Danger Point is about a two-hour car ride east of Cape Town. There’s not much reason to visit. Even less these days with its tourism industry in ruin.

The area got its name from a 15th century Portuguese explorer named Dias. Since then, some 140 ships have sunk after hitting the shallow rocks jutting out from its beaches. The furthest rock sits barely below surface more than a mile offshore.

However, it wasn’t the shallow rocks that worried Dias. It was the sharks.

For years, Danger Point was home to ferocious great white sharks. The jagged rocks and treacherous currents made the area perfect for predation. Shipwreck survivors stood almost no chance of reaching shore.

The closest town, Gansbaai, is a fishing village fifteen miles up the road. With only 12,000 residents, it counts on tourists to make its local economy work.

The unusually large population of great whites turned Gansbaai into a go-to spot for shark diving. This is a top bucket list activity. Tour operators put you in a metal cage, lower you into shark infested waters, and laugh as they watch you fear for your life.

However, the sharks recently vanished. Tour operators chum the waters, troll past the typical shark-infested areas, and might turn up one shark in a day. Just a few years ago they’d see around ten on the same route.

Carnage on The Beach

A typical adult male great white is around 8-10 feet long. It easily weighs 2,000 lbs. Females can be twice that size.

Watching one of these predators eat from the safety of a submerged metal cage is an epic experience. The sharks have razor sharp teeth. Marine biologists estimate the power of their bite at 4,000 pounds per square inch. That’s almost 7-times the bite force of an adult lion.

Gansbaai locals know not to swim in their shark-infested waters. What they’re now adjusting to is dead sharks washing up on their beaches. It’s happening frequently these days. What’s more bizarre, the sharks are mostly intact missing only their liver.

Liver is one of the most nutrient-dense foods on the planet. It’s packed with proteins, fats, oils, and vitamins difficult to source in other foods. While I’ve never tried shark liver, I do eat grass-fed beef liver occasionally. It’s a powerful superfood.

Shark liver takes this superfood source to the next level. A 2,000-pound adult male shark can have a liver weighing upwards of ~600 pounds. Depending on various changing factors, it’s common for the liver to make up a third of its body weight.

That’s why scientists can’t get over the surge in dead sharks washing up on beaches missing only their livers. With surgical precision, something has a seemingly limitless taste for shark liver.

The Danger of a Bad Defense

Finally, we know who’s to blame for the devastated condition of the great white population. In fact, we now have drone footage of how it happens. Orcas, or “killer” whales. The ocean’s ultimate apex predator feasts on shark liver to the tune of several thousand pounds in a two-hour hunting session.

The fascinating part of this is the whales had no prior history of eating great whites. This is new.

You see, killer whales are the top of the dolphin family. Think, Flipper’s savage cousin. They’re huge, 5-times the weight of an adult male great white. But what makes them the most dangerous predator in the ocean is their ability to learn.

Whales hunt in pods. They work as a group. They teach, learn, and cooperate as a pod. This is no match for the shark who while savage, hunts alone.

Two specific whales seem to be the toughest hunters in the ocean right now. They appear responsible for dozens of shark kills in each hunt. Biologists call them Port and Starboard as identified by their respective collapsed dorsal fins. One falls to the left, one the right. Here’s a video of them working together to quickly extract a 600-pound shark liver for lunch.

As you can see, the shark does try to evade the attack. It swims in a tight circle. This is a time-tested defensive maneuver used by its prey. But it fails.

A bad defense is to blame for the world’s formerly terrifying great whites washing up on beaches by the dozen with only their organs missing.

Comfort Leads to Complacently

Let’s have some sympathy for the great whites. Or, is it empathy? I can never keep the two straight.

The shark gets comfortable with free reign of the oceans. There’s a shark tracking website called OCEARCH. It shows how they’ll cruise from Martha’s Vineyard in the summer to Key Largo for the winter. Back and forth for decades eating hundreds of yellowfin tuna on the journey. It’s a great life.

People aren’t much different. We’re just more sophisticated animals. We identify threats to our security or comfort. We come up with accepted defense strategies to employ when threatened. Then, most of us never change the strategy. That’s especially the case during a prolonged period of good times.

What makes humans worse is we get comfortable as a group. The whole group accepts the same strategy. Anyone who disagrees is an outsider. Total group agreement is what we like. We’re almost all doing the same thing, at the same time. Then something comes along and whacks the unaware, defenseless mob.

What may surprise you is this happens all the time in high finance. I’ve seen it in every crisis. I saw it last week.

If you warn of a threat, the herd leaders call you a Cassandra. They essentially defend the herd’s thinking. Instead of looking at external threats, they exploit the complacency of the herd. That’s their advancement strategy. And it works great.

Then something comes along and rips out your organs, so to speak. The former herd leaders ask, “Who could have seen that coming?” When pressed for answers they say, “We all missed it.”

Maybe they’ll propose an investigation by a group of compromised former bureaucrats. They’ll promise to get to the bottom of it, much later of course. They’ll need time to find who’s to blame. Don’t hold your breath.

You’re Responsible for Your Own Financial Justice

Suddenly last week people collectively realized there’s a problem with our debt-based financial system. They’re right. Perhaps more right than they realize.

We just ended twenty years of the most dangerous money experiment in human history. After centuries of fighting for the right to build, own, and use wealth as a tool to better ourselves on an individual level, we let it go in a mere two decades. In return, we got some cheap meals, a stucco shack, and a 3-day Caribbean cruise.

We fixed the rate of interest on hard-earned savings. We encouraged borrowing at maximum capacity. We lowered the cost of borrowing surgically to control the flow of commercial activity. We turned over the reins of the world’s greatest economic system to a committee.

Capitalism is as natural as the animal kingdom. Some creatures make it. Some don’t. They get complacent. They get their liver ripped out by a more effective operator.

We spent twenty years lulling people into a trance with the illusion of stability. The first few years had a lot of detractors. Then fewer. By the virus era anyone who questioned Fed policy looked like an idiot. If you didn’t binge on borrowed money, you missed out.

Take the venture capital world for instance. Here’s how it works.

You and a friend have an idea. You see a part of life that could be more efficient with technology. You incorporate. Key assets include an idea, and a laptop. You refine the idea and pitch it to investors.

One investor says, this is a good idea. But, it’s risky, early days. They offer you $100,000 for 10% of your new company. That gives your company a value of $1,000,000. You still own 90%, or $900,000 of that $1 million. Remember, you’ve got a laptop and an idea, maybe a website with a slide deck.

You take the $100,000 and buy more laptops, hire someone in India to work with data. Maybe join a co-working space, get active on Twitter, and start using a lot of tech jargon.

You’ve got momentum. But you need more money. You’ve found another investor who wants to be part of this change you’ve identified. They see how if successful, you’d reach a big swath of the population. They’ll give you $1,000,000 for another 10% of your company.

Your first investor likes this move too. Total company value is now $10 million. You’re worth $9 million on paper before taking the new funds. The first investor is up 10-times. This is moving in the right direction. But remember, while the equity value of your company lurches higher, only a fraction of that value is real in the form of actual cash changing hands.

The strategy keeps going like this until you run out of new investors or the company actually turns into something and gets a takeover offer. I know this sounds simple, but it’s how many friends of mine made a paper fortune last decade. It’s the closest thing to alchemy I’ve seen.

However, the whole ruse depends on a continuous stream of investment capital. Remember, the valuation of our example company marches higher with small investments. Each time selling a small percentage for more and more. 10% of the initial idea was $100,000. 10% of the advanced idea may cost $10 million, or $100 million. That values the firm at $1 billion, on paper.

When The Money Stops

I saw the easy money stop in late 2021. I remember noticing tech titans unloading stock. Musk, Bezos, Gates, etc., they all sold huge sums of stock. Bezos stepped down from Amazon. Gates left the Microsoft board. These were big moves, and swift.

If you recall, that’s the same month Bitcoin hit its all-time high of ~$70,000. Let’s call this generally the fourth quarter of 2021. Just weeks later in the first quarter of 2022 we had the first Fed rate hike, and the Ukraine flare up.

From there the Fed raised rates at an unimaginable pace. We’re used to capitalism. It’s what our social studies teachers told us in middle school. The truth is, it’s merely folklore. What we have today is centrally-planned capitalism. It’s inspired by free markets. But it’s carried out by committee as opposed to buyers and sellers setting prices.

The chart below shows the interest rate set by the Fed. After years of essentially fixing the cost of money at nothing, it turned the economy into a pawnshop almost overnight.

Remember our startup example. It thrived as new investors wanted to play in the technology sector it hoped to revolutionize.

With the cost of money fixed at 0%, investors who generated 1% returns made a profit. That’s a low bar. The best ideas run first. Over time, you reach for riskier ideas. After a decade of this people buy into PancakeCoin hoping to flip it for a profit.

PancakeCoin is a real thing. It has a ~$700 million market cap. I keep an eye on it because it tells me people still want to gamble. I’m waiting for something to come along and rip out its liver.

Slowly at First, Then Instantly

With the big picture in focus, it’s easier to see why the most vulnerable banks are in trouble. The news of the Silicon Valley Bank (SIVB) failure last week is nowhere near as complex as it appears in headlines.

This was the go-to bank for tech startups. It was local, it understood the tech scene. It catered to this sector during an unprecedented period of success. However, recent trouble in the tech sector is not what took the bank down overnight.

Seeking Alpha reported the average SIVB accountholder had a balance of $4 million just before the bank collapsed. That’s a far cry from the average customer at a national bank hoping to keep their balance high enough to avoid having their debt card declined at a convenient store.

The bank had around ~$173 billion in deposits. This is individuals, companies, and funds combined.

The rapid failure had little to do with recent tech industry layoffs, or the tech scene generally. The reason it went down overnight is it was not prepared for the Fed’s radical rate hikes. The interest rate fixing committee turned into a pawnbroker overnight. That put SIVB in hock.

Here’s how it happened.

During the first three quarters of 2021 the tech sector raised more money than any time I can remember. If you recall, people had an appetite to speculate on anything, including the craziest ideas. I remember digital cartoon images of apes on boats selling for millions. This is what a speculative grand finale looks like.

SIVB’s client base took full advantage. These people are smart. They realize you raise money when it’s available, instead of waiting until you’re forced to. They parked that excess investor cash at SIVB.

Banks typically use customer deposits to issue loans. They capture the spread between the interest paid by the bank to depositors and the interest paid to the bank by loan borrowers. This is known as net interest margin. It’s the key way banks turn a profit.

If the bank has more cash than demand for loans, it can buy bundles of loans made by other banks. That’s what SIVB did…to the tune of nearly $100 billion. Remember, it had ~$173 billion in deposits so the numbers make sense.

The issue is, most of the loans SIVB bought carried fixed interest rates. That means as interest rates shot from 0% to 4.5% almost overnight, the interest rate borrowers paid the bank stayed flat.

Imagine you bought a 3% bond for $1,000. It pays $30 of interest per year. Market rates rise to 6%. That means interest payments on newly issued bonds would be $60 per year. The value of your 3% bond is no longer $1,000. It’s worth a bit less, maybe $900, to compensate for higher-paying bonds available in the market.

SIVB did this in a big way. It bought a pile of fixed rate residential mortgages in 2021 using excess depositor cash. Mortgage rates shot higher. The value of its fixed rate mortgages fell quickly.

Most investors would use a hedge to protect against this. SIVB largely did not. As rates shot up, the value of its ~$100 bil of loans fell by 17% as of September 30, 2022. That’s according to its quarterly SEC filing. See page 15 for more detail.

Get this, federal regulators did not require the SIVB to address this rapidly growing loss. If the bank planned to hold these debt investments to maturity that is. That meant the value could fluctuate wildly without impairing its capital requirements. As rates shot higher, the value of these fixed rate loans kept falling.

The issue became real when SIVB depositors asked for some of their $173 billion back. Depositors moved money to banks paying higher rates. Some spent money running their businesses. Financing markets for startups dried up. That meant no surge of new deposits coming in.

SIVB needed cash. It went to sell these fixed rate debt instruments. The loss of value was greater than the banks entire capital base.

The Tip of The Iceberg

Last issue we talked about the split personality of investors. Inside every great investor both have a place. There’s a trustee, who realizes investing is a game of survival. There’s a gambler who wants to win big, bigger than anyone has ever won, and walk off a hero. This is not a time to gamble.

Think back to what happened after the market topped in 2021. The free money party ended. That means everything that benefitted from the free money binge on the way up, might be a candidate for suffering on the way down. This is what gravity looks like.

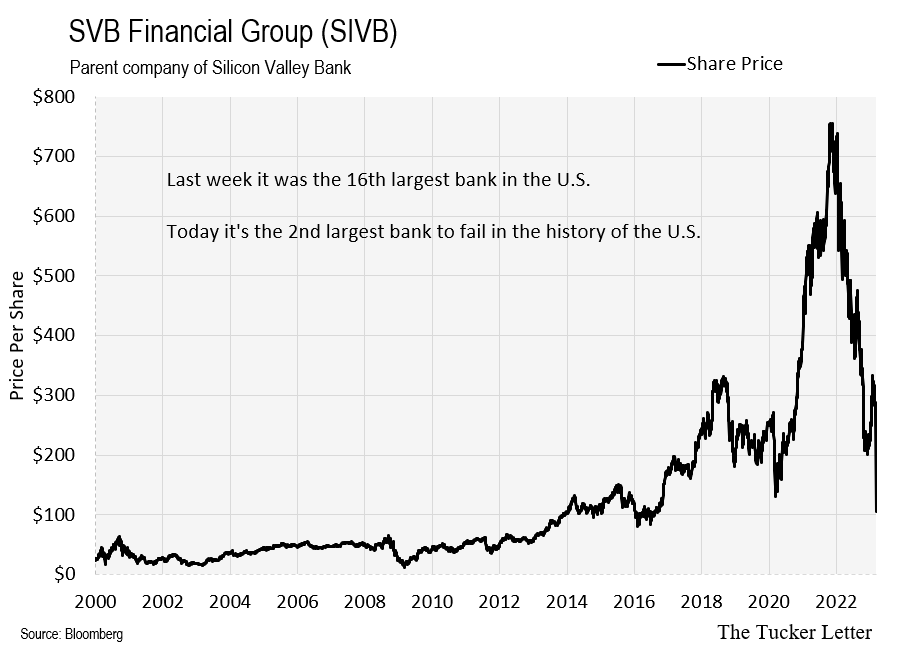

SIVB had a huge run. It was the bank of the Silicon Valley boom. The tech boom had a mainline to easy money. Any idea got funding when the base rate of return was 0%. Here’s what happened to SIVB stock.

The right price here is likely $0/sh. It’s halted at $106 pending formalization of the regulator’s salvage plan. The equity is worth $0.

SIVB is not alone. The banks who shifted their business towards crypto-centric customers are also in trouble. Silvergate (SI) failed last week.

Signature Bank (SBNY) suffered the same fate. What I found absolutely amazing about this one is an analyst at Compass Point lowered their price target for SBNY to $135/sh from $145/sh on Friday March 10. The next day regulators seized the bank. That means shares may be worth $0. They change hands for $2.30 as I type. This shows you if analyst opinions are your auto pilot, you might want to take the wheel.

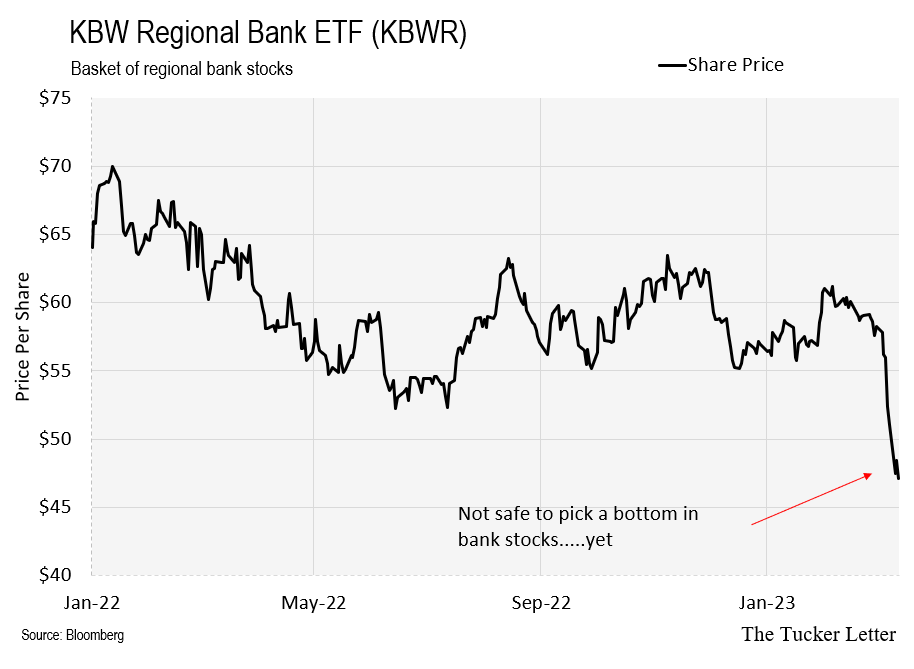

These are the worst of the banks at this moment, meaning the most exposed. Regional banks as a group don’t look so hot. Many have quoted dividend yields of ~6% or more. It’s too early to take a stab at this. That will change at some point.

Remember, we’ve had a lot of failures since late 2021. I can count at least a dozen high-profile crypto failures that ended as zeros. Now some of the riskier banks. The Fed will keep this up until something breaks. I mean something big. Don’t let it be you.

Things may get worse from here. The SIVB bailout sets a precedent. You can bet there are major moves being made by firms trying to avoid being next.

We Will Buy Some Stocks

Don’t worry. There are some stocks worth owning even in this current market turmoil.

I will begin to build out our trustee portfolio in future issues. Right now it holds cash and 4, 8, and 13-week Treasury bills. When we add investments to that portfolio, only subscribers will have access to the picks and the thinking behind them.

The job of a trustee doesn’t stop in a tough market. It might seem boring at times, but remember, over the long run, survival is more important than having a big short term win.

In the next issue I’m excited to show you the one chart I use more than any other in making investment decisions. It’s largely the reason I’ve avoided much of this year’s trouble so far.

It’s so simple. You don’t need a special computer, a math degree, or any complex tools. I promise, it’s easy. And I hope you’ll see how it’s a great tool to help spot winners and avoid losers.

Best regards,

Thanks for the article, good read as usual, is the Carbon play a future offense or defensive move? Also, any word on its upcoming listing?

Thank you EB. Read Why Gold Why Now a few years ago. Good Read. Also got the audiobook. Kids (8 and 10 y.o. at the time) didn't seem that interested. As an investor in MTA and NOVRF, very familiar with your work. Wish you great success. Hope MTA and NOVRF also return to their highs!!!