It’s not easy being an American.

Take a look at these mental health statistics from 2023. Hopefully they don’t, “make you anxious.”

The National Institutes of Health reports Americans suffer from:

Adult Anxiety – 43% of adults

Adolescent Anxiety – 31.9% of adolescents

Specific Phobias – 9.1% of adults

We’re supposed to stop dead in our tracks when we hear this subject come up. Empathy, compassion, and support are the correct responses. But the numbers say that’s not helping.

Of the 43% of U.S. adults reporting a surge in anxiety. Psychiatry.org cites these factors:

77% - The economy

73% - Elections

70% - Current events

69% - Gun violence

When elections are scarier than gun violence, you know something isn’t right.

Anxiously Waiting for The Fed

The common belief about anxiety is you catch it. People talk about it this way all the time. They place one hand on their upper chest as if gasping for breath. They say, "You're giving me anxiety!"

It must be like that time when Oprah gave everyone in her audience a car. Nobody saw it coming. Anxiety apparently comes out of nowhere, taking hold suddenly. And once you have it, there’s no getting rid of it.

51% of U.S. adults take a prescribed drug regularly. An increasing number of those scripts address brain chemistry. It’s part of the fight against anxiety disorders.

Penn State researchers say an American female born in 2019 will spend 60% of her life on prescription meds. Males don’t fare much better at an expected 48%.

Plus, you absolutely are not allowed to criticize the situation. Failing to validate, soothe, and yield to anxious people could get you canceled.

Sadly, these triggered souls don’t recognize real help for what it is. The 77% of adults reporting anxiety over the economy might be cured overnight if they found the true source of their worry…U.S. central planners.

Stop Pretending

The problem is, most of us grew up thinking we lived in a free market. We learned about supply, demand, capital, and investment. Folklore was, avoid debt, save for a rainy day, and delay gratification. But that’s all out the window.

These days, the Fed sets the pace of the U.S. economy. We call it a market, and we have a national sense of pride about it. Meanwhile, it’s anything but free.

Take interest rates for instance. It’s the cost to borrow money. You’d think savers decide what to charge borrowers.

Spending less than you earn creates savings. That money is available to borrowers who need funds to finance a business. Too much money available, rates fall. Not enough money available, rates rise.

That’s a free market fairytale…a nice feel-good story about capitalism. It’s popular because it feels attainable. People feel energized, excited, and ready to get ahead of their neighbor.

And remember, we don’t like our neighbors much in America. We say we do, but deep down we want to be sure we come out ahead of them.

Take the current obsession with tracking jobs data. We cheer for unemployment. We think central planners will turn the money spigot back on if the job market collapses.

While market gamblers clamber for more Fed money, people looking for work don’t always share their excitement. All the cheering for more unemployment might be “giving them anxiety…”

Predicting The Next Move

The trick these days is predicting the Fed’s next move. It’s not easy. What people want is more fresh money shot into the system. And right now, they watch that spigot like hawks.

Apollo Global Management (APO) is a $65 billion alternative asset manager. That means it leans heavily on credit in creating complex ways to skim cream off the top of American commerce.

As you can imagine, predicting the next wave of fresh money into the system is a big priority for APO. It has an entire team monitoring every keystroke coming out of the Federal Reserve.

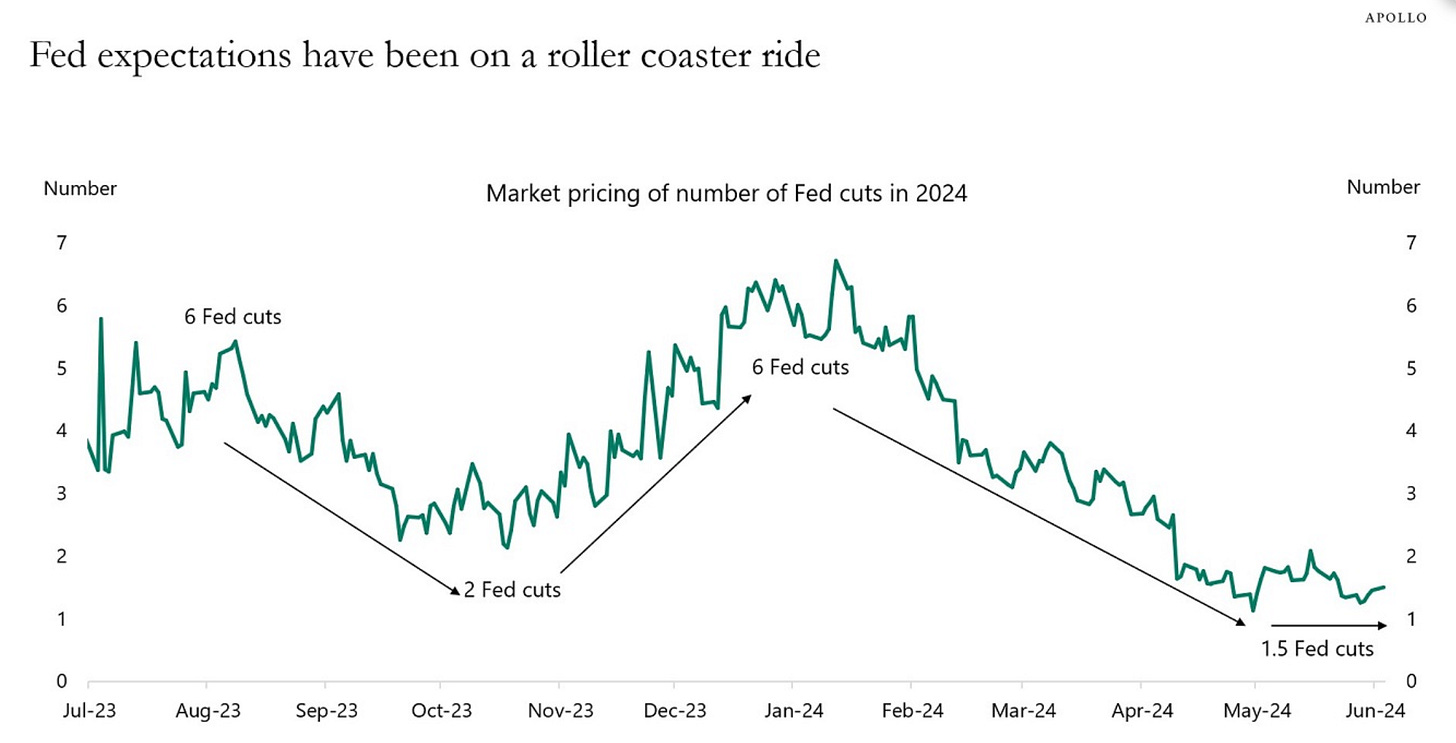

Earlier this week that team put out of chart tracking the expectation of more free Fed money. In this case, it has to do with the Fed’s key price fixing tool, overnight interest rates.

The chart shows how over a one-year period, expectations moved from 6 rate cuts, down to 2, back up to 6, and down to 1.5.

We called this dizzy bat a long time ago. We warned against taking these headlines seriously. Read them, yes. Believe them, never.

No wonder everyone has anxiety. The entire U.S. economic system depends on access to credit. The Fed stands at the spigot reaching down for it, then pulling away. It’s enough to drive people crazy. Especially credit junkies.

Old Tools Don’t Work

In the old days, we’d monitor foot traffic at stores. We’d do channel checks. We’d go up the food chain trying to spot weakness at vendors before it tagged the earnings of a listed stock. None of that matters anymore.

Those old tools helped to track the pace of business. During capitalism, we had recessions. Avoiding them meant keeping capital safe while the market sorted things out.

That’s not how it works anymore. Around 2000, the plan became permanent economic expansion with the occasional brief panic, just to keep people on their toes.

Centrally controlled capitalism is about managing the market. And it’s a tough job. The Fed finds creative ways to inject new capital into the system. That stimulates growth. Think of it like savers in the old days.

But individuals saving and investing took too long. It was also hard to control. This new centrally controlled way is much easier.

The only danger is, things get stretched out. That threatens the system. If people start to think there are unlimited supplies of U.S. dollars, they’ll stop believing the dollar has value.

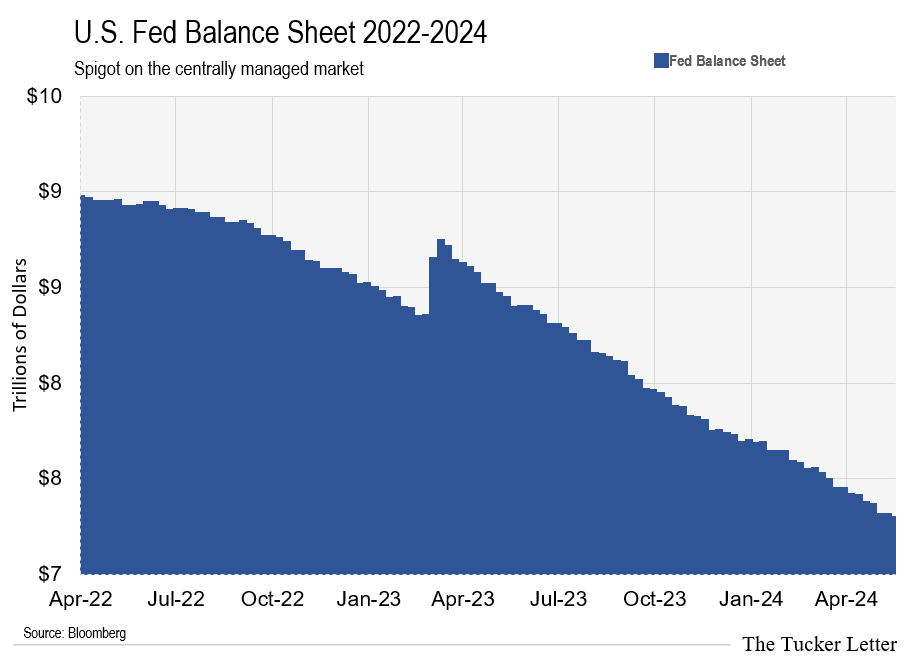

This chart tracks the Fed balance sheet from 2000 through 2022. Think of this as the starter money created and injected into the system. It multiplies from there.

By 2022, things were too extreme. The Fed risked an international revolt against the dollar. It had to flip the switch and remove this starter capital from the system. There’s no time for the market to do it either. We’re 24 years into central control.

The key thing people miss is, other nations, borrowers, and even lowly citizens hold up the value of the dollar…because they need it. If they don’t need dollars, the whole thing breaks down.

And the amazing thing about the dollar is its value. Backed by nothing, people need this hollow scrip to meet all kinds of obligations.

Just imagine yourself in charge of managing this unusual asset. It might be the most powerful invention in history. With the stroke of a computer key, you create wealth. Push things too far, you spoil that power.

It’s not easy being a central planner. And 2022 was a perfect example. They had to drain dollars out of the system, fast. But, not so fast they harmed the flow of commerce.

Starting in April 2022, the central planners sucked ~$1.8 trillion out of the system.

And they did it to preserve the power of the dollar. After the 2020 emergency response to shuttering the entire economy, things got out of hand. The ~$2.2 trillion injected into the system funded wild speculation.

When money showed up out of nowhere, people turned the markets into a dog track. That money had to come out.

Remove The Excess

The Fed tweaked incentives to quarantine that ~$2.2 trillion. It corralled the funds in a temporary liquidity facility called the U.S. Temporary Cash Added/Drained – Banking System Overnight Repo Market.

At least eight times during this withdrawal period we predicted the pace, possible ending, and intention of the Fed’s emergency cleanup operation. We showed this chart every time.

Notice how the facility corralled cash in 2022, and shrunk at almost the exact pace of the Fed balance sheet over the same period.

This marks the ninth time we showed this chart. The Fed’s draining is almost done. However, it may run things down until there’s a real problem.

And to all the dog track gambling junkies looking for something to bet on, beware. The U.S. stock market has a value of ~$55 trillion. It’s double GDP…and a sign of still too much money chasing too few opportunities.

While the long term direction for most numbers is up, the central planners tend to let things run off a cliff from time to time. It justifies their hands-on actions.

Following everyone else over those cliffs is optional.

Why I Hauled My Kids to Miami Monday

Most of the gamblers panting over Fed releases want constant action. From Reddit forums to Twitter hacks, they need something to bet on all the time.

I don’t think they have a good track record. In fact, I think most of them feed money into the market allowing more sophisticated people to harvest it from them. It’s wealth consolidation. The opposite of a socialist idea called wealth distribution. And participation is optional.

For instance, most people like low-priced stocks. They think the low price means huge upside. Usually, it’s exactly the opposite.

I went to Miami on Monday to attend an annual shareholder meeting in person. The company has a ~$450 stock price, no debt, and generates enough profit to comfortably pay over ~$400 million per year in dividends.

I was the only outside shareholder to attend the meeting. And from what the Chairman told me, the only shareholder to ever bring his young children to the meeting. For what it’s worth, I bought them a few shares of the stock, giving them the legal right to attend.