Turns out, the state-of-the-art F-35 fighter jet, stops working if its foreign owner misbehaves.

That’s fine for the U.S., which designed and built the plane. It is after all the military’s ~$2 trillion baby. But allies who purchased them seem suddenly concerned.

Just imagine paying ~$109 million for one of these planes, or more like ~$2.73 billion for 25 of them because you really can’t do much with only one. Then trying to scramble them down a stretch of your rugged coastline to scare away rebels. Without notice, the plane barely outperforms a Cessna.

~$109 million is the top-of-the-line model. It has vertical landing capability. There is a cheaper version for ~$82.5 million. That one lands on regular runways.

The Aviationist, an industry trade publication, says the F-35 has at least “8 million lines of code” and needs near constant updating. Plus, if disconnected, the 10-figure beast becomes vulnerable within hours.

Canada, Portugal and Germany went public with concerns about investing in the F-35. Each has open orders for planes in production…and now wonders if it’s a good idea.

But they surely knew this years ago.

In 2017, E.U.-based website Modern Diplomacy reported extensively on the F-35’s U.S. dependence. It went on to detail the obvious danger of purchasing war equipment from other countries throughout history…this is not new.

The site went on to say back in the early 1990s, Australia purchased a bunch of FA-18s that couldn’t see the Hindenburg heading their way without dashboard systems tethered to the U.S. They rebuilt their own systems, replacing the OEM equipment.

You really start to wonder why anyone buys this stuff…

False Comfort

It’s overall pretty easy to trick people. To lull them into a place of comfort. That leads to old behaviors feeling safer than doing any critical thinking about changing circumstances.

Allies expressing recent concern about the obviously backdoored fighter jet should know better. Civilian trade publications spelled out the problem years ago. But foreign leaders kept right on the old track.

And the same goes for regular people. For instance, they carefully create a 6-digit passcode to lock their smartphone. The odds of cracking a 6-digit numerical code are one in 1,000,000 tries. They feel safe with this secure code.

However, it’s well-known that all name brand smartphones sold in the U.S. are backdoored. One example is Pegasus software, which gives “zero-click” access to phones. This means the phone owner doesn’t need to click any suspicious links, the intruder merely enters the phone from the backdoor, which is wide open.

The same goes for desktop operating systems. Sensitive defense operations tend to take place on very old versions…like Windows 95…created before the backdoor.

And it goes on down the line, from smart thermostats, to accounting software, to baby monitors, self-driving cars, bank accounts, crypto wallets, and some day very soon, FedCoin. Increasingly, every part of life has a backdoor, trap door, remote control or other tether to some entity that’s not you.

The countries buying weapons systems that don’t work, planes that only fly with permission, and Treasury bonds the issuer might seize by sanction, know the risks, and do it anyway.

The reason for the recent concern about their ability to defend themselves is, they now fear a mercurial chief occupying 1600 Pennsylvania Ave, might actually throw the kill switch.

On a personal level, Americans do the same thing. They pledge allegiance to a buy-the-dip managed stock market even though it violently changed course this quarter. Most will resist change, sticking to the old behaviors that used to work, only beginning to question them once it’s too late.

Change is Good

It might be too late for countries tethered to the U.S. defense system.

They never developed their own defense. Maybe they couldn’t. The point is, good luck changing course now.

There’s no sense in staring at a kill switch for twenty-plus years then suddenly being horrified someone might flip it.

The problem is, people don’t like change. They’d rather make the smallest adjustment possible, and have someone promise everything will be OK.

It’s the intellectual equivalent of painting yourself into a corner. Ignoring the square room doesn’t make the problem go away.

We do this on a personal level. Things change over long periods. People don’t want to spot and adjust to the new trend. After all, they just got used to this way of thinking. It’s their comfort zone.

Take the last 15 years of buy-every-dip in the U.S. market. It’s what worked. It’s what people remember. It’s what they’re comfortable with.

Every person that bothers me for free advice has the same mindset. Surely TSLA goes “back up” or NVDA makes a new high or my favorite one, “stocks always go up over time.” Sure buddy, whatever you say.

And maybe it’s my perspective that makes this so amusing. I can’t stop thinking about the same types of people in 2010 telling me stocks are dangerous, banks insolvent, and Fed money printing will destroy us all.

I remember people supporting Occupy Wall Street, The Ron Paul Revolution, and the Tea Party. They really believed the system was doomed. Now they think it’s indestructible.

The problem is, they miss the turning points. The kill switch on the big trend.

The Financial Kill Switch

Thinking back to the Occupy people, their general outrage over the tiniest amount of Fed money printing…it seems so innocent now.

It’s easy to see what people got wrong. And seeing it might help us navigate the massive and obvious change of course underway right now.

In November 2010, the Fed Chair Benjamin S. Bernanke wrote an editorial in the Washington Post laying out his exact plan for managing the U.S. economic system. Almost no one took him at his word.

He described a virtuous circle effect enabled by Fed money printing. We say printing because it’s historically easy. More accurately, he created money through a slow steady purchase of government and mortgage debt. It was a microdose of stable capital dripped into what we incorrectly call a free market.

The genius of his plan was the prediction he’d control societal attitudes. That would in turn nullify protests, ease fears about the system, and in time cause people to forget all about the recent tumult.

“[…] higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending. Increased spending will lead to higher incomes and profits that, in a virtuous circle, will further support economic expansion.”

Ben Bernanke – Washington Post November 3, 2010

We didn’t listen…

He published this in a major national newspaper. He told us we’d live in a reflexive feedback loop of prosperity. It seems so obvious now. And fifteen years later, it’s over.

Maybe we should listen to the new voice telling us what he’s about to do.

Tide Change

The first step in right thinking is not compulsively doing the thing that no longer works.

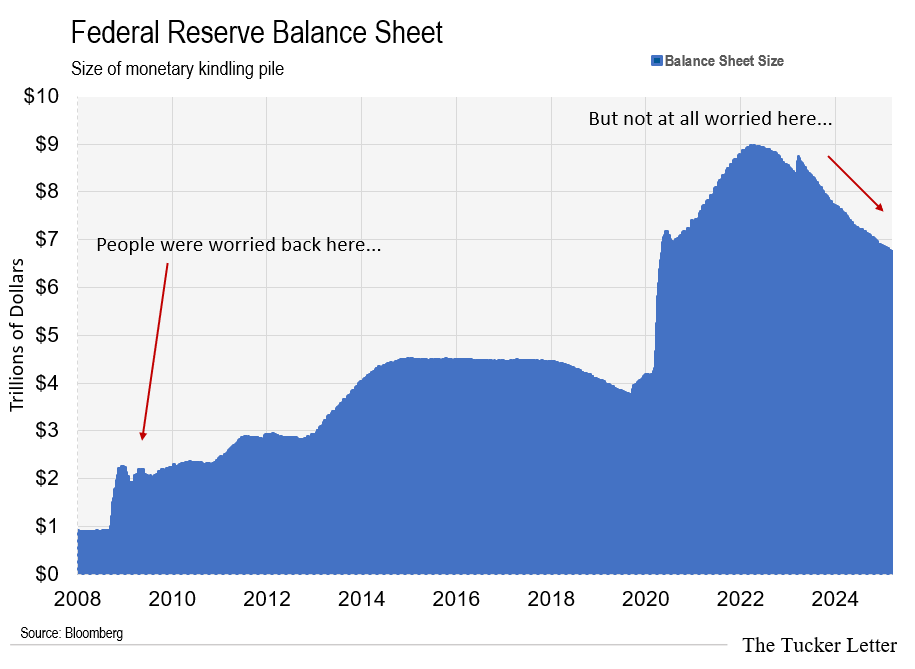

For starters, the 2010 Bernanke opinion piece hit the wire when the Fed’s balance sheet was ~$2 trillion. It never came down.

The virtuous circle kept right on going.

You might remember the now tiny effort to reduce this pile of Fed cash in 2018-2019. It caused severe market strain. The 2020 flu panic reversed that brief decline more than doubling the pile over the next two years.

People talked about how they don’t like debt, the country’d surely fail. It all amounted to handwringing, and useless chatter. Their actions showed they loved the virtuous circle. Which eventually got out of hand, turning quarantined office workers into penny stock gamblers.

However, after hitting ~$9 trillion in early 2022, the pile started shrinking. Known as “tightening” the Fed let bonds mature monthly retiring cash used to create the virtuous circle in the prior decade. These were 5, 7, 10-year Treasury debt instruments maturing at the end of their respective terms.

With the pile falling to ~$6.75 trillion, the Fed recently slowed the shrinkage. It’s as if they know there’s a problem.

They may realize the virtuous circle worked not only with American behavior, but also with wealthy foreigners. Trillions of dollars flowed around the world as business picked back up in the post-crisis global recovery…thanks to the virtuous circle.

Those wealthy foreigners turned around and bought U.S. stocks betting the reflexive upward spiral of the powerful virtuous circle would keep going… and it did.

But nothing lasts forever. And almost nobody ever recognizes the first stumble as a sign of what’s ahead.

If the circle sucked trillions into the U.S. system, the broken circle might send it back out. It would mean trillions of dollars hitting reverse, flowing out of the U.S. market.

MAG7, Netflix for all, and the power of U.S. tech dominated world markets. Success beget more success. The stocks defied rational expectations.

But it’s a big world… and there are other opportunities.

If money flows out of the U.S., foreign investors don’t have to buy the dip.

Four Times the Level That Worried Us

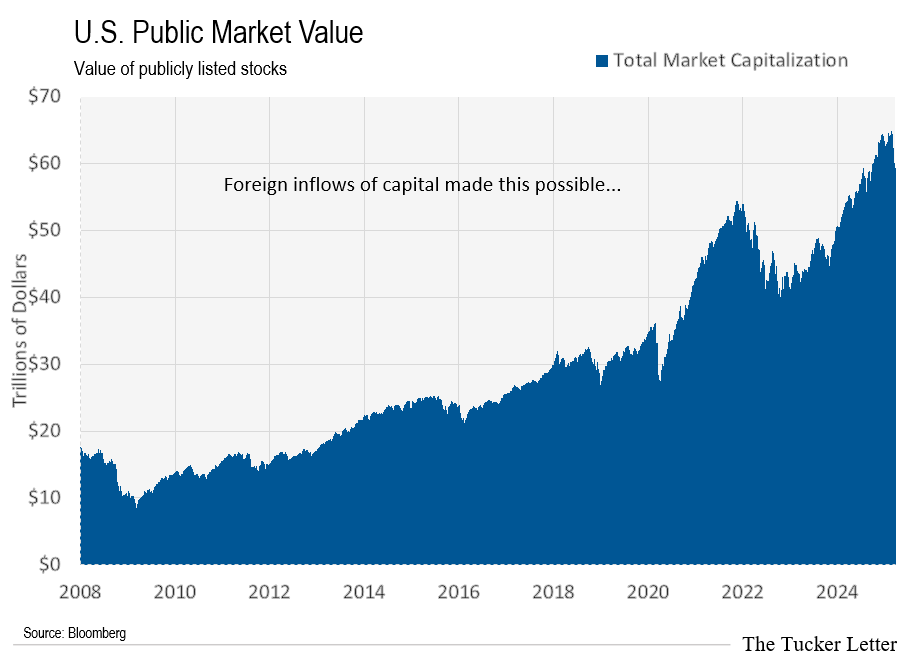

The total value of all U.S. traded stocks tripled in the years following Bernanke’s virtuous circle.

Worrywarts in 2010 thought ~$15 trillion was a dangerous level. Today they think ~$60 trillion, or even ~$65 trillion in late January, is a buy-the-dip call to action.

If a few trillion flows away from the U.S., the value of stocks that benefitted most from the inflow could re-rate in a hurry. We’d get to see how much people really believe in the popular stocks they rigorously defend.

Meanwhile, the one asset without a kill switch sits quietly at an all-time high. $3,025 is the new gold price, and it barely gets attention. Something is up with gold…

In the 2000s, people talked about funny price movements. Some alleged there were big orders placed, then withdrawn before being filled. A technique called “spoofing.” Those who alleged it were cast off as conspiracy nuts. Sometimes called worse.

Around the time the virtuous circle kicked off, that all stopped. There were lawsuits related to the market action. Two years ago, at least a decade after the alleged activity, a few lower-level traders took the fall in court. It’s important to note, we have a legal system in the U.S., not a justice system.

What’s funny about that is gold kept moving in a controlled way, but without the spoofing of the prior decade. Meaning, fundamentals like supply and demand didn’t have much sway over price moves.

People started noticing large volume in the futures market. That’s trading in contracts tied to price moves in gold…not necessarily the metal itself.

Futures started out as a way for farmers to pre-sell crops, using the money to pay for capital expenditures like equipment and field maintenance. Over time, they morphed into a tool for speculators.

Gold futures have no tie to metal. It’s incredible. Instead, they represent the cash spread between purchase and sale of the contract itself.

For instance, this is how the gold action would affect the beef market. Say beef prices shot up double on news a drought threatened the herd. Speculators could sell millions of pounds of beef into the market. Not actual beef, which takes months and years to produce, but contracts for future beef delivery.

The fine print of the contract would say no actual beef must be delivered, only the cash difference between the beef price and the agreed price of the contract.

And what’s great about that is if you sell millions of pounds of beef into a market short on beef, you’d send the price way down. Adding tons of new supply to a high-demand market cools prices.

Then, instead of using the proceeds to acquire a farm and a bunch of calves, just buy back the contracts that tumbled in value when they faced the avalanche of new supply…caused by you.

Again people dispute this as a possible explanation for gold’s good behavior over the past 15 years…coincidentally the virtuous circle years.

I asked famed market strategist Zoltan Posner about this in New York nearly three years ago. He seemed puzzled…and said we should connect later. Which he declined to do.

All I did was ask… I didn’t allege anything. The question was:

“Isn’t it odd that half-a-year’s worth of mined gold gets sold into the market during one session, anytime the price moves up? Then apparently bought back later, only to show up again, sometimes within weeks?

Seemed like a good question. I’ve met most of the gold mining CEOs. I’m not sure they have the acumen needed to trade at that pace. Or any pace for that matter.

Point here is… the open interest in gold futures is drastically lower. Recently it was ~40% lower on the active contract compared to a year or two years ago. But again, it could just be another one of those freak coincidences that plagues the gold market.

Still No Buyers

I’m still not convinced people own physical gold in any material way.

I hear about option trades, gold crypto tokens, and worst of all, leasing arrangements. Subscriber Bronco wrote in with this:

“Hey E.B., Would love to hear your take on the latest hot topic? … [online coin dealers] paying interest in gold??? Don’t understand it at all and honestly seems like a Ponzi to me!

Bronco is wrong for the right reason.

Meaning, it’s not a Ponzi. That’s when the new money goes to pay back the old money.

However, it’s a way to lure income-hungry gold owners into a leasing scheme. Perfectly above board… but adding fuel to the already dangerous fire.

With gold up ~39% in the last year and ~15% this year, it’s amazing people can’t just take profits as needed. The general public seems obsessed with income. Even though income tax rates are often far higher than those on asset sales…

Either way, the action in gold says a lot.

At current known supply, that’s mined gold hoarded around the world throughout history, $3,025/oz means a total gold value of ~$20.68 trillion.

For reference, the estimated value of all assets in the world is ~$300 trillion. That’s a rough number… but the context is useful.

And we know the U.S. stock market values all public U.S. equity at ~$60 trillion.

And TTL Founders learned last week the value of all U.S. residential real estate is ~$50 trillion.

So, maybe gold at $5,000/oz or ~$34.2 trillion is the right price… or something higher.

Instead of making wild price predictions, we’ll go back to an old metric. The Dow:Gold ratio. It’s a measure of how many ounces of gold it takes to buy one unit of the Dow Jones Industrial Average.

Right now, the number is 14. It’s been as high as 20 recently. That’s tracked using the orange line in the bottom chart below.

Historians point to extreme stock routs where gold shines as stocks grind…sending the ratio as low as 1. That would mean an ounce of gold worth 1 unit of the Dow. And would definitely mark an extreme where hoarding overpowered optimism.

And if you’re a real gold bug who’s just giddy about the idea of trading fractional-ounce sovereigns for gas down at the bodega, try to keep all four legs on the floor and remember you’d probably be assaulted while pulling the gold out of your fanny pouch. Be careful what you wish for.

Several Portfolio Additions

With the kill switch in clear view, and a platoon of business people in cabinet positions clearly not afraid to use it, we need to make several portfolio changes today.

For starters, the gold price move far outpaced stocks of companies in the gold industry. We can and will buy quality there now.

Plus, the message from Washington is American businesses making real products have priority. It seems like the end of the line for big puffy ideas, narrative businesses, built on hopefully scalable tech, levitating at every rotation around the virtuous circle.

Those likely will not go away, but they might grind sideways for a while. Chopping and flopping along the road to maturity…but that doesn’t do much for stockholders. So, we’ll own what was out of favor while those led the pack.