Nowhere is an expensive place… If you’re not careful you’ll blow your monthly grocery budget in one visit.

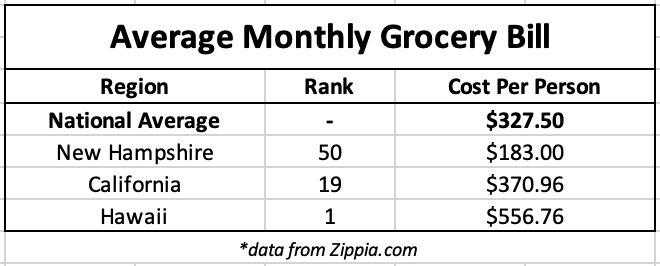

The average American spends ~$325 per month on groceries according to research site Zippia.

California, where I am this week, ranks 19th in the nation at ~$371 per month.

That means $371 keeps a single California resident fed all month. $12.37 per day doesn’t leave much room for excitement…. But the data says it keeps them from starving.

That may be true. But it doesn’t tell you what type of food you’re eating. My guess is there’s a lot of cheap, processed junk in the $371. Junk that while cheap today, will cost you big later.

I’m much more interested in higher quality, cleaner food than the cheap processed food available on the average snack aisle.

So, I decided to see how far $371 would take me at Nowhere.

Budget Blowout

$371 didn’t get me very far.

First stop, the smoothie counter. I wanted to try the Hailey Bieber. That’s the signature drink of Justin’s wife. It’s beautiful, and looks like blended, frozen cotton candy.

Quinn, the boss of the smoothie counter, either couldn’t or wouldn’t tell me if the Hailey Bieber was as good as it looked. “All of our items have varied ingredient profiles.” That’s pretty obvious Quinn. But for a $20 smoothie, I’d expect a little more enthusiasm.

I don’t eat until noon. That means it’s been ~18hrs since my last meal. I’m excited to kick things into high gear. Much more excited than Quinn. She’d struggle if she worked on commission.

I ordered the Bieber smoothie and a “super tonic” which has deer antler and Siberian ginseng. Quinn worked two registers and didn’t have much patience for me but I needed more snacks. Nowhere has some of the best Spanish Marcona roasted almonds I’ve ever tasted. They come in a glass jar which tacks on a $2 refundable deposit.

Grand total for snack time, $76.59. That includes a ½ gallon of award-winning, “hyper-oxygenated” water. It’s still hot in east LA. I need to stay hydrated.

If the Zippia data is correct, the cost of my snack would feed a thrifty grocery shopper for almost a week.

A Grocery Gold Mine

That was an amazing snack…

The Hailey Bieber lives up to the hype, even with a $20 price tag. I’m not sure the deer antler super tonic does anything, but it’s fun to drink.

Nowhere is a real place. The actual name is Erewhon, a scrambled version of nowhere.

It’s the best grocery store I know of. The first time I visited was 2014. I lived in Venice, on the west side of Los Angeles. A friend told me we had to try this store. It had a tonic bar and other very “LA” things we were into at the time.

I didn’t know it back then but that was the first and only location. On Beverly Blvd near West Hollywood, it’s now one of the smallest of the company’s 10 stores.

Erewhon sells food like Bergdorf sells designer handbags. It generates enviable sales per square foot.

If the weekly sales estimate of $1 million per store noted in The Hollywood Reporter is accurate, the location I’m in today does ~$5,000 in sales per square foot.

Too give you some idea of how incredible that is, it’s 10-times the per-foot sales of Nordstrom, and 20-times Kohls. Or roughly 7-times organic grocer Sprouts, which TTL subscribers know all about. Turns out my $76 snack is part of an anomaly in the grocery business.

But Erewhon is packed. I’m now in line trying to order a $40 plate of grass-fed Korean Bulgogi beef for lunch.

If there’s a recession on the horizon, it’s not showing up here. At least not yet.

Running out of Money…

It’s mid-afternoon now and I’ve spent 60% of an average Californian’s monthly food budget. But I’m having a blast.

The store is full of bizarre outfits, beautiful people, and the occasional undercover celebrity. But the average person really would run out of money shopping here. At this pace, I’ll be through a monthly grocery budget by tomorrow evening.

Monthly budgets exist for a reason. No matter how big your pie is, there are only so many slices. The slices look a little smaller these days.

For years people thought happiness stopped growing with income after $80,000. Getting a second car didn’t change your life as much as the first one did, and so on. Basic needs are met at that $80,000 threshold, so we thought.

Turns out, it’s not true. Visual Capitalist notes feelings and mood continued to improve with income up to $625,000 per year. That’s where the survey capped out.

You’ll need $625k of income to consistently shop at Erewhon. Deer antler tonic for a family of four starts to add up.

But if making the jump from Kroger to Erewhon felt good on the way up, going back to Kroger could mean the opposite….or worse.

The Prozac Effect of Easy Money

More income does make things easier.

If a number keeps rising, people tend not to ask questions. Costs rise, income rises to match. People have it too good to introspect.

Then, suddenly, the tide goes out. It’s something we haven’t seen in a long time.

When we had recessions last century, people knew the tide occasionally went out. They knew things got tight. It wasn’t smart to be overextended.

That was a long time ago. Certainly before the Fed decided controlled capitalism would be better than free market capitalism.

Controlled capitalism didn’t happen overnight. People generally had a thrifty nature after generations of free markets. The Fed lured them into a new game.

The game goes like this. Slowly juice the economic system with a continuous drip of fresh, new, extra cash. That extra money flows through the system funding any transaction dependent on debt.

Think back to real estate before the late 1990s. It was not exciting. There were no TV shows about home flipping. Mortgage rates were ~8%. Home prices generally climbed at a pace of 2-3% per year which, as any homeowner knows, matches the pace of normal structural repairs. Boring business.

Then rates started falling. Quarter by quarter, borrowers had more capacity. If you bought property, maintained status quo, and waited, you felt like you built equity.

While you did build equity, it was deceptive. People felt they were real estate entrepreneurs. Sometimes they were. Improving a property, adding square footage, or changing its purpose can add tremendous value.

However, borrowing at 7% to purchase, waiting a year, and selling to someone who borrows at 6% is not very difficult. It’s easy to see how a massive segment of the adult population feels they are real estate tycoons after more than two decades of falling rates.

Then, suddenly, everything changed. Rates reversed 20 years of declines in a matter of months. The result, everyone froze in place.

And that’s not the worst of it… The smartest sellers realize they need to cut the price if they want to move the home anytime soon.

If homeowners felt rich on the way up, they might not take the decline in stride. I don’t know any middle American real estate enthusiasts who parked excess home equity in a safe place. Maybe you do…

I also hear them saying, “I’ll refinance when the Fed reverses course….” Good luck timing that.

Home buyers don’t seem tuned in to what real estate is worth if borrowing costs triple. The same goes for stocks.

Draining The Pool on Purpose

This has been a terrible year for the average stock. You might not realize it if you own an index fund. That’s because a handful of large technology stocks have the indexes up ~15% on the year.

These are weighted indexes. That means $500 into the S&P 500 Index gets a lot more Apple (APPL) than Campbell Soup (CPB).

To be exact, that $500 into the S&P sees $35.50 go to Apple shares and $0.10 to Campbell.

There’s no comparing a soup company to the most iconic telephone maker in the world. However, the way the index treats new investment dollars makes the big companies even bigger, regardless of fundamentals.

Apple today has a market value equal to ~10% of the entire U.S. economy based on GDP. It might get bigger… But it will be unusual for a cell phone company to grow larger than entire swaths of the U.S. economic system.

That said, the earning power of the other 493 stocks in the S&P 500 Index is almost free these days. This chart shows the year-to-date performance of the S&P 500 Index weighted by market against the same index with each stock receiving the same $1 across the board.

It means putting $1 in each of the 500 stocks so far produced a return barely clinging on to 0% this year.

Things are about to get worse for stock enthusiasts.

There still seems to be a lot of enthusiasm towards stock buying. At bear market bottoms like 2003, 2009 or briefly in 2020, people don’t trust the rebound. They’re so demoralized they think another downdraft is immanent.

While the enthusiasm is lower than 2021, it’s not gone.

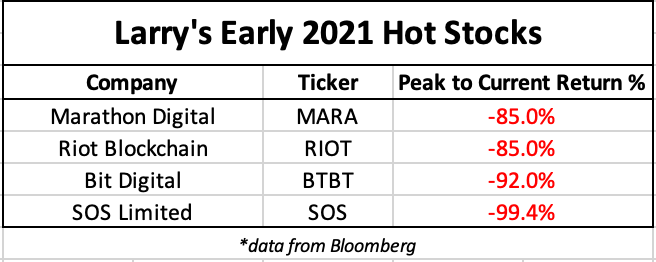

Take Larry Jones for instance. He has a site called Stock Up! With Larry Jones. 614,000 people like it enough to subscribe. Based on the comments, Larry is a beacon of financial wisdom.

In early 2021, Larry was all bulled up. That’s stock lingo for full throttle risk taking.

In this video, he discussed amping up bets to turn ~$2,000 into ~$30,000. He even shows a live look at his brokerage account on air.

Notice the lower left section of the screen shows the title, “This hot stock could 3x in 2021.” He says in the 1990s 12% per year was killing it, now we’re looking for returns like that in a week.

Here’s the bulk of the portfolio he showed in the video. I’ve tabulated the returns marking each stock’s peak price, around the time of the video, and its current price as of Monday.

I want to make something very clear. I’m not picking on Larry. It takes hard work and guts to build a YouTube channel with 614,000 subscribers. Larry is clearly a star.

But after watching his recent video discussing partially losing his voice at an Earth, Wind, and Fire concert the night before, he’s clearly not ready to tap out. Neither are his followers.

He got to meet the band… and a record-industry friend told him he’s super bullish on one of the crypto tokens named for a dog. There are so many I can’t keep them straight. The one Larry likes has, “five zeros and an 8” the way he tells it. That’s speculative junkie lingo for you can get a trillion of them before they become real dollars and cents.

Larry now records videos from the cozy interior of his Range Rover parked in what looks like the cul-de-sac of a subdivision.

The pitch here is buy $5 per day of Apple stock forever and you’ll become a millionaire…

It’s a bear market Larry. It was a bubble, you helped blow it up, and while it deflates you might be wise to wait in T-bills.

Fed Has the Drain Wide Open Now

Larry might not notice it because he doesn’t have a Bloomberg terminal, but the Fed has money flowing out like a dam breach.