That’s according to a friend who called me for advice the other night. Well, I assumed he wanted advice. Perhaps he simply wanted to vent.

He’s not alone. I hear this all the time now. When I ask for more detail the reply is “I’m dipping into my savings, work is slow, everything is expensive.”

I have a bad habit of not being able to listen, empathize, and then commiserate. While my intentions are good, great in fact, I forget people mainly wish to be heard. Of course, they do want things to get better. As long as it doesn’t involve any uncomfortable change.

I think you might be different. You might realize that rarely do things get better without change. If you’ve been around a while you know the best things happen when you’ve had enough of the beliefs that got you down.

If I’m right, you’ll enjoy picking apart my friend’s gripe. You might hear comments like this right now from your friends. People seem confused. However, I’m not confused. In fact, I see what looks to me like a clear path ahead. It doesn’t look pretty, but I can see it. I’ll share what I see with you now. But first, let’s get reacquainted.

Three Years Off

I, E.B. Tucker, need to re-introduce myself. You might recognize me from media interviews. I’m a frequent guest on many financial shows. I wrote several large newsletters for years. I speak at conferences, wrote a bestselling book, serve as an independent director on several boards, and stay busy moving around the world doing what I love.

In February 2020, I decided to give up what everyone around me felt was a dream job. I went from blogger to widely-subscribed author in about a decade and a half. On a one-night trip to Minneapolis I decided to quit.

The trip had nothing to do with my work. I flew to hear a lecture on Dogen at a local Zen Center called Dharma Fields. The next morning, as if a bolt of lightning shot through me, I decided then and there I’d had enough.

It wasn’t personal. I worked with many kind, honest people who let me be myself. In fairness, they made plenty of money publishing my work. It was a good working relationship overall.

Here’s how the epiphany happened. I realized the growing annoyances and irritations were similar to a check engine light on your dashboard. It’s usually not an emergency. But one day they’ll plug that little computer into the car at the dealership. They’ll tell you the part is worn out and has been for a while.

My publisher's response was shock. I was in the middle of the most successful marketing campaign going at the time. I didn’t care. It was time to move on. I agreed to work for as long as needed to make the transition smooth. Then came the pandemic.

I started getting calls from everyone I knew. They asked, “What do we do?” “What is going on?” “What is the stock market doing?” All day long I had these chats. People seem to call me during chaos for a reason. If I ask why, they typically say they know I’ll have a clear view on what’s happening.

In 2002, I took an aptitude test. One of the notes read, “Could organize safe exit from a burning building.” I remember asking the test administrator what she expected me to do with that, become a fireman? She said a lot more that turned out to be accurate. We’ll discuss that prescient experience another time. The aptitude test is something I recommend to all ambitious young people.

When the inbound calls during the pandemic panic didn’t cease, I got tired of repeating myself. On Friday April 10, 2020 I stopped taking calls and decided to write a book. 23 days later I had a 236-page book draft completed. Three weeks after that it hit bookstore shelves. From that point on I pointed callers to my book on Amazon.

While that book had the word gold in the title, it was about much more. I hoped people would see how I think as I relayed true stories from my experience. I included photos, which seem to help people stay focused. After selling over 50,000 copies I’m still not sure I accomplished my mission.

With the book published, I continued my twenty-plus year daily routine. I read and study, talk to people on the phone, watch the markets, and get outside every day. This has been a 7-day per week routine for as long as I remember. If someone told me I’d die tomorrow, I would not change a thing. I’m an intellectual, an introvert, and an endlessly curious person.

What people might not suspect is I struggled greatly with school growing up. It was really all institutions, not just school. I ended up in difficult situations as a result. We’ll talk about that more as we get to know each other.

What’s important today is after three years away from providing market commentary I’ve decided to come back. I’ll write to you here, on Substack. You’ll see The Tucker Letter in your email box every other Thursday. That’s the plan for now at least.

Initially, this will be a free service. I welcome your feedback, helping me refine the format, process, and delivery. I’ll work hard to give you what’s missing, the clear view. In time, we’ll transition to a subscription service. This will be your way to access my ongoing thoughts on the state of the market. No publisher, no sleezy sales promotions, and no distractions from our major definite purpose.

I’ve created a life that suits me. I spend every day doing what I love. I have what I consider financial freedom. By my definition that’s totally unrestricted freedom to think based on what I see happening with my own eyes, instead of what someone else needs me to think for their purpose. I decided this as a teenager and have never lost sight of it; I value it tremendously

In time, I’ll show you how the life I have today took shape. It wasn’t luck, it wasn’t family connections. It was learning how to think clearly, spot which way the wind blows, and get in front of it. Stick with me and I’ll show you how. Don’t worry, this is not school. I’ll keep you well entertained along the way.

Back to My Suffering Friend

Let’s get back to my “It’s not getting any better” friend. I’m curious if you hear the same comments from your friends. After I share my view on what’s ahead you might notice more signs and indicators hiding in plain sight in your daily life.

To be fair, my friend is in a sensitive spot. He works for an AMC or appraisal management company. Prior to the housing collapse there was no such thing. Thanks to federal legislation he’s a ~$500 buffer between you and your mortgage lender.

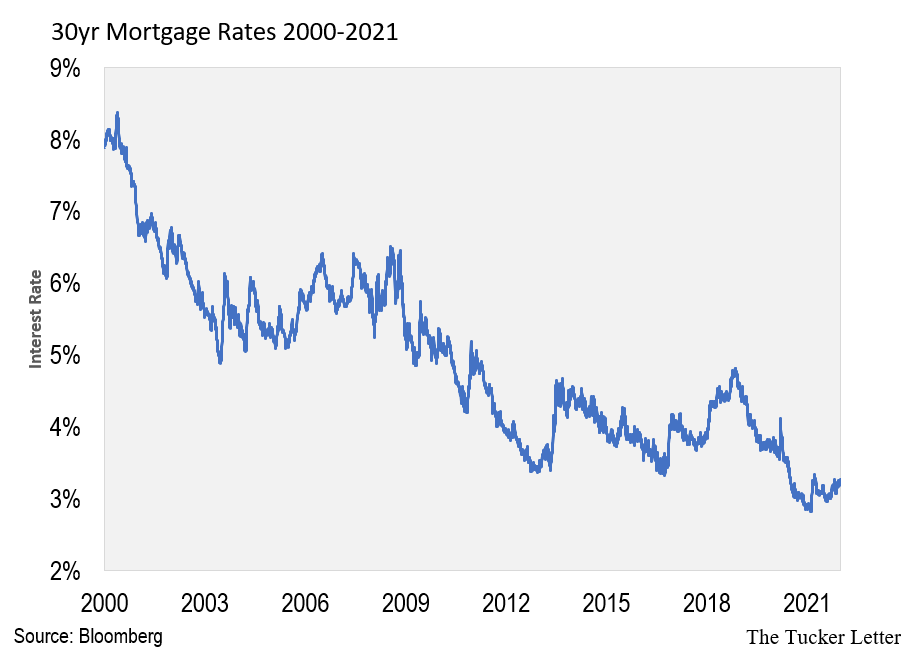

What I warned, and he forgot, was the mortgage business lives and dies with interest rates. As rates fall, borrowers can take larger loans with the same payment. Here’s a chart of 30-year mortgage rates from 2000 through year-end 2021.

That explains the commonly held belief that real estate is the best business in America. It’s hard to argue. However, success breeds complacency. Twenty years of improving business conditions will lull anyone into believing good times never end.

If lower rates mean feast for the mortgage business, higher rates should mean the opposite, famine. Here’s a chart of the same 30-year mortgage rates since the beginning of 2022. It tracks closely with the pace and intensity of my friend’s growing trouble.

Let’s keep this ultra-simple. If you borrowed $300,000 at 2.95%, assuming no principal repayment, you’d owe $737.50 per month in interest. If you borrowed the same $300,000 at today’s 6.66% rate, you’d owe $1,665 per month. That’s an increase of $927.50 per month needed to harness the same $300,000 of buying power.

Throw on top of that the explosive cost of property insurance in some areas, surging materials costs, hard to find labor providers, and you’ve got more than an uphill battle for my AMC friend as, fewer mortgages translates to fewer supervisory fees for him.

Are We Doomed?

Yes. I hate to be the one who tells you this. But yes, we are doomed. However, there are a lot of first downs between here and that ultimate outcome. So, let’s play the game and enjoy it for a while.

I asked my friend if he could stand another 14 months of this. 14 months of lower revenue, sluggish sales, lower prices, and ultimately a less valuable business. He said no. But, he’s not ready to quit.

Notice the psychology. He’s frustrated. He wants to vent. He’s a smart guy. But he doesn’t see where this goes next.

Why 14 Months?

I spend a big chunk of my day sitting in front of a Bloomberg terminal. If you’re not sure what that is watch a video interview of me on YouTube and you’ll see it on my desk.

My setup is four screens, two keyboards, and 40+ information tabs, spreadsheets, and webpages open at any time. For some reason, this works for me.

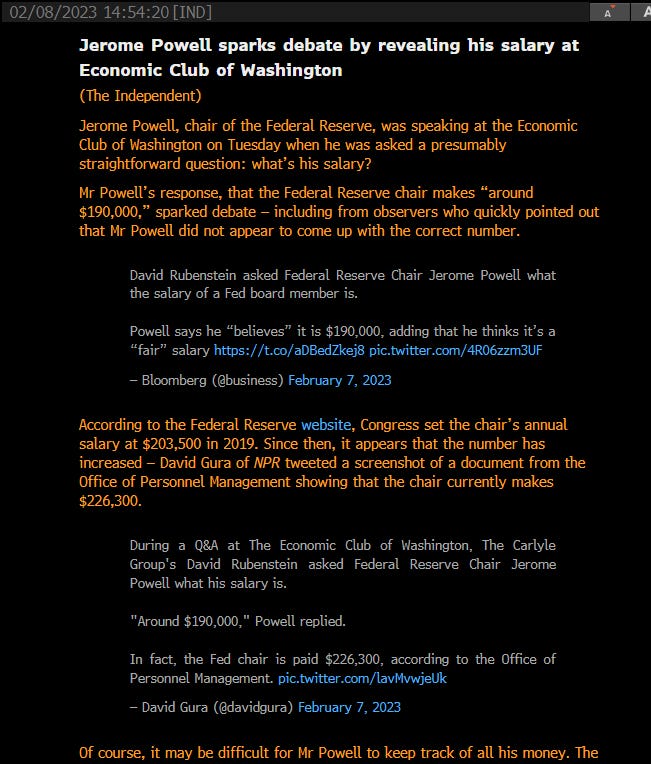

Last week on the Bloomberg I noticed David Rubenstein interviewing Federal Reserve Chair Jerome Powell at the Economic Club in Washington, DC.

This might not seem like must-see news to you but I’ll stream this type of interview while working on other things.

The interview caught my attention because Rubenstein was essentially Powell’s boss earlier in his career. OK, I’m sure he’d say that’s not true, but Rubenstein was one of the five founders of the private equity giant The Carlyle Group. Powell had a successful career there as a ranked executive, left to work at Treasury, then came back. He made a lot of money for himself and the partners. Carlyle ultimately went public in 2007 making Rubenstein and the other founders billionaires. Powell’s stack isn’t quite that high but what it lacked he certainly made up with influence. When the man who controls interest rates sits down with the man who made billions from falling interest rates, I’m paying attention.

Let’s take a minute to be clear on one thing before going on. I’m not a conspiracy theorist. I don’t care to get into bizarre theories of who runs the world etc. I know who runs the world. I’ve met people in the power scene. It’s nothing to envy. The top of the pyramid is more vicious than the bottom. I’ll stick in the lower segment of the upper quartile. It’s cozy.

I make this clear so we can have a productive relationship here at The Tucker Letter. No crazies, it’s unproductive. It doesn’t matter if someone faked the moon landing, get over it. We’ve got a life to live and we can’t enjoy it if we’re stuck on crazy.

In this case, let’s use logic and reason. Rubenstein takes softball questions to a level I’ve scarcely seen. His jokes are difficult to endure. However, he’s a made guy, with his own show on Bloomberg. He gets to do what he wants.

That said, let’s be sober about the setup here. Private equity depends on leverage. I worked for a company in my 20s that sold out to a private equity firm. Let me show you how it works.

Pay $800 million to buy young E.B.’s employer. Immediately saddle the business with $850 million in debt. Shortly after the loan closes, issue a shareholder dividend for $850 million to investors. The private equity group is the investor, so they’re carrying the business risk free.

Next, tell young E.B. he needs to find cost cutting opportunities, sell more, work more, and raise the bar if he wants a bonus. He does want a bonus, so he tries hard, and survives. Many colleagues don’t.

In the process, the product becomes cheaper, the staff dumber, the service thinner, profit margins moderately fatter. Then sell to another private equity firm for $900 million booking a $100 mil profit plus generous fees of course.

The entire business model depends on access to cheaper money. Private equity firms owe a debt of gratitude to the Federal Reserve for 20 years of making this once-risky business risk-free. The broader point here is, without consistently lower borrowing costs, firms like Carlyle are a lot less profitable.

Back to the interview. Take a look at these questions. All made to portray the man who controls the cost of borrowed money as a humble, civil servant.

My point here is not to bash Powell. He seems like an OK guy. It’s to highlight the 14 months of pain my friend should expect.

Jay Powell’s Master Plan

Powell said he’d like to take the Federal Reserve balance sheet back to pre-pandemic levels. That means it needs to shrink…. by a lot.

Here’s a chart of the Fed’s balance sheet back to 2000 when it was a mere $500 billion. Pre-pandemic is hard to see here as the growth of the chart gets a little crazy. It’s roughly ~$5-6 trillion. The exact number is irrelevant because I don’t think we’ll get there.

What you may not know is the Fed currently takes ~$100 billion per month off its balance sheet. This started last year with ~$48 billion per month. We can talk about the mechanics another time. For now, it’s the size and pace of the trend that matters.

As you see in the chart above, the current size of the balance sheet is ~$8.4 trillion. That’s another 14-18 months to shrink back to pre-pandemic levels depending on the pace.

Think of it this way. You have $100,000 in credit card debt. Four years ago, it was almost half that. Now, you want to get back to that lower balance.

It’s easier said than done. You’re in for some lean times. Add to that the surging cost of interest eating into your budget. This won’t be fun.

What Happens Next?

Months ago, I said the Fed would raise rates until something broke. People keep asking me what is it that will break… it doesn’t matter.

Think back to the mortgage mania of the mid-2000s. I had a hunch this would blow up. I lost money buying puts on Fannie Mae in 2006. The insanity kept up for another year.

In that case, I had no idea Washington Mutual and Countrywide Financial would be the mortgage lenders to crater. Nor did I have any idea AmSouth and Wachovia would cease to exist. But it really did not matter which bank folded in the end. If you got the trend right, you won.

In this case today we’ve never seen a central bank raise interest rates like this Fed. Jay Powell took rates from unprecedented lows to nearly ~5% in record speed. The chart below shows the Fed’s primary rate-setting tool, the discount rate, going back to 2010. Notice the extreme pace of hikes since last spring.

Imagine trying to project costs, investment, and general business forecasts with borrowing costs moving at this pace.

My AMC friend doesn’t fully appreciate what this type of chart means for his mortgage business. He feels it, he’s telling me it’s bad, but he doesn’t have the market knowhow to see it coming. It’s going to get worse. He’ll need to endure his competitors folding. Bear markets aren’t over until people swear off the business forever.

Poll your friends. This is something I do all the time. It’s a messy ordeal but valuable. Ask what they think about real estate. Do the same with other groups for things like Bitcoin, technology stocks, anything. If everyone thinks something is good but those in the business are depressed, there’s usually more downside.

Work on Spotting the Trend not Being Mired in Gloom

Earlier I mentioned having trouble with empathy. It’s hard to see my friend stuck. His check engine light says there’s a problem. He needs to address it. Instead, he keeps driving saying this car just isn’t the same. He’s right.

You hear this in failed relationships too. People say, “I knew it was bad I should have left earlier” etc.

The reason I point this out is while listening and observing you’ll begin to hear people describing symptoms. They’ll wait until they’re terminal to do something about it. In the money world it’s too late to sell when your asset is terminal.

And you don’t have to end up at rock bottom. Those closest to the center of the centrally planned economic system don’t wait for newspaper headlines to make moves.

They understand the Fed needs to keep cranking up rates to firm up its dollar system. The system as they know it relies on demand for dollars, borrowers of dollars to be more specific. That system has enemies today. We’ll talk about that more in the future.

In the next issue we’ll talk about what I’ve done to be ready for what I see so clearly. Stay tuned.

Saw your interview on Cambone about two weeks ago. Re-watched tonight...caught more 2nd time thru.

So intense. Thanks man.

Thanks EB. Your solid sense of values and your sense of humor are a breath of fresh air.