.

New buyers now had access to 5.75% mortgage interest rates. That meant greater borrowing capacity even if their income matched yours.

This works like walking into an auto dealer with a monthly payment capacity of $500. You ask the dealer how much car that gets you. You have no awareness of the total price, only what you can afford. What this type of buyer usually doesn’t fully grasp is the lower the interest rate, the more car you get.

It’s so simple. The Fed decided to stave off recessions by controlling the flow of credit. No longer would savers determine who borrowed and for how much. That’s too risky, leads to booms and busts. It’s bad for politicians too, people get cranky when they feel pain.

We’re on the tail end of a radical money experiment. It’s not going well.

Meanwhile, not every asset binged on credit. Some fell off along the way. As people realize the true cost of things they need, those assets stand to benefit.

Let’s Be Clear About One Thing

We’re not getting into gold here at TTL. Not right now at least. You can read my book on gold in one sitting and know all there is to know about the subject.

The point here is, without the radical money experiment of the past 20+ years we’d have very different asset values. That’s across the board, from stocks to home prices. San Francisco and Silicon Valley feel that right now. Other markets will soon.

People feel it most in the value of their home. The home accounts for the bulk of the average person’s net worth. Home prices are stuck. They might be worse than stuck if the Fed keeps pace.

At the same time, costs are way up. Insurance, repairs, maintenance, utilities, all up big. This could get out of hand quickly. Borrowers with a floating interest rate will be the first to go.

That said, we have to keep playing the game. We have capital and ideally want to keep it.

When unrest kicks up, I expect the Fed to reverse course. This could result in a massive loss of confidence. Faced with a choice of crippling its domestic economy or setting off radical inflation, it has no good outcome in sight.

What we want to do in the trustee portfolio is avoid sectors of the market where debt fueled a huge run-up in stock prices. Believe it or not, there are some that didn’t benefit at all from the money experiment. Or in the case of the company we’ll recommend today, the benefits came too fast in the first innings of the experiment. Then came the bust. Now with credit markets frozen, we have some choices. Sectors with low debt and surging sales look set to fly as others shrink under the weight of too much debt.

Quick Housekeeping Update

A few quick things before we get into the meat of today’s issue.

My last recommendation had a big earnings release. That stock jumped on the news. The market “surprise” matched from the fundamentals we discussed.

Things can get too hot too fast sometimes. I don’t get very excited about these things. In fact, I get less excited and more skeptical as things heat up.

Keep in mind, the trustee portfolio is an actual portfolio. As trustee, I’m tasked with buying stocks worth owning for a while. I have a responsibility to the beneficiaries of the trust. They can fire me, or worse. These are not trades. We’re allowed to make the occasional mistake, but not due to recklessness.

Some of you posted specific questions in the comments about how to trade the last recommendation. You’re welcome to do that. Only subscribers can see the comments. However, I’m not a licensed financial advisor and can’t answer them.

I will answer some of your general questions from time to time in regular issues. Subscribers can use the contact email to send questions.

The trustee portfolio is a marathon, not a sprint. I promised boring, and we got a pop quickly. Let’s stick with boring. If you’ve worked hard for your savings, you’ll over time appreciate steady, boring growth.

Now, back to the action…

What Did Not Feast on Cheap Money

Nothing feels debt free like holding an ounce of physical gold. Banking crisis, savings panic, economic malaise, doesn’t matter. It’s immune to credit shocks. But it’s not the only asset with that feature right now.

As the Fed cranks up interest rates the most rate sensitive businesses crater first. Zombie companies, risky banks, credit junkies, all can’t find a chair when the music stops.

Not everyone danced at the credit party. Today’s recommendation certainly did not. In fact, it went bankrupt in the summer of 2020 when SPACs, speculative crypto coins, and meme stocks dominated the headlines.

What’s great about corporate bankruptcy in the U.S. is you can exit largely debt-free.

The way this works is simple. Say your company borrows big to finance growth. You grew in the wrong direction, missed it entirely. You’re left with a huge pile of debt and slowing sales.

Your stock price craters, trades for pennies. Filing for Chapter 11 bankruptcy protection allows the company to pause creditor actions while reorganizing the business.

A judge presides over the fight. It’s common to see corporate debts reduced by 75% or more. As compensation, the former debt-holders, while singed, get some stock in the reorganized business.

The company continues to operate through this entire process. In a cyclical sector of the market, it can reemerge just in time for an upswing. If it’s debt-free, or at least reduced debt to a manageable level, that can mean surging profits.

That’s the case for the company we’ll recommend today. It’s in a rarely seen segment of the oil business. It’s one of the most cyclical parts I know. After all but one of the major players in the sector went bankrupt, it’s growing rapidly without the burden of too much debt.

The Ups and Downs of Energy

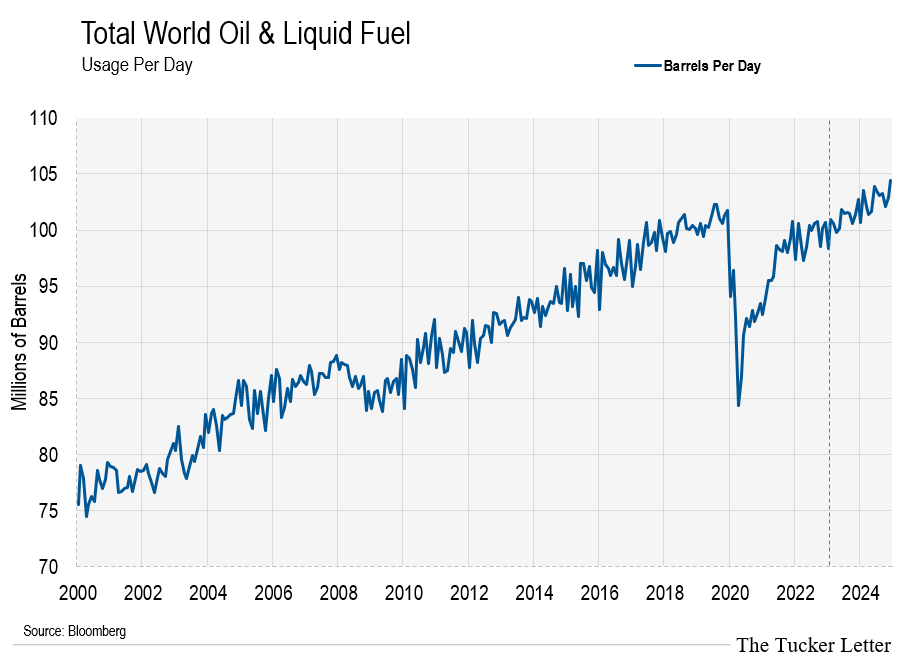

The world uses right at 100 million barrels of oil, and other liquid fuels, per day. The U.S. Energy Information Agency (EIA) estimates this number at almost 105 million barrels per day by the end of next year.

I know this might not seem right based on societal trends. Teslas are cool. Plastic bags are not. The developed world is on a crusade against fossil fuels. And why not? If there’s a cleaner option, let’s use it. Nobody wants to go back to the L.A. skyline in the 1970s when you couldn’t see downtown from the beach.

The developed world uses about 5% less fuel today than it did in 2000. Oil usage for this segment of the world continues to drop.

Meanwhile, the developing world uses far more.

When we say developed, think of the U.S. market. It’s 5% of the world population and ~25% of GDP. Europe, Japan, Australia, and other mature economies fit into the same category.

However, that leaves billions of people in the developing category. 1.4 billion Indians, half of whom have mobile phones, half of those have smartphones, and as a society they use more energy than they did 20 years ago.

It’s important to think of the scale involved here. Billions of people climbing up the ranks has a far bigger effect than 5% of the world population cutting back.

This chart shows how oil usage in the developing world continues to grow, far outpacing conservation movements in developed economies.

That’s where the growth is. Daily oil consumption in the west falls, while it rises in the east and the global south.

The key point here is, regardless of how much you and your neighbors cut back, there’s a herd moving up the food chain. They need the energy you’re not using, and more.

But, We’re Not Buying an Oil Company…

We might buy an oil company soon, but not today.

There’s a segment of the energy market set to fly as the Fed turns too much debt into a weapon. This segment borrowed huge to finance growth in the 2000s. That created an equipment glut. Then a bust, leading to bankruptcy for almost all the operators.

Meanwhile, the U.S. seems to think it won’t need oil anymore. It produces only ~13% of the world’s oil. That’s well-short of its daily consumption, and hardly enough to claim market independence.

Worse yet, when prices spiked last year, the current administration flooded the country with supply from its strategic reserve.

I am genuinely curious how the Department of Energy plans to refill this. I’m not sure it can without sending oil much higher.

The setup for oil looks great. With prices hovering around ~$80/barrel for WTI and ~$85 for brent, the oil business works.

The segment we’ll add to the trustee portfolio today is a key part of where I see new supply coming from.

The main driver of supply last decade was U.S. shale. That market binged on cheap debt. Any well got a drill with cheap credit available.

The reason cheap money gravitated to shale is these wells produce very quickly. That means once tapped, the well gushes for the first few months. Then it tails off quickly. The years of production that follow rarely equal that initial surge.

Easy credit is hot money. It moves quickly to the next idea. It’s not an owner, it’s transient.

Where we’re going in the oil business is long-term. That’s where the real supply is. I’m talking decades of production from a well. The costs are big, for the producer.

We’re not interested in the producers right now. We want the company they can’t live without.