Tenino, Washington sits about 90 minutes south of Seattle. I went there last week to print money…with the mayor.

The small town has its own local currency. Wooden bills you can spend with local merchants. It’s all part of a century-old tradition rooted in basic economic principles.

The first thing I learned was how to pronounce the name of the place. It’s “ten-nine-oh.” And Lorne Ackerman, the chief money printer, wouldn’t start the machine until we had that covered.

The press stamps out fresh wooden bills at a rate of one per second. It’s belt-driven. The lever in my left hand disengages the press if you need time to load the next bill. That’s the smart way to do it. Lorne showed me his flattened finger as proof.

There are different denominations. In the picture above I have a stack of freshly printed 10s. We swapped out the metal engraving blocks to run some 5s too.

Lorne told me this press is the same one used by Don Major in 1931, the year this money experiment started.

Out of Cash

Tenino Mayor Dave Watterson wants to stimulate the local economy. He talks about it like a President. Lorne is his Fed Chairman, standing by to run the printing press as needed.

They figured out how to manage their local economic system. They even talked about the local system the way Chairman Powell talks about the U.S. system.

They told me Tenino introduced the wooden money back in 1931. Due to depression era demand for physical U.S. dollars, the town bank ran out of cash.

That meant local commerce seized up. The butcher and the baker had no way to pay workers, or buy supplies. Customers had no way to spend. Everything stopped. That prompted three businessmen to step in and stabilize the local economy.

Don Major owned the newspaper. He had a printing press. The other two men were doctors. They had financial standing and trust within the community. Together, they saved Tenino.

The men printed custom bank notes as a substitute for U.S. dollars. They created a parallel currency. It kept a peg to the dollar. Locals could spend the money at shops in town. Merchants accepted the bills because the three men promised to exchange them for dollars later. This restored confidence.

The first round of money printing used paper. The Tenino Museum has those bills on display. People largely opted to exchange the paper scrip for dollars when possible. However, that changed on the second round.

Tenino, like many rural towns in Washington state, had a rich history as a lumber producer. Don Major decided to run the second round of money on thin pieces of wood. That proved more popular. Instead of spending the money, residents hoarded it.

Of the roughly ~$3,000 worth of wooden money created in that second printing, barely ~1% returned for dollars.

For some reason, residents hoarded the wooden money. The paper money felt like a promise to pay, and that was good. But the wooden money felt real.

Why People Hoard

Hard work is real. Energy spent working is gone forever. People don’t feel good about spending that energy in exchange for something they don’t trust.

This goes back to the roots of modern money. Our feelings toward it haven’t changed much. Maybe they should…

Money arguably freed us from serfdom. People toiled under feudal lords. They plowed fields, built walls, and occasionally took orders to fight and die for a cause important to the lord.

This system, crude as it might seem today, existed for most of human history.

While free man has many forces to thank including literacy and property rights, money stands out as the most helpful. We learned to spend less than we earned, and use the balance to buy a better life. The proof is, we still believe in it today.

Americans rate everything in terms of money. Retirement readiness, home value, mood, everything gets a rating. Then it gets a feeling. If we feel less than, we’re upset. If we feel more than, we’re arrogant. Yet the whole rating system is arbitrary.

We check Zillow to see if we’re happy in our home. We rarely think about the house in terms of how much we enjoy living in it. If we did, we wouldn’t care about the value.

Central planners know this. It’s an important part of their plan to control and manage the U.S. economic system. They even confessed it. But we didn’t listen.

“…central bank models have long incorporated the wealth effect of house prices and other assets on spending…” Janet Yellen

What Yellen means is, a rising home price encourages consumer spending. If we feel rich, we act the part.

Central planners know what happens when we feel poor. We worry, panic, and hoard. If things get too bad, we revolt.

When we worry about money, we won’t spend. In fact, we might try to sell our possessions all at once. We’d hoard the proceeds, removing it from circulation. That drains the plumbing. It throws the whole debt-based system into a tailspin.

The reason is, our centrally planned economic system only resembles capitalism. To stay upright it needs us to keep borrowing and spending. Keep playing the game. That keeps the wheels greased. Decades of heavy borrowing means the value of assets depends entirely on the next buyer showing up.

Like a famous brand bought by the private equity squad, it only looks like the brand we remember. The outside looks familiar, but the guts are empty. The squad sold them for scrap. They’ve done the same thing to the entire U.S. system.

Benjamin S. Bernanke came right out and said as much in 2010. He told us the purpose of QE or Quantitative Easing. While controversial at the time, in retrospect, he was honest. And it worked.

“...higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending.” Benjamin S. Bernanke

Think about that in the context of today’s surging NVIDIA Corp (NVDA) share price…up ~650% over the trailing three years. Or, the seemingly unstoppable rise of the magnificent seven tech stocks that monopolize financial headlines.

Or, the third wave of the Bitcoin rally, which most people seem unable to believe in. And could mean sending the price to ~$100,000 before the doubters capitulate.

People feel rich. And rich people behave better than poor people. Central planners know this.

QE Lowers Crime

Growing up, I remember visiting New York and DC. My father wisely told me, “Don’t leave the hotel lobby!” He was right. It wasn’t safe.

In the early 1980s. Times Square was nasty. Today, there’s a corporate drug store on every corner. If we took a woke millennial back to the same street corner in 1981, they’d have a panic attack. And not the type of popular anxiety they all seem to have. I mean a real panic attack.

The U.S. was not safe in the wake of the 1970s. It debased its currency, saw interest rates explode, and struggled to arrest a tumbling standard of living.

It’s almost as if the central planners learned something. People today have very little “real” net worth. They own stocks loaned to brokers, houses mortgaged again and again, and even speculative computer tokens stored in the cloud. Yet they behave as if they have an empire on the line.

U.S. crime rates are the lowest in three decades.

Meanwhile, the Fed’s wealth effect seems to work. It’s a fringe benefit of its radical money experiment. While old-timers and thrifty conservatives warn it can’t last, should be different, and isn’t moral, the results are extraordinary.

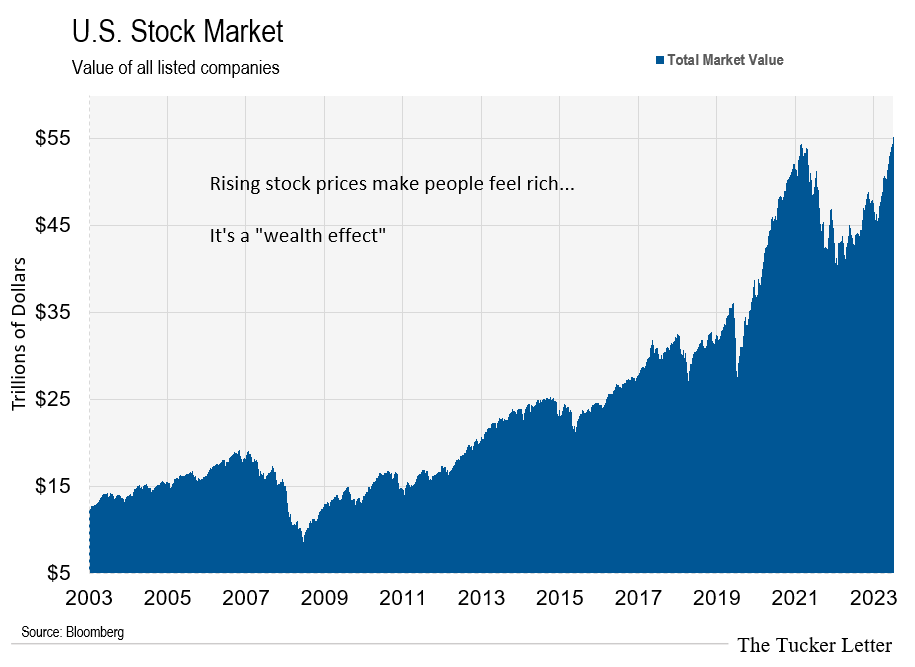

In the past twenty years, the value of all U.S. listed stock grew 345% from ~$12 trillion to over ~$55 trillion today.

While naysayers might one day be right, going along with the Fed worked out better than fighting it.

Meanwhile in Tenino

Back in Tenino, I had more wooden money than I could spend.

That’s the trouble with running a printing press…you don’t know when to stop.

Mayor Watterson seemed thrilled. I bought $320 worth of wooden bills, and planned to recirculate them. That proved harder than expected.

Turns out, not everyone takes the wooden money. The local Chamber of Commerce exchanges it for dollars, but some businesses don’t buy in.

For instance, the U.S. Post Office in downtown Tenino wanted no part of the wooden money.

And another group of locals isn’t buying in…immigrants.

The girls at Los Compadres were a “firm no” to the wooden money.

I insisted the bills were real. If they took them to the local Chamber, they’d get dollars. I even offered a 100% tip… nothing worked. The only wanted dollars, or a U.S. credit card. Maybe it’s a bad history with currency, or general distrust.

Finally, I found someone to take the money. She only had cookies for sale. They were delicious. And with $300 left to spend she said she’d take as much of the money as I’d give her.

In fact, she thought it was odd I wanted to spend it. She said most people hoard the money. We talked for a bit, and I explained living 3,000 miles away was one drawback. The expiration date was another.

I’m not sure I’ll make it back to Tenino. The cookie merchant couldn’t imagine why. I explained that while it’s a pleasant town, with certain advantages, I’m an urban monk…and feel most comfortable wondering the concrete streets of a major city.

The Road to FedCoin

Someday the girls at Los Compadres won’t have a choice. They’ll take FedCoin, or break the law.

FedCoin is an idea I predicted in 2016. I have no proof the Fed aims to create this sinister form of money. Once proof exists, it’s too late.

However, I do know FedCoin, as I envision it, solves three major problems. These aren’t problems for you and me…but they are for central planners intent on controlling the U.S. economic system, and the world.

Counterfeiting – Tenino solves this with serial numbers and signatures. Fake money takes power away from the printers, and that’s a problem. FedCoin solves it by recording every dollar on a closed loop blockchain. This offers all the benefits of Bitcoin except in a closed loop…meaning only the Fed controls it. That’s good for the Fed, and bad for us.

Tax Evasion – The U.S. seems to collect ~18% of GDP in taxes. If you’ve been a high earner, you know the tax laws are grey, at best. Only working-class people think more tax is a good idea. Anyone paying tax realizes the sham for what it is. FedCoin makes tax collection automatic.

Behavior Control – With every dollar notched on a closed-loop blockchain housed at the Fed, naughty citizens come under control with a click of the mouse. Social credit scores might be used to restrict FedCoin spending to necessities.

Some people say it’s impossible. Others say they won’t go along. Both are hopeful delusions. You’ll go along, or you’ll live in the woods.

Everything from wiring money for a home purchase to boarding an airplane already requires proof of innocence. In the land of due process, we now validate our right to free movement. Try opting out of onerous regulations. It’s impossible.

Look back 30 years. Make a list of now versus then… notice how the walls go up one by one. It’s always for a temporary or emergency reason. They never come down.

Next issue we’ll try to spend another favorite alternative currency. I’ll do the field work next week and report back. We’ll also discuss potential means and methods you can expect leading up to the introduction of FedCoin.

The One Indicator to Watch Today