The Great Equalizer

And how most people won’t make money off the recent silver rally

Pretend for a minute you have a personal Wikipedia page. It’s a public accounting of your life, your early years, rise to fame, various conquests, and maybe a few scandalous allegations.

On the right side of the page, there’s a picture of you, one you’re happy with of course. Below that there’s personal information, where you were born, and where you died, some time in 2026.

It means 2026 marks the end of your earthly experience, as a human at least. We’re not getting into anything beyond that. The big question is, would you be happy with how the Wikipedia page reads?

Right away people resist this question. How they resist it says a lot about them. The question has little to do with dying. It’s all about how you live.

There’s the typical default to traditional afterlife beliefs, often folksy. This gives people permission to stop thinking about how they live today. It’s a mistake to cling to this. You’re cheating yourself out of better living now.

Then there’s the widely-accepted bucket list. This one is as bad as sending Santa Claus a wish-list. If you have a bucket list, tear it up. It’s nothing more than a distraction. Go do all that stuff right away and you’ll see why it’s little more than a pacifier.

The overlooked feature of the end date on the Wikipedia page is, it’s the moment when everyone is the same. All the games stop, all the ranking, the comparing, the status, the bad thinking, hiding from reality, passing time by distracting yourself… it’s all over.

Thinking about that for just a minute can radically change how you live today.

The Power of Narratives

With most people, there’s a huge gap between what they say and what they do.

If you want to have a lot of friends, don’t point out the vast difference between these two things. Let people tell you stuff, and act impressed by their explanation.

Let them tell you about their dieting plans while they order fries for the table and devour them without help. Don’t give them a hard time about it.

If you tried to explain the real secret to weight loss, consuming fewer calories than you expend daily, they’d feel shame. Nobody likes that.

Let them talk about how they don’t have enough money, or they hope something good happens, or there’s a Powerball winner somewhere that must feel so good. All of this is distraction thinking. It has zero correlation with success. The talker doesn’t want success guidance, they want empathy.

You’ll slowly notice people need beliefs. They gravitate towards platitudes, group thinking, and simple explanations for dynamic situations. Let them do it… It’s how they’re wired.

We’re in a sort of hypnotic state of striving. The foundation is scarcity; the walls are a rating system we all agree on. The roof is some accepted outcome we all hope for but no one can name. This is how the majority marches through life.

It’s the unexamined beliefs that get you in trouble. Until the Wikipedia page ends… then it’s all over, in an instant. That’s the moment when not one of these narratives works anymore. You’re face to face with reality. The music stops… everyone gets to see your real dance partner.

Thinking about it for even one minute today might change everything about how you live tomorrow. It’s your chance at clarity.

The Extremes

There’s a thought exercise for fixing bad thinking. Try to name the beliefs that drive you, and carry them out to the extreme... as a thought exercise.

Think of it like two people with a drinking problem. Both crave relief from the perceived stresses of life. The first rations drinks like one of those self-feeding machines you buy for a dog who’d otherwise eat until their stomach exploded. The second person goes full tilt aiming to annihilate the emotional stress on a bender.

We think the first person, the rationed user, is better. We reward that person, we give them a pass to seek palliative relief, almost daily. Meanwhile, we shame the second person. Yet going off the rails often leads to real behavioral change. We all know rock bottom is an uncomfortable place.

It’s the extremes that highlight bad thinking. Once you see it, the odds of change increase.

That’s especially true when it comes to money. Western society has generally bad money thinking. It’s societal psychosis. Everyone buys in. From panhandlers to billionaires, nobody has enough. The mere definition of enough money is a moving target as elusive as a desert oasis.

Just try pointing this out in conversation. You’ll notice right away people defend, then attack. Try pointing out the scarcity mindset driving people to do things they’d otherwise avoid. Then highlight the fact starvation in America is optional. Cite the piles of uneaten meals dispensed at Washington Square Park every day… you can literally subsist on handouts from people who received handouts.

Even suggesting this causes people to lash out with a stream of defensiveness. They label you insensitive, a gaslighter, and likely end your friendship. Let them go. It’s for the best.

There’s Never Enough

Billionaire Robert Brockman died in 2022 at the age of 81. He claimed mental incapacity in his final years as the IRS prosecuted him for the largest personal tax fraud conviction on record.

Brockman built and ran a huge automotive software company. He made a pile of cash. He was then an early investor in Vista Equity Partners, a massively successful firm run by fellow billionaire Robert Smith…who also had significant IRS troubles.

Even with more personal annual income than an entire subdivision of working families, Brockman became obsessed with frugality… and tax evasion.

The Wall Street Journal reports he stayed in budget hotels, eating frozen TV dinners. If you’ve never had frozen TV dinner, round up $3.74 and buy one at the grocery store sometime, it’s hard to imagine choosing it over homeless handouts.

“In the settlement, Brockman’s estate agreed to pay $456 million in back taxes and $294 million in penalties for tax years between 2004 and 2018.

Brockman was known for his penny-pinching ways, staying at budget hotels and eating frozen dinners in his room…”

What nobody points out is, behaving this way with billions of untaxed dollars stashed offshore is clinically psychotic.

High-end obituaries are a great place to examine undiagnosed money psychosis. Take Garry Winnick for instance. He was a financial engineering expert alongside Michael Milken in the late 1980s junk bond mania.

Winnick died heavily indebted, leaving his wife clueless as to why she’d have to find a new place to live. She thought they had a net worth of ~$6.2 billion but he slowly managed his way into foreclosure.

The couple lived at a 40,000 square foot, 8.5-acre sprawling estate in Los Angeles. It had more landscapers than a Disney theme park. Covered in gold leaf and gaudy statues, the widow never imagined they had a cash flow problem. Gary spent his last days drawing down lines of credit against anything lenders would accept as collateral.

There’s nothing wrong with success. Prime filet of beef digests easier than a $3.74 frozen Hungry Man Salisbury Steak TV dinner…

The problem isn’t the money… it’s our thinking. We’re so compulsive, as a society, we don’t know the difference between too much and not enough.

Right Thinking

I don’t make New Year’s resolutions… If there’s something I want to do, I’ll do it now, or make a plan to do it as quickly as possible.

It’s a different way of thinking… and it changes more than merely how you start the year.

The resolution gives people permission to fail. Making a promise to fix a bad habit later feels good. Almost everyone does this. It keeps them in the comfort of the herd.

When you change quickly, and decisively, you stop running on fear and hope. When it comes to money, you stop making investments hoping to change your life. Instead, you make ones that match the likely outcome of what you see happening in real time.

You’re then free to try something. If it doesn’t work, change. Without the need for a herd narrative pacifier, it’s easier to spot opportunity.

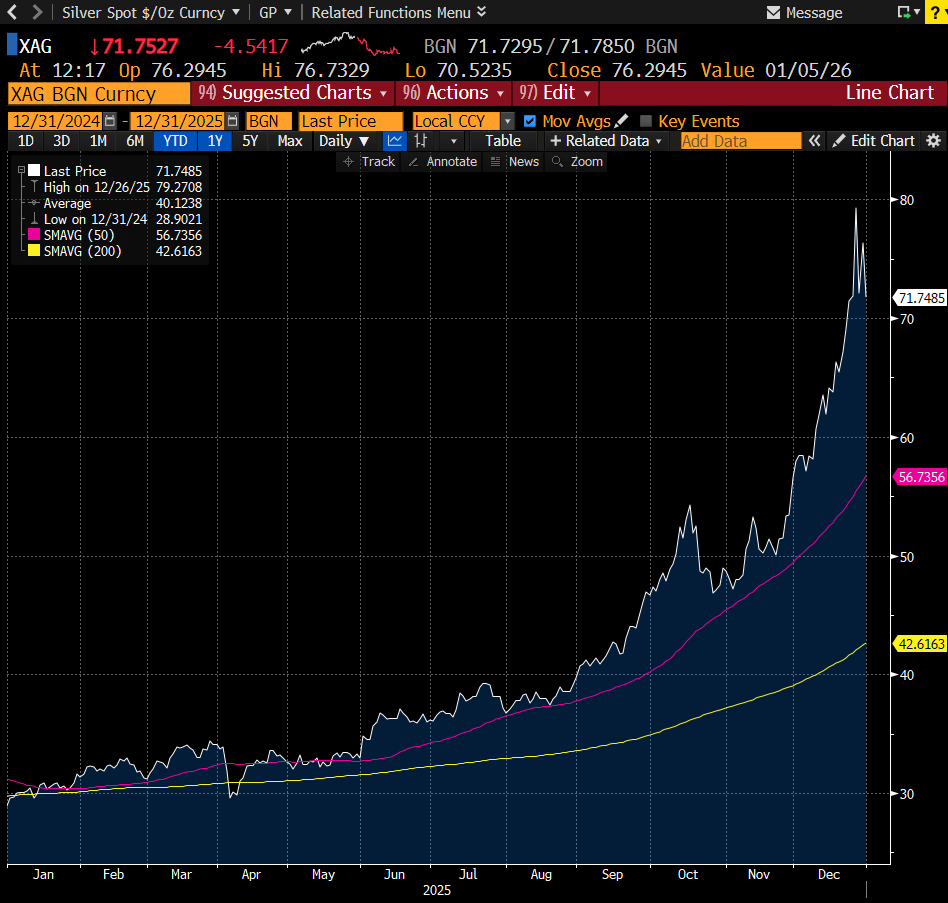

Take silver for instance. The price broke ~$80/oz last week, up more than ~150% for the year…few people will profit from this move. Worse yet, not one of the hundreds of news stories I saw discussed the guts of the move accurately.

For starters, silver attracts ideological investors. There’s something about it… if you’re clear-minded, you’ll spot it right away.

One segment talks incessantly about silver as coinage. This is an insane reason to own something. Coined money is now made from the cheapest base metals available. We will likely have low-denomination coined money for a while, and there is slim chance it’ll be made from silver.

Further, nobody cares if you trust the money or not. You’ll use what they tell you to use, and you’ll either like it, or starve. Soon, that’ll be FedCoin. Go ahead and disagree in the comments below.

Plus, the digital age is a great era for bureaucrats and societal control mongers. The populace is so disoriented from watching TikTok videos of people applying makeup or making their cat jump over things, they have virtually no idea what’s going on.

Then there’s the “supply crisis” silver investor. This segment has limited understanding about how prices work.

There’s been a material deficit in silver supplies for many years.

The simple numbers are annual supply of around ~1 billion troy ounces. Of that, about ~80% is mined and the rest comes from recycling or harvesting scrap supplies.

Silver is a key conductor metal used in everything from solar panels to electric vehicles. Annual demand is upwards of ~1.2 billion troy ounces now.

Try to avoid going down the rabbit hole when reading about this obvious ~200 million troy ounce annual deficit. Financial engineering renders the physical deficit irrelevant.

Pointing this out incites rage within the silver community. That’s OK. It’s not personal… They need to defend their ideology… Even at the expense of profit.

Take for example the recent rise to ~$83/oz and the swift correction to ~$70/oz.

To be crystal clear, I do believe silver will eventually top ~$100/oz. But I also believe most silver enthusiasts will fail to profit from it.

The reason is, they tend to misunderstand the power and effectiveness of financial engineering. It’s a powerful force in our centrally planned economic system.

Set The Price to Whatever

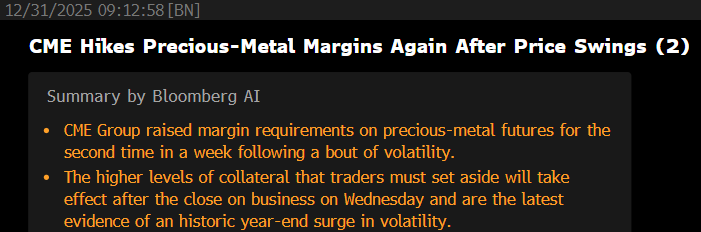

When the silver price rose ~10% in one day last week, I knew there’d be trouble.

You see, physical silver demand from investors has almost nothing to do with the price. Meaning, people going out and buying silver is not material when it comes to price discovery.

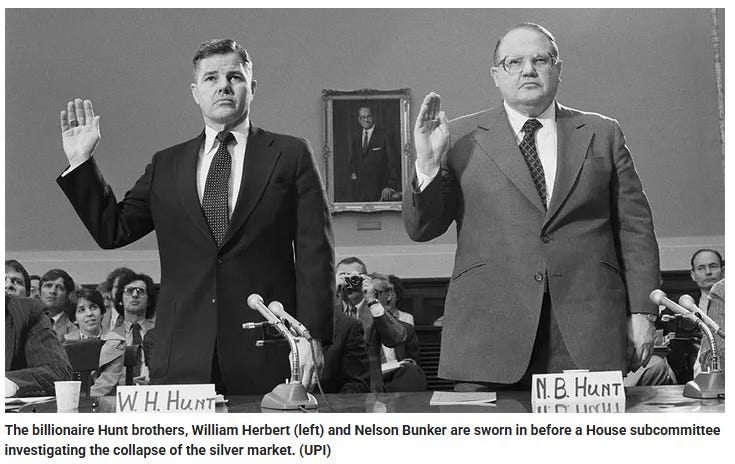

Sure, enough buying does eventually become a problem. And it almost did become a real problem in February ~2021 when silver bugs came out in force trying to corner the market. Almost like a flash mob version of the Hunt brothers’ escapades in the early 1980 surge to ~$50/oz.

The Hunt brothers also failed to understand the radical power of financial engineering.

The mechanism here is leveraged futures contracts.

Futures are a speculative bet on future delivery of any commodity. They started out as a sensible way for Farmer Brown to pre-sell next fall’s corn harvest as a means of funding the immediate expense of planting and growing the crop.

Investors who thought maybe a dry summer would reduce corn yields gave Farmer Brown the money to plant. If the national crop came in heavy, they’d lose. If it came in light, sending prices higher, they’d win.

You can easily see how this turned into a popular betting scheme. It’s almost an old-time version of the modern obsession with betting on the outcome of everything from the number of touchdowns in a game to who becomes the next governor of New Hampshire.

Broad interest in this way of speculating brought new sources of investment capital to commodity producers. Exchange operators further innovated allowing investors to make the same size bet with smaller amounts of money.

This means instead of funding Farmer Brown’s entire crop, merely come up with ~10% of that amount and they’d loan you the rest.

Play that out… Farmer Brown needs $100,000 to grow the corn crop. You put up $10,000 to control the $100,000 bet. Crop values go up, you see $10,000 turn into $20,000 in a hurry. They go down even ~5%, you’re down ~50%.

Trading Gone Wild

Earlier this month, a 5,000-ounce silver futures contract cost only ~$4.40/oz. Now it’s ~$6.50/oz.

That’s not the price per ounce. It’s the cash needed to control an ounce in the market. Meaning, deposit that amount and profits from the movement of a ~$70 ounce are yours to keep. So are the losses…

It’s how most traders bet on movements in the silver market. Or any commodity market for that matter.

If they buy the ounce of silver outright for ~$70 it ties up too much money. After all, a mere ~150% gain in a year is not enough these days.

With only ~$4.40/oz tied up, the move from ~$30/oz to $70/oz is much more dramatic. If you’re not with us here, with a mere $4.40 you captured $40 on that silver move… pretty sweet.

But most traders go full-bore. They can’t help it. It’s in their blood to press a winning trade.

If you’ve traded leveraged futures, you know they’re the pure, uncut cocaine of trading products. Nothing moves more like futures on a day like last Friday in the silver market.

But as any seasoned cocaine user knows, the comedown effects can be brutal.

As the price shot to ~$80/oz, the exchange raised that $4.40/oz margin requirement to $5.00/oz then again to $6.50/oz.

That means anyone with a 5,000-ounce futures contract had to pony up another $3,000 on the first hike and another $10,500 including the second hike.

Sounds like no big deal, but say you added contracts to the trade at $80 or higher…betting it would keep going. The surprise hike in margin rates sent prices plummeting to ~$70 meaning you watched that hero trade go against you so fast you’d barely have time to reach for the mouse before you’re getting a call from the broker to wire more cash.

Things get messy fast… and it almost always happens this way. Often on a Sunday night or a time when most people are not paying attention, liquidity is thin, and heads roll in a hurry.

A Year in One Day

The Hunt brothers didn’t fully appreciate how well this works. Modern traders and silver ideologues often don’t either.

On Monday, silver futures (March 2026 contract) traded ~1.26 billion troy ounces. It means well over a full year of silver demand turned over in the paper futures market.

Paper here means the contracts are merely a cash-settled bet on price direction. They have almost nothing to do with physical metal.

However, as the price falls, coin stores and dealers catering to physical investors adjust accordingly. That’s because they often use this futures market as a hedging mechanism.

The point here is, this system works. It works a lot better than the silver hoarders care to admit.

If you want to make money, you’ll need to pay attention to it.

If you don’t care about making money, and merely need an ideology to believe in, keep fighting it…

Let’s Make Some Money

Prime beef filet is better than Hungry Man Salisbury Steak frozen TV dinners… so let’s spend 2026 eating on white tablecloth and not using the microwave in a budget motel.

We know how this modern financial system works… we know it someday ends in a horrible Wikipedia entry. But that day is not today… and it might be a while before that happens.

Plus, a bet on implosion is a bet against life as you know it. Be careful what you wish for…

As for silver, let’s see if the current washout ends violently, setting the stage for a spring 2026 assault on ~$100/oz.

If it does, it might be a good time to sell a few bars just to make sure the market works… could be a fun experiment in TTL.

Meanwhile, 2025 was the worst year in many for stock pickers. Meaning, people who sat still and did nothing in the S&P 500 Index (SPX) clocked a ~16.8% gain not including dividends. Closer to ~18% if you do.

The Trustee Portfolio did OK considering the rest of the pack…

The goal is not life-changing performance… that usually happens accidentally. I’ve had more than one 100x gain in my career…each time it was a bet I felt so wary of I never expected it would even double.

It’s why TTL is a marathon, not a sprint. It’s why good investing is about good habits, and rational thinking. It’s why the best investors often spend a ton of time reading, studying, thinking, and learning just for the sake of it… it’s the lifelong passion that pays the biggest bounty.

That said, we did have a few happy accidents last year… and surely will have more.