The lobby of the Okura Hotel in Tokyo is a special place.

Not because of who you might run into. In fact, you might not see anyone in the cavernous space. There’s no bar, café, or lobby lounge like you’d expect to see when you enter a premier American hotel.

It’s also not a luxurious space. At least, not in the way we tend to use the term. There’s no marble, expensive artwork, or dramatic lighting. Instead, it’s all about the way the space makes you feel. And it’s all by design.

In fact, the hotel developer and his architects designed every meticulous detail to create a certain feeling.

Take for instance the sitting area at the end of the lobby. While comfortable, it’s also quiet, calm, and elegant. It makes you feel at home. Or maybe the way you wish your home felt.

The architect specifically designed the sitting area as “sunken.” That creates a feeling of separation from the from the main lobby. He used four stairs to achieve this. Not three, not two, exactly four. And it feels perfect.

I read about the Okura in a magazine years ago. While sitting in the lobby last month, I tried to remember what magazine. It may have been Rolling Stone. Either way, it’s a space I wanted to experience in person.

I keep a list of these places. For starters, it helps keep you alive. If you get to the end of the list, you’ll start thinking about what’s next. My strategy is, keep the list growing.

What intrigued me about the Okura is how specific the architects were. What I know is, the owners allowed this attention to detail. Maybe they valued the outcome as much as I do. The product you get when you leave an architect alone is perfect, and hard to quantify.

It’s much easier to recognize poor design. We’ve all stayed in a hotel that just didn’t make sense. We can’t put our finger on it, but the feeling isn’t right. Something doesn’t work. Most of the time, the owner went cheap on design. They call this, “value engineering.” It’s a polite way to say, “penny-pincher.”

Originally built in the early 1960s, the owners replaced a large portion of the Okura a few years ago. The updated section matches the original intent. In fact, they preserved much of the old lobby.

Here are a few comments from Yoshiro Taniguchi, the original designer. Compare them to how you feel in a typical American hotel.

“People who use a hotel are looking for warmth or welcome that gently encompasses what is said to be the heart of travel….It is an emotional process, like devising a Japanese poem. The creation must embrace both the mind and the body.”

He went on to describe the purpose of a hotel lobby as, “a quiet place to relax.” It’s a world away from what we call a nice hotel. It’s intentional, and as close to perfect as I’ve seen.

The Okura hosted every U.S. president back to Nixon. If you make it to Tokyo, it’s worth going out of your way to see the property. At a minimum, the lobby.

When Time Stands Still

Intention is part of the Japanese culture. Up and down the island you feel it in every interaction. It’s more important than fame, fortune, or a quick profit. The feeling sticks with you.

That’s the Japanese culture. Their money is a different story. When it comes to investing, Japan has a lesson for us.

As we discussed last issue, the post-war Japanese production miracle created immense prosperity. They focused on process. They got it right, then ramped it up. When the western world needed products, Japan stood by with the best.

Dollars, pounds, and the world’s solid currency of the day came flooding into Japan. It put the country in position to dominate on the world stage. That is until the 1985 Plaza Accord which right-sized the Japanese yen.

However, its stock market charged ahead for several more years. With the yen sidelined, enthusiasm for Japanese stocks held up until the end of the 1980s.

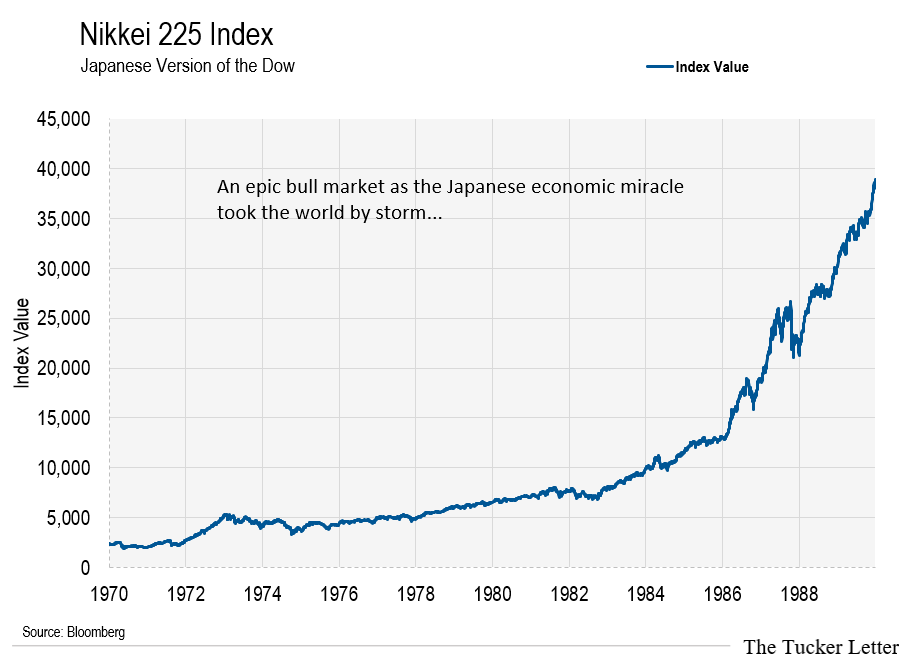

The Japanese equivalent of the Dow Jones Industrial Average is the Nikkei 225. It tracks the price action of the country’s top 225 companies. It’s a globally recognized benchmark for Japanese business.

That means it’s the measure of overall performance for investors. Nikkei up, generally means stock market wealth up. It’s comparable to the indexing investment craze in the U.S.

Most people in the U.S. quit picking stocks a long time ago. In fact, if you bring up individual stock ideas at a dinner party you might get a lecture. Nothing beats index investing, they say. For the past decade at least.

So far this year, a handful of stocks saved the index from decline. They effectively pulled the index into positive territory. Without the surge in NVDIA (NVDA), Meta Platforms (META), Apple (AAPL), Microsoft (MSFT) and Alphabet (GOOGL), the indexes would be much lower.

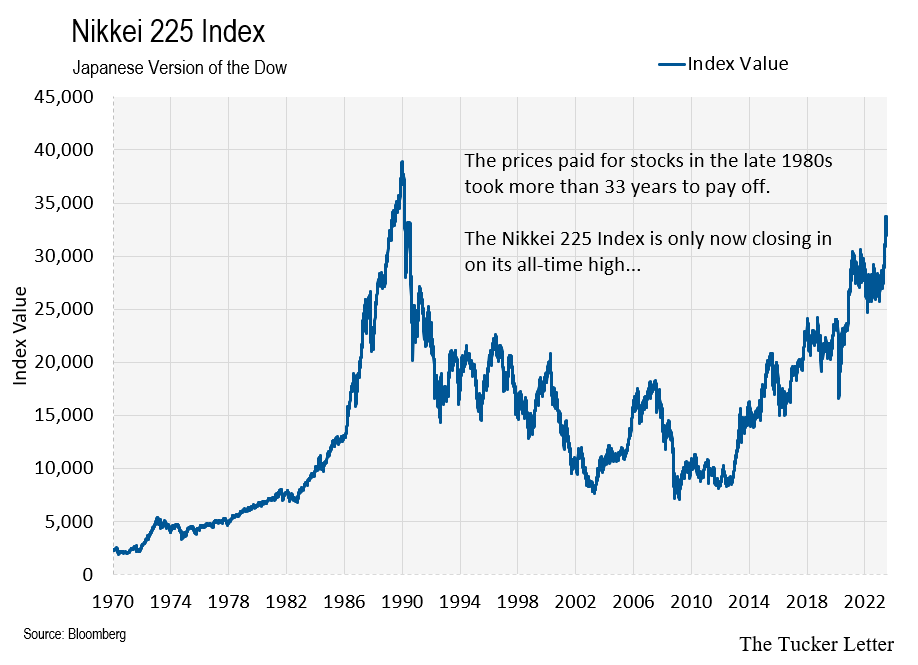

What happened in Japan in the late 1980s might be a warning to us of what’s ahead for the mighty U.S. market.

Think about it. The yen commanded a high valuation against world currencies in the early to mid 1980s. Vacationing in Japan was out of the question for all but the wealthiest Americans.

The dollar has a similar profile today. You might not feel it in suburban America but foreigners do. Visiting the U.S. is expensive. If the country produced products the way it once did, they’d be prohibitively expensive.

And then there’s the stock market similarity. The Nikkei 225 had an epic twenty-year period of consistent stock market outperformance between 1970-1990. People get used to that kind of consistency. Towards the end they’ll pay anything to be part of the trend. The index climbed more than 20-fold over this period.

Japanese stocks seemed unstoppable. In the early days of a move like this people are skeptics. Imagine the average American in the early 1970s. They’d scoff at the idea of owning a Japanese stock. They might be a war veteran. They’d have opinions keeping them from participating. This is normal.

Slowly, people buy in. Over time, people feel left out. We call this FOMO today. By the end, it’s a frenzy.

But frenzy always takes care of itself. People throw caution to the wind to be a part of the popular trend. Sound familiar?

The Japanese bull market did finally end. And when it did, it took more than three decades to get back within reach of its all-time high. Only now, more than 33 years later, does the Nikkei have a shot at regaining its 1989 high.

It Can Happen Here

I want you to ask yourself a question. Try to answer honestly. Would you be willing to hold your current stock portfolio for 33 years to see a return? How about for 18 years?

What that means is you’d watch your stocks chop around. You’d see the price up one year, down the next, for a generation. Most people don’t have the patience. And for good reason.

The problem is, most investors lose perspective. They stick with the herd. When an investment finally goes mainstream, they buy in. They feel part of something, they feel comfortable.

It gets worse. Once they buy in, they’re convicted. It slowly becomes ideological. They talk about it with other believers. They rarely indulge in outside opinions. That’s how U.S. tech stocks feel today.

Everyone in the world has eyes on U.S. tech stocks right now. I sat down for dinner in Kyoto next to a couple I assumed did not speak English. Half way through the meal they started talking to me. He was an art dealer from Hong Kong. She was an executive at the auction house Christie’s.

As my new acquaintance whipped out his phone to photograph the next course, I noticed he had an NVDA stock quote pulled up.

From Hong Kong art dealers to housewives, there are not many fresh eyes left to discover NVDA.

What this means is the convicted run out of new converts. It takes fresh buyers to send stocks higher. It’s that simple.

Stocks overshoot fair value all the time. It’s not unique to the Japanese market being carried away with the economic miracle in the 1970s and 1980s. U.S. stock indexes went nowhere from 1964 to 1982.

During that period, people thought the major U.S. stocks of the day could not go down. An investment in the Dow bounced between 800-1,000 for 18 years.

What this means is a U.S. stock index investor of the 1960s era made no forward progress for almost two decades.

Those investors, convinced of idea that major U.S. stocks were the best thing to own, sat out the 20-fold rally in Japanese stocks. They missed the surge in gold prices from $35 to $800. They missed a speculative mania in commodity stocks set off by the oil price shock. All that passed by while they sat in an index that went nowhere.

When you look over your stock portfolio, ask yourself if you’d be able to sit happily for more than a decade to wait for a payoff. If you’re honest, the answer is no.

Optional Suffering

By the time an investment has mass appeal, I’m skeptical. The herd doesn’t have a good track record when it comes to critical thinking.

That said, it’s a good idea to quiz people about what investments they like. If you get the same answer from enough people, you know the easy part of the trade is over. Time to move on.

These days, things get concentrated quickly. There’s a hive mind of sorts when it comes to investing. Something moves, people pile in, and momentum builds quickly.

But the more this happens, the more the herd ignores other opportunities. The trick is to spot the trend before the herd goes stampeding in. Before they indiscriminately throw money at an idea their cousin tells them is great.

We have an example of this in the trustee portfolio right now. We’re up big on a stock in an overlooked sector. The business keeps getting better. We’ll add to this trade today by adding the competitor of our top pick.

Adding to Winners