Japan is in trouble.

Its adult population seems powerless over investment scams. Most of them originating from Facebook ads.

So far this year, roughly 20 people per day report losing ¥13,000,000 to what they perceived as the promise of instant riches. That’s a total of ¥260,000,000 in hard-earned savings lost every day.

The ¥13,000,000 per person is around ~$85,000 U.S. dollars. For comparison, it’s about 120% of what the average American earns in a full year of work. And that’s before taxes.

The numbers are staggering. And with almost one person per hour losing that amount to schemes, scams, or outright fraud, it’s an epidemic.

Worse yet, the money losers clicked to their own demise. The company now known as Meta serves up reams of tantalizing ads designed to dupe Japanese adults. That’s according to lawyers representing the growing class of victims.

Hard to Fix This Type of Problem

The problem is cultural.

Japan was a pile of rubble after the second world war. Worse yet, it had no viable domestic fuel source. Its leadership chose hyper-efficiency, and a plunge into putting microchips into every imaginable item.

After twenty years, the result was an epic boom in productivity. By the 1960s and 70s, the Japanese economy roared ahead. It wasn’t luck, it was good strategic thinking.

Since every gallon of gasoline came by ship, from a foreign land, they built cars that sipped. They made smart gadgets, and designed as if the computing age was imminent.

By the 1980s, Japan posed an economic threat to the developed world. While some Americans griped about their little cars, others warned they’d soon own all of California, and the New York skyline.

But that was more than 40 years ago. It was a generational top. What followed was a period of stagnation, deflation, and no growth.

Japanese learned to hoard cash, which at times bought more tomorrow than it did today.

Beware of Conditioning

An entire generation learned to hoard wealth.

Then, without warning, inflation returned. So did growth.

The problem with cycles is, most people don’t notice the trend change. Instead, they expect the previous cycle to start back up any minute.

Take our current bull market in gold for example. The last one of consequence was in the 1970s. It’s half-a-century behind us now. Sure, the chart from back then says gold shot from $35-800/oz over a ~10yr period. But anyone trading that market with serious money would be pushing 80 years old now. While 80 is still young enough to play tennis, it usually means retirement from speculative investing.

What the current gold market shows is by the time a new one rolls around, nobody remembers what to do.

And the same goes for the problem now facing Japanese investors.

After stuffing cash anywhere possible for ~40yrs, they suddenly needed investment returns. Stock investors alive and active during the unprecedented run of the 1980s would be at least 70 now, likely older.

Just imagine you were a Japanese investment professional, in your mid-30s, during the 1980s bull market. You made so much money you couldn’t spend it all. You bought a home with a view of Pebble Beach. You bought French wine by the pallet, Italian sports cars, and Swiss watches on impulse.

Worst of all, you were the smartest person in the room. Every conversation ended in a lecture to holdouts, non-investors. Get into stocks, or get left behind.

But then, it turned. The index fell 82%. It fell, and fell, for almost twenty years.

You’d be in your mid-70s now. Right after the top, people listened to you. “It’ll come back.” But it doesn’t. After almost 40 years, you’re a bus driver, potentially with a drinking problem.

Old habits die hard. When you wake up every morning to success, it’s hard to imagine losing.

Stock Market Novices

Maybe the bus driver was right…only a generation early.

The recently-scammed Japanese men in their mid-50s report mostly the same story. They saw a Facebook ad touting sensational investment gains. They clicked, they were skeptical, the scammers built trust by giving access to a special investing app. It’s a fake, simulated account. When they saw the balance grow daily, they started depositing money by bank wire.

First they wet the beak with small gains. Then they make you feel like you can’t win big if you don’t play big. Scammers know how to create the fear of missing out. Desperate for investing success, the suckers wire more and more.

Japan Times goes on to report on one man who wired a chunk of yen equal to $1 million USD. The money is gone, and he blames Facebook.

This might go on for a while. The thirty-plus years where stuffing cash in a box worked out great just ended. The same way generals fight the last war, investors position for the last bull market.

A Better Way – Buy What You Know

In fairness, these Japanese investors don’t know what to do. They want investing courses taught free of charge, and elected leaders aim to set that up. But it won’t help.

Classes are a popular way to learn about new things, but in the case of investing, are often worthless.

The most overlooked path to investing success is, buy what you know.

Peter Lynch wrote a book about this in 2000. It’s so simple a middle school student could digest it.

He talked about visiting stores with his kids. He paid attention to what drew them in, then researched those companies. He was retired at the time, and it was his way of conducting on-the-ground research.

Lynch believed in this strategy twenty years prior. He told people about it openly. While he had a successful career, few passive investors took his simple advice. Here he is telling Louis Rukeyser about the strategy back in 1982.

He goes on to say people work every day in some industry. They know it inside and out. Then they venture into investments in some new industry they know nothing about. It boggles his mind. Mine too.

This advice could save middle-aged Japanese from being scammed.

Instead of clicking on flashy Facebook ads, they could simply buy the country’s main stock index, the Nikkei 225. It’s up ~17% so far this year. That’s nearly ~50% more than our S&P 500 Index…not including dividends.

Savvy readers might say the Japanese yen is down, and currency variations make it complex. Yes, but the average 50-year-old in Tokyo wiring millions of yen to scammers might sleep better plowing money into a solid company.

Taking Mr. Lynch’s Advice

Our most recent recommendation is up ~10% in less than a month. I’ll be at the company’s annual meeting, hopefully reporting back with fun insights.

That’s the investment side of things. I also wanted to see what it’s like being a customer.

Last week I got a new air conditioning system at the office.

It all started with the third repair on the existing HVAC system. It wasn’t the parts, and I wasn’t being cheap about it.

The issue was, the old drain line didn’t have enough pitch. Each time I had a repair, I’d ask the tech, “Shouldn’t we rip the whole thing out and start over.” It was ~15 years old. The prior owner expanded without replacing the system. The technicians didn’t consider all of this, and thought I was crazy. But that’s what we finally did.

My desk area, where I spend countless hours, sounded like a wind tunnel every time the air came on…which was all the time last summer. The previous techs didn’t see the problem. Finally, this one did.

Once he saw it, he went on about how this is all wrong, and needs to be redesigned. I let him think it was his idea. He came as a referral, owns his company, and is honest.

I told him to rip it all out, all the vents, all the insulation, all the equipment. Start over, and do the job the way he would do it if he owned the place. I told him to use the nicest materials available, and I’d leave for the entire week to give him space.

Last Friday I walked back into an office to find a space with perfect humidity, all new duct work, and an 18-seer Bosch system that is so quiet I’m not sure it’s on.

The installer told me most people don’t want to spend the money. The average unit replacement sees products like Goodman, Carrier, or Trane stuffed into the existing space. These are the Ford and Chevy of HVAC systems.

There’s nothing wrong with those products. They blow cold air, and are more efficient than older units. But they’re in the minor leagues when it comes to comfort, and innovation. Bosch, Mitsubishi, and a handful of other premium brands offer unmatched comfort.

Here’s Where It Got Interesting

The installer, Ali, sees my Bloomberg terminal. He asks if I’m a day trader. No Ali, I am not a day trader.

He goes on to share he considers himself a swing trader. I apologized for mistaking him for an HVAC contractor… He showed me how he bought Starbucks (SBUX) earlier in the week, sold it, pocketed a few hundred bucks.

Then he explains he’s a seasoned veteran at this game. Crippling losses, trading on excessive margin, and failing to adhere to discipline taught him the hard way how to swing trade. It sounds difficult… especially when swing trading happens in the far corner of my office attic, which must be 200 degrees right now.

Ali then asked me what I think about all that. I suggested he make things easy on himself and look at our most recent recommendation. It made money off of the system he just installed for me…and never had to go into the hot attic. His response, “You need real money to buy and hold.”

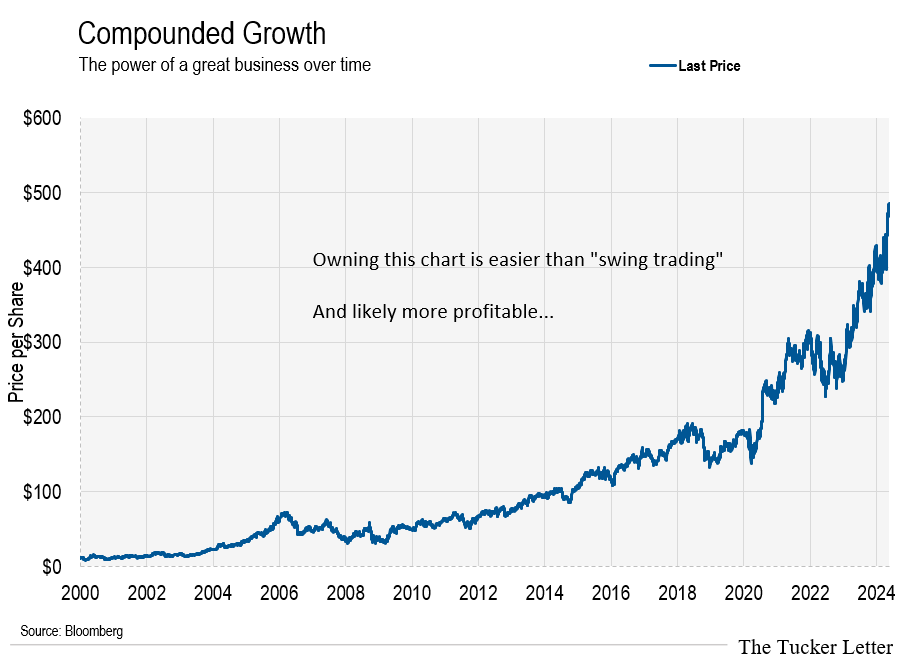

It’s not true. This is the company’s stock chart going back to 2000. $1 grew at the same percentage as $1,000,000 over that period.

It’s almost a guarantee the average person has the same reaction Ali did to that chart. They say it’s too late now, they need the next company that’ll do that. But it’s not true.

Novices want a secret tip. They’re no different than people who wonder out of the bar looking for a dime bag in the alley…if people even do that anymore.

Meanwhile, there’s plenty of action in the bar. People who stay put meet other people, and have fun. People looking for dime bags risked being robbed, or shot.

Turning Japanese

Similar to Japan in the 1980s, our stock market is the envy of the world right now.

In fact, of the ~$55 trillion in U.S. market value, around ~50% belongs to foreigners. Someday, they might sell. If they do, “swing trading” the most popular technology stocks gets difficult.

The swing trading itself is not the hard part. Computers do it easily. But we have preferences, beliefs, and at times, convictions. Computers don’t care about any of that.

We also know people feel comfortable with the last cycle. The one that just ended, or is about to end. New ideas scare us. After we see them for a while, they feel safer. Living through more than a decade of tech stocks trouncing every other segment of the market makes people think they can’t lose. As of now, they’re right.

However, if money starts coming out of U.S. technology stocks, even a little, the computers swing trade those stocks to the downside. Ali and his cohort might get pummeled. If that happens at the far end of my attic, his smartphone could overheat. That would shut down the Schwab trading app.

All the while, he has hands-on knowledge about a company in our portfolio. It’s tightly controlled by a family. They sit on the board. They steer the ship. And so far, they generate growth and profits for us.

Numbers Go Up

While the story stocks of the last bull market might wobble, the price of the things we need keeps rising.

These days, numbers get bigger. They have to. If they shrink, the whole system collapses.

It’s not much different from one of those inflatable bounce houses at a kid’s birthday party. There’s a fan hooked to the side. If air keeps coming in at a steady pace, the house stays inflated. If the flow stops, it collapses into a useless pile of canvas.

Our financial system needs a steady stream of fresh money flowing into it. Without that, it deflates as fast as the bounce house.

And if you notice, the same dime bag junkies looking for a quick score stop to tell you things aren’t right. They’re all convinced we’re in for a crash. If you listen carefully, they’re deluded. If they really believed we faced a crash, they’d keep the dime and do something more practical with it.

The long-term outcome is the chart shown below. The numbers keep going up. They have to go up, and if you have a tie to the American capital markets, you better hope they do.

The lines track U.S. Federal Government outlays. Yardini Research broke the lines out independently.

The top blue line is the total. As of April, U.S. spending is ~$6.34 trillion…and climbing. Nobody volunteers to take a pay cut.

The next time someone tells you things aren’t right with the U.S., ask them about this chart. Which of the lines will collapse?

The red line, tracks Medicare, and social security spending. Unlikely that goes down.

The purple line shooting straight up tracks interest on the government debt heap. That’s going up either with interest rates, or with the size of the pile, which never shrinks.

Imagine yourself as Fed Chairman. You’d look for the path of least resistance. Today, that means carefully controlling the flow of money and credit to keep the bounce house inflated.

It means keeping stock prices on a steady uptick, home prices slowly growing, and wages creeping higher. All that generates more tax revenue.

If you can manage it without people catching on, it’s financial alchemy. People feel wealthy seeing nominal prices constantly rise. And wealthy people don’t revolt.

If that’s the real plan, there’s no need to click on Facebook ads touting life-changing results. Our best performing stocks in the Trustee Portfolio merely promise to do the best job possible running their respective businesses. And so far, that’s good enough for us.