Edward Bernays thought people were stupid.

He had a special insight into how they think. He saw them as herd animals, looking for a leader. To prove it, he invented a new, revolutionary industry called, “public relations.”

The helpful-sounding name disguised what became one of the most powerful influences on our daily lives. It softly and subtly tells us how to think about most things.

PR guides our opinion. It manages our relationship with facts. Bernays called it, “managed consent.” He felt like we couldn’t be relied upon to make decisions independently…that was too risky. We might choose something good for us, and bad for the ruling class.

However, by guiding our perception of facts and events, we’d feel like we concluded the predetermined outcome. That means we’d march in the direction our handlers pulled us, and we’d think it was our idea.

Until Bernays came along, people bought products based on durability, utility, and need. From the industrial revolution into the 1920s, commercial persuasion had little effect on consumer behavior.

Bernays offered his new service to skeptical companies. It sounded too radical to work. One of them gave it a shot.

The American Tobacco Company needed a sales boost. By 1929, cigarettes were widely available. That put a strain on organic sales growth. The company hired Bernays to come up with ideas.

At the time, only men smoked. People thought the habit wasn’t ladylike. This meant tobacco companies battled for a share of half the population.

Bernays told tobacco executives he understood the source of the gender issue. People associated a lady smoking with other crude activities. There was a social taboo…and he could change it. He’d remove the barrier.

The executives set him to work. They surely wondered how one man could change the belief of an entire society.

What they didn’t realize was Bernays had a secret understanding of how people think. While the tactics and efforts were his alone, the foundational knowledge of how our minds work came from his uncle…Sigmund Freud.

Torches of Freedom

The 1920s saw America’s first major step towards gender equality. With voting rights guaranteed by constitutional amendment at the start of the decade, the era marked a turning point for women. It meant the general concept of gender equality was slowly sinking into public opinion.

Bernays thought he could piggyback this trend and deliver results for his new client. There’s an art to this. It means noticing the new idea in seed form, and watering it. It takes a clever mind, and a little finesse. If successful, he might be able to double the size of the cigarette smoking customer base.

The plan went like this. Bernays called in a favor to a friend at Vogue magazine. He needed two dozen debutantes. These are college-aged girls deemed the freshman class of high society.

As the Easter Sunday parade kicked off in New York City that weekend, he’d position the debutantes as a group of protestors on the parade route. He’d give them pre-made signs and chants touting gender equality.

Next, he’d tip off local reporters. He’d stir up a rumor. A picture of rowdy society girls protesting would sell a lot of papers. Every reporter in town would show up to get a picture. The girls show up not knowing the full scope of the plan.

One last minute detail… Bernays tells the girls smoking a cigarette would enhance the power of the protest. It would be a real challenge to societal norms.

The stunt worked. Women felt equal in a new way, as smokers. Bernays delivered for his client.

American Tobacco Company took a big gamble on this new idea called PR. It paid off. Soon, every other tobacco company followed. The race was on to capture a cigarette market that doubled almost overnight.

For Edward Bernays, finding work wouldn’t be a problem for the rest of his life. He lived to the ripe age of 103. That likely outpaced the women who picked up a smoking habit in the name of gender equality.

Herding Cattle

Bernays was the nephew of Sigmund Freud, pioneer of the psychotherapy movement.

Freud had a view of mankind that was arguably dark, and arrogant. While referenced as a therapy icon, he didn’t think much of the independent individual.

Essentially, he saw man as a primitive creature. Torn between the impulse to reproduce or violently take the necessities of life. Left unmanaged, society would descend into periodic chaos.

The only hope, as Freud saw it, was a rational combatting of these urges. Social norms would create a reward for those who stayed in line. Think of it like giving a dog a treat for good behavior. This was essentially the ego principal in his famous id, ego, superego theory.

Freud’s sister sent her young son Edward to spend summers with his uncle, the radical shrink. Edward soaked it all in. Where Sigmund wanted to manipulate minds, Edward saw more promise in commercial use of theories.

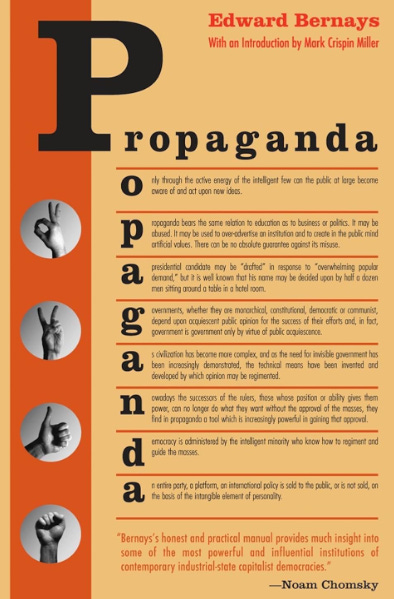

Armed with cutting edge insights into controlling or manipulating human decisions, Bernays got to work. He wrote a book aptly titled, Crystalizing Public Opinion in 1923.

He followed that with an even more direct explanation of what he saw possible. Propaganda puts the whole strategy, and its intended outcome, in print. That was 1928.

But the 1929 stunt with American Tobacco cemented his role as an iconic, behind-the-scenes figure. Businesses, politicians, and elites of all stripes needed what Bernays had to offer.

Leverage Their Belief…

Think of it like a ride at Disney World. Kids grab the controls, truly believing they work. But the ride goes on regardless of where that child steers. The perception of independence is a key part of making the experience memorable.

The Bernays playbook does the same thing. It makes you feel like you came up with the idea to support the cause he needs you to support.

This came in handy during the war era. He had a blank check from corporate America. It, in turn, had the backing of the wartime government, desperate to shake off the depression.

The 1939 World’s Fair in New York proved an essential propaganda tool for Bernays & company. “Democracity” would showcase the world of tomorrow. People would later consume products and services matching that reality.

Tobacco companies, car dealers, and a myriad of consumer goods benefited from the Bernays approach. Governments also benefited.

The trick at the World’s Fair was an open secret. Bernays gave a presentation to the planning committee in 1937, two years before the event.

He mastered the art of manipulation. He compared the mass public to a giant herd, following whoever stepped up to lead. He called them irrational, maybe he was right.

If public relations shaped most of what we know of the 20th century, surely it works today.

The World’s Best PR Campaign

The whole thing really makes you wonder…

If cigarettes evoke freedom, and cars…democracy, maybe an ever-rising home price and 401k do the same for free market capitalism.

But in each case, the facts say otherwise. People die from emphysema, American cars are plastic clunkers, and managing the pace of asset growth is not a free market.

Belief in the U.S. money system is key to its survival. If you stop believing, you’d stop playing the game. That means no more tax revenue, no more borrowing, and no more demand for dollars. The Fed can’t let this happen.

That’s why the current obsession with rate cuts might be the greatest PR strategy of all time.

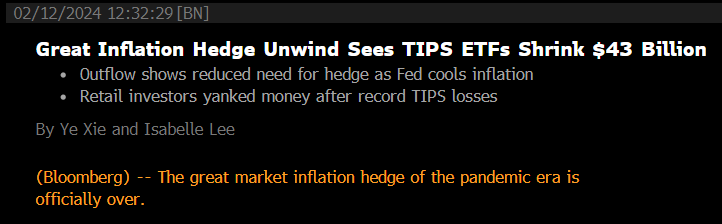

Notice this story on Monday touting the Fed’s defeat of inflation. It’s a technical knockout, investors scurry away defeated.

Unfortunately, on Tuesday, the situation reversed course…

This is dizzy bat at its finest. From one day to the next, if you tried to trade these moves, you’d drive yourself crazy.

The way this looks in markets is large, daily gyrations, only helpful to highly-leveraged algorithmic traders.

Notice the gold market on Tuesday morning, just after the 8:30 CPI release. Keep in mind, CPI was higher than expected. That means higher prices… and you’d assume a rush to assets like gold. But no…

The expectation of rate cuts in March got pushed to June, sending gold tumbling. The entire system sits like a panting dog waiting for a treat.

Gold is an important market to watch because it’s large, highly liquid, and sensitive to narrative shifts outside of stock market hours.

But don’t worry, there will be a story of new rate cut expectations soon... Gold might recover the 1% loss in 10 seconds. Stock futures follow the same path. And it’s all designed to manage your consent to centrally controlled markets.

The Fed’s Real Plan

Forget about the news…

The Fed’s real plan is to drain the excess pandemic liquidity from the western financial system.

There were too many dollars shot into the system during the flu panic. Around ~$2.2 trillion to be specific. That money needs to come out, without creating a major panic.

As the 2020 shock faded, the Fed steered its pile of slush into what’s called the Reverse Repo Facility. It’s a corral used to contain liquidity.

Containment works by setting the interest rate paid on excess liquidity channeled into this holding pin.

Here’s what this looks like. Notice the surge in early 2021. The peak closely matches the total amount of extra money injected during the earlier panic period.

The goal is to keep you distracted while it drains this pile of slush… and it’s working.

Story by story, day by day, the Fed steers your expectations. Rate cut sooner, market surges. Rate cut later, market slumps.

Professionals bet heavily on these daily moves now. In and out of positions dozens of times per day hoping to capture tiny moves using maximum leverage.

It’s not a game worth playing… the daily gyrations take a toll. As of this week, it’s down. Next week, maybe up.

All the while, most people can’t stop praising the free market. They love home equity, NVIDIA stock, and the dream of catching a high flier. The odds of that are low, until the Fed turns the page on its cleanup operation.

That’s why I’m personally making a large investment outside the market this quarter. I’ll share the details with you below my signature at the end of this issue. As the investment plays out, I’ll also share the results.

Meanwhile, we’ll stay positioned in key sectors of the market with the Trustee Portfolio. We have concentrated bets in certain areas. It’s working… One sector specifically is up big, and we still need to add our final position. If the market cools, we’ll make that move.

In the meantime, let’s review where we stand.

Trustee Portfolio Update