Turns out, the big man doesn’t want me around right now. At least, not in his living room.

And it’s too bad. He’s had a rough few weeks. You’d think a visit from the Tucker kids would cheer him up.

We’ll be in town next week. In fact, we’ll stay directly across the street, almost within earshot. I thought it would be rude if we didn’t at least let him know.

The White House belongs to all of us…according to our grade school teachers. And while technically true, it doesn’t feel that way these days.

Anyone can request a tour. Your Congressional representative is the contact point. If you ask them, they’re supposed to add you to a queue. From there, the White House staff and security apparatus take over.

I reached out to my rep a few weeks ago. I explained the Tucker kids ought to see this grand estate. It might inspire them, being future tax payers.

While I didn’t get the tour, my rep did add me to a solicitation list for campaign contributions. Maybe that’s the way to get priority on the tour list…

Increasingly Out of Reach

Washington, DC is an incredible place. It has no tangible economic output, yet controls close to ~$6 trillion of GDP.

Sure, you can get some of the best food in the world. And just about any premium personal service you desire. But outside of that, you’d struggle to find someone creating anything of substance. As far as productive capacity goes, it’s a hollow shell.

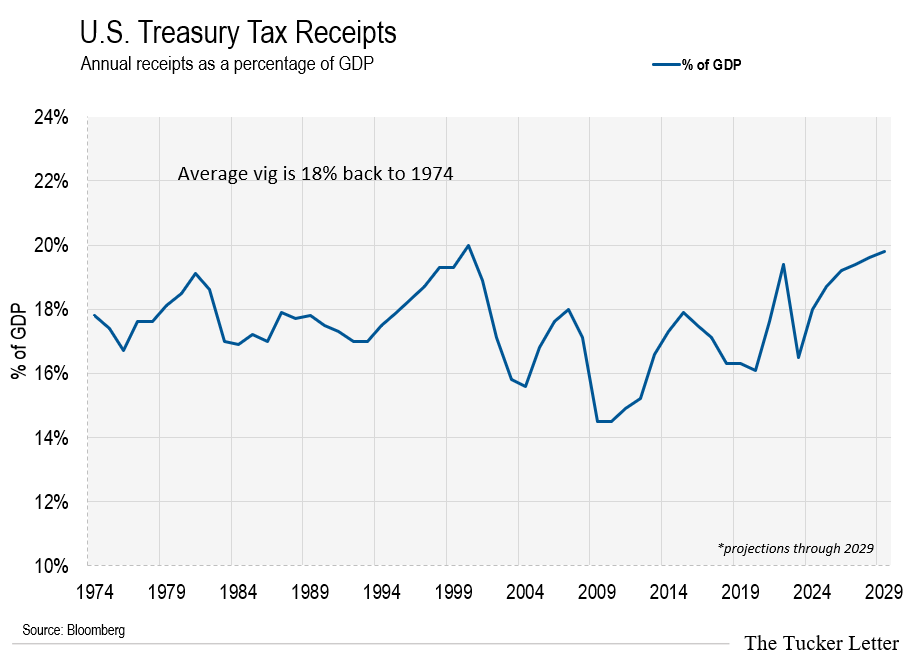

But the power to tax doesn’t need smoke stacks and assembly lines. DC skims 18% off every dollar of GDP in this great land. It doesn’t matter what the personal income tax rate is, going back half a century, it always manages to rake in the same percentage.

For instance, in the 1970s, the top income tax bracket was nearly double what it is today. Yet the take remained the same…as a percentage of GDP.

It means as far as DC is concerned, it’s all about GDP growing, and never shrinking. The particulars of the tax code are merely negotiating points.

And the U.S. is a dignified tax collector. It keeps a clean look while raking the table.

It’s one of only three countries in the world taxing its citizens regardless of where they live and work. Eritrea and North Korea are the other two.

Critics call the tax policy of these other two nations radical. The U.S. is far more humane. It uses certified mail and electronic account seizures instead of brute force.

Either way, it’s a lot of money. And it keeps pouring in.

The numbers get bigger. They have to. If the system shrinks, the whole thing collapses.

It’s why we saw radical financial intervention in 2020. While one hand of government pulled the emergency brake, the other responded to prevent a separate emergency.

It’s the problem with centrally controlled capitalism. Call it whatever helps you avoid looking at the facts…but we’re a long way from a free market.

In a free market, buyers and sellers set the price of everything. We know it works that way on a local level. People drive across town to save money on milk. Low prices on similar goods run competitors out of business. Then prices rise, leaving the consumer with fewer options, and vulnerable to price gouging. Market forces are common sense.

But centrally controlled markets need intervention to quell the effects of prior interventions. And that’s what we need to watch as modern investors.

Adjust Our Thinking

We need to think like DC elites to survive and thrive in this new system. If our pile grows slower than the national pile, we’re losing ground.

The problem for the technocrats running things these days is they can’t leave the spigot on indefinitely.

Think of it in terms of the social drinker and the problem drinker. It’s hard to argue against one cocktail before dinner, or five ounces of fine wine with a steak. It’s fun, enjoyable, and socially acceptable.

Problem drinkers, for whatever reason, are a long way from that. They get the yips, like Nicholas Cage in Leaving Las Vegas when he can’t endorse a check in front of the bank teller.

If you remember the scene, Cage only knows how to fix his problem with more of what caused it. After a few drinks, he returns to the teller with a steady hand, ready to cash the check. His solution merely prolongs the inevitable.

And the inevitable for us is bigger numbers. But not too much too fast.

This chart tracks total U.S. Treasury debt outstanding back to 2000. Notice the pile never shrinks…

More interesting is the pace of growth. It roughly doubles every eight years.

During the run-up to the 2016 presidential election, debt stood at $19 trillion. Today it’s $35 trillion. That’s close enough to call it a double.

And it’ll double again. Assuming we still have elections in 2032, it’s a good guess we’d see debt hovering somewhere north of $70 trillion.

The New Game

It all adds up to a 9% pace of growth for the debt pile. That tracks back to the early 1970s…and there’s no reason to expect it would stop. Fifty years makes a trend.

The problem for some investors is they don’t understand the rules of the new game. They think about the U.S. economic system as if it were a small business, like a local hardware store.

Everyone knows the store owner can’t borrow indefinitely. If debt grows at 9% while revenue grows at 3% the lenders eventually ask questions.

But again, that’s a free market situation. It’s one where lender and borrower have a serious chat. There is no serious chat for the U.S. Treasury…assuming things don’t get too out of hand.

While the federal debt pile grows in one direction at a steady pace, the Fed has a trickier job.

In our centrally controlled system, the Fed manages the economy. Market forces are cruel, like the North Korean tax collecting authorities. Much too harsh.

Instead, the Fed aims to inject fresh money into the U.S. system when things get tight. That softens the pain of contraction, which is a necessary part of the free market system.

People get a little over their skis during good times. We’ve all seen it. The sting of past failure fades as the bull market runs on.

When things tighten up, they face the music. It’s when owners of a small business put on the apron, pick up the broom, and pay close attention to the till.

The Fed knows that needs to happen, and wants to keep it contained.

Fed cash is a lot like seed capital for the rest of the U.S. economic system. It’s the $1 deposited in the bank that gets loaned out 10 times.

When freshly minted Fed cash goes into the system, it shows up on the central bank balance sheet. Notice here the unusual surge in 2020. That’s when ~$2.2 trillion had to go in to prevent a full-scale collapse.

Then, it had to come out. But slowly, and delicately.

We all know what happened in 2021. Stocks with no viable business shot to unusual highs, overnight. Smart shareholders sold. Novices bought more.

In 2022, the Fed opened the drain. It had to get money out of the system before radical speculation, rampant inflation, and casino spirits wrecked the system.

This chart tracks the key tool used to corral excess Fed money. It’s an overnight lending facility designed to pair surplus cash with reputable debt instruments, like Treasuries.

Notice how almost the exact amount of slush pooled in the repo market, $2.2 trillion, then slowly came out. And now, it’s effectively finished.

We’ve talked about this chart as a key indicator of Fed action for close to a year. The flatline near $400 billion seems to be the sign it’s work is done.

This facility does not need to be zero. It’s been around for years. It serves a key purpose for central planners. They need a vast array of mechanisms to control, contain, and manage the world’s largest economy.

With most of the slush melted, it’s about time to watch for a fresh injection. And everyone knows it.

The Family Business

In the old days, you’d do on the ground homework to predict a recession. That’s useless now. Instead, you can do about the same thing by simply watching the most connected players in the market. (Subscribe to continue reading)