My father owned and operated a small retail furniture store. The kind of place you go to buy a La-Z-Boy recliner, or a kitchen table.

I spent most of my free time working there as a kid. I loved it.

One day on the sales floor, he whistled me over to the manager’s office. When I came running, he said, “This is Mr. Smith, the sales rep from Broyhill Furniture…shake his hand and introduce yourself.”

Up until that point, my training in how to interact with adults was eye contact, firm handshake, and brief salutation. Then hush. So that’s what I did.

Dad says, “Notice anything?”

My eyes doubled in size when I realized this guy had no thumb. I mean, he essentially shook my 9-year-old hand with a boney nub. It was wild…I had no idea what to say.

He was a nice guy, standing there in dress pants, shirt, and conservative tie. He seemed like an overall success, just missing one of his thumbs.

With a warm smile on his face, Smith unloads a story on me. He and his brother were at the beach when he was coincidently, just about my age. They’d run around on the sand dunes, which these days is patently illegal. We all but chain-link them now to protect delicate foliage.

Smith says his brother had some cherry bombs, “You know what those are son?”

“Yes sir, I’ve heard of them.” That was a lie, I’d seen them in action with my friends, and loved every second of it.

Cherry bombs are very powerful. The American Pyrotechnics Association (APA) website notes they’re also illegal. They violate the explosive material limits set in the mid-1970s, about the time Smith lost the thumb.

The limit set back then was 50mg. That’s about half an aspirin tablet worth of gunpowder. It’s the amount used in the paper-wrapped fireworks sold in big packs today. A single cherry bomb had more than 20-times that amount.

He tells me he held the cherry bomb while his brother fumbled with matches. It’s windy at the beach, he notices the fuse lit, and goes to toss it. Too late.

So much for the thumb. At least we start out in life with two of them.

I’ll never forget my father proudly observing this conversation. To his credit, that was good advice in the early 1980s. But considering today’s statistics, it’s irrelevant.

Safer Than Ever

The Chinese invented fireworks. It’s a logical next step from gunpowder, which they figured out around the 9th century.

Potassium nitrate, sulfur, and charcoal combined to make the powerful explosive material that changed mankind forever. Not just on the battlefield, it also changed how we celebrate. Pack that explosive into a tube with a bevy of smaller, colorful explosives on top, tie a fuse to it, and whammo, you have a festive mortar.

It seems like the Chinese still control the fireworks market. The APA says barely 1% of the astounding quantity of fireworks discharged in 2020 were American made.

For some reason, Americans love to blow things up. So much so they ignited 436.4 million pounds of colorful explosives last year, 427% more than in 2020.

Plus, that’s just what people blow up at home. Add to it the professional firework displays put on by sports teams, cities, and theme parks, and the numbers get even bigger.

The APA supports the time-honored right to celebrate with controlled explosions. The industry trade group goes to great lengths to defend pyros nationwide.

Barely half of U.S. states allowed fireworks as recently as 2000. Seasonal entrepreneurs set up makeshift stores in tents across the border. States realized the effort to control pyrotechnic desires was futile. 47 states and DC now say let it rip, at least today, America’s birthday.

Vermont and Illinois only allow fireworks on a stick, like sparklers, which are pretty boring. Massachusetts still forbids all forms of pyrotechnic expression.

It’s hard to understand why those holdout states don’t cave and give residents what they really want. There’s no significant fire danger in western Massachusetts. And safety isn’t a good reason, according to statistics.

The APA says being a pyro is much safer than playing basketball. Last year around the July 4 holiday, 2,425 kids ages 5-18 reported an injury from fireworks. That’s 78% fewer than those injured shooting hoops. It’s 90% fewer than those injured swimming.

For kids at least, fireworks seem safer than sports. And the overall numbers match for adults too.

Total usage is up 1,600% since 1976, America’s 200th birthday. The overall odds of injury while discharging those fireworks is down roughly 95%.

New Advice for a New Era

It makes me wonder what other pieces of advice don’t work today.

In that same furniture store I learned the importance of the profit and loss statement. Nobody thought to tell me it wouldn’t matter one day. Back then, there was no endless stream of venture financing desperate to buy into growth at any cost.

It was a different era. You spent less than you earned, saving the rest as capital. More capital meant more stability. That’s what you needed to survive a recession, or business downturn.

We don’t have recessions anymore, and you also don’t need any seed capital to get filthy rich.

Take WeWork for instance. It just filed for bankruptcy protection. Founder of the shared office rental company Adam Neumann is a genius. He rented an office, and re-rented smaller sections to individuals. It required very little capital.

He signed leases, and sub-leases as quickly as possible. He presented his idea as part of the technology investing boom. He sold shares of the business at a $47 billion valuation, to sophisticated investors. The value is now $0. The company belongs to its creditors.

Neumann raked $2.3 billion out of it according to Bloomberg. Instead of being thrifty, or adhering to old advice, he wisely whipped up a good story and sold it to greedy speculators.

But he’s not alone. The free money era drew out the most aggressive opportunists.

Rishi Shah pushed things even further. He had a healthcare advertising firm that didn’t even place many of its ads. He greased the upper rings of the U.S. political ladder to climb faster.

Investors felt comfortable with his connections, and skipped the process of doing homework.

Crypto firm FTX did the same. Its management behaved like adolescents. Sleeping on beanbag chairs, eating vending machine snacks as meals, and taking prescription amphetamines while cohabitating in a luxury penthouse. The smartest investors in the world wrote checks for billions…without looking under the hood.

Fraud runs rampant in the Fed’s free money era. Managed capitalism doesn’t have the same checks and balances as a free market. It takes different skills to succeed.

Ozy Media CEO Carlos Watson knows what it takes to win in the Fed’s new world.

Evidently, Watson is a TV personality. Since I don’t have a TV, I’ve never heard of him. He appears to be a political commentator, among other things.

He and his colleague used a device to scramble the sound of their voice while pitching the company to Goldman Sachs. They said the executive talking was worked YouTube, and couldn’t disclose his identity, but could disclose that parent company Google wanted to buy the firm for hundreds of millions, and Goldman should invest ASAP.

I enjoyed learning about business fundamentals as a kid… Nobody ever thought to teach me the real fundamentals needed to succeed in an economic system managed by central planners.

Buzz Now…Pay Later

On an individual level, the entire concept of being thrifty, paying off debt, and living within your means is irrelevant. It’s advice from a different era.

I should tell my kids to gamble on crypto, study Reddit for meme stock ideas, and while you wait for success, make installment payments on basic necessities.

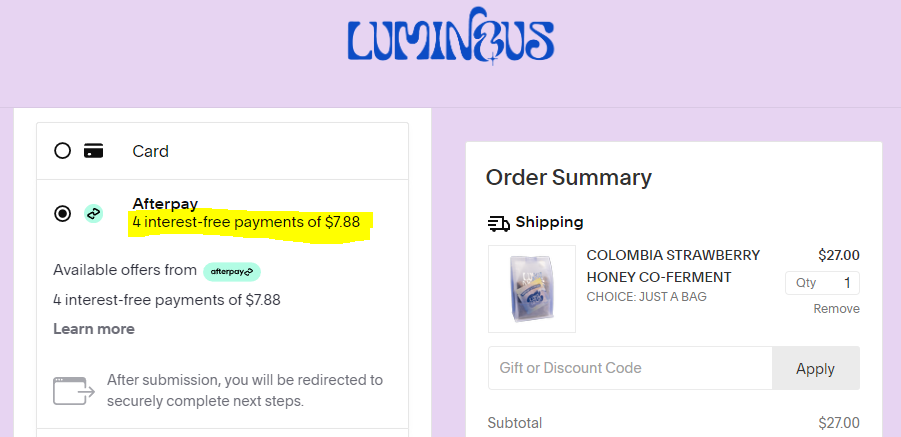

You might notice the “pay over time” option at online checkouts. Almost every item qualifies for installment payments. I’ve seen monthly payments offered while ordering coffee beans for the office.

From coffee to leisure activities, nowhere in this modern era is spending less than you earn part of the wealth equation. And it’s from the top down.

Asset managers don’t care if the company keep $0.01 or $0.10 of every dollar generated in sales. The story value of the business matters most. In addition, how fast can you grow the customer count. That’s it.

There’s a piece of this equation people seem to miss. The entire daisy chain rests on one critical ingredient… and endless stream of cheap financing. And that’s in question right now.

It has to be. You can’t run the spigot wide open forever, it loses pressure. Dialing it up, and down, simulates a market-based economy.

And that’s why we wait patiently for tomorrow, Friday July 5, when we’ll hear if enough people lost their jobs in June to trigger action at the central bank. We’ll do that every month, until we get what we want…more cheap money.

But there’s a problem. It’s a big one.

The excess money created to engineer a perma-boom over the past 15 years won’t go away. There’s too much, and it’s flooding increasingly odd parts of the market.

Nobody wants to let go. Private equity funds sell business interests held by old funds to new funds, they borrow from sister funds, and money-losing businesses beg, borrow, and trade to avoid devaluing the business. And it works…for now.

Everyone believes the Fed stands by ready to act, slashing borrowing costs back where they belong, 0%.

As proof, the U.S. Treasury yield curve remains inverted for the longest period in recorded history. This means the Treasury pays substantially more to borrow for a month than it does for 10 or even 20 years.

The chart of Treasury borrowing rates across time shows the market expects the Fed to cut short term borrowing costs imminently.

A cut would lower the front part of the graph to form an upward sloping cost curve…which would be “normal.”

After all, another piece of advice most of us heard growing up was it costs more to borrow for longer… evidently not.

Still Too Much Money

The second piece to watch is excess money still sloshing around. Someone has to lose, and nobody wants to take the hit.

Dealers report a record high appetite for lending…rivaling bull market excesses. This means lenders willing to charge barely above the risk-free rate of interest…just to get the money put to work.

It’s more evidence of the universal believe that the Fed stands by ready to lower rates. Institutional investors want to stuff as much money into business loans as possible, at today’s “high rates” before the Fed lowers the bar. That Fed move would boost the value of loans issued now, regardless of borrower fundamentals.

(CLO is a collection of bundled loans offering investors/lenders more broad distribution of borrower risk)

Powell knows he can’t cut too soon, or the excess money left in the system will feed rampant asset inflation…far beyond what’s needed to keep the investing masses sedated.

Worse yet, if he waits too long, workers suffer, consumers run out of monthly cash, and younger generations lose faith in the narrative of our free market system.

And that’s exactly what it is… it’s a story about a free market. It’s slogans, folklore, and hope that the meme stock you hear about will be the one that changes your fortunes overnight.

As you send up a few hundred pounds of fireworks today, set off a big one in honor of that.