Ryan Holdsworth has a 9-year-old Chevy Cruze. He hopes to drive it for another 4 years. He’ll need a miracle to make that happen.

It’s fair to say the Chevy Cruze was not America’s finest engineering moment. It only takes a few minutes browsing comment threads on cruzetalk.com to see why.

I got behind the wheel of one of these beasts a few years ago. Avis rented it to me on a quick 24-hour business trip to Fort Lauderdale. I had real concern I’d make it to the meeting and back to the airport alive. The thought of driving one for 13 years is horrifying.

And it’s not because I’m a car snob. In 2010 I bought a 9-year-old F-150 XL bench seat pickup for $1,800 from a scrap yard. It was my daily driver for five years. I took it cross country, and back. I valet parked it all over Santa Monica and Malibu, CA, sometimes filled with debris. I had the time of my life driving that thing.

But Mr. Holdsworth has a different issue. His job at a local grocery store in Grand Rapids, MI means showing up in a professional manner. He can’t stuff a beat-up work truck with an orange light on top in the employee parking lot.

Plus, he makes a certain amount of money. That means keeping a close eye on expenses. His budget drives decisions, and thanks to an explosion in the cost to borrow money, a new car isn’t in the cards.

Like most Americans, he’s a long way from depression-era fear. But something still doesn’t feel right.

Invisible Pain

According to the latest employment information, everyone has a job. It’s hard to find real pain anywhere in the economy right now. Airports, cruise ships, theme parks, and Vegas hotels all appear to operate at capacity.

The issue is, suddenly, things cost more. And it’s not inflation. At least, not the 1970s type.

We’re in an odd kind of recession. Almost like when scientists tinker with the genes of animals, then breed them to see what happens. Only this time the Fed is the scientist, and the tinkering is with our life savings.

It’s all a consequence of the Fed’s price fixing game. While they don’t fix the price of a Chevy Cruze (no longer in production thankfully) they do fix the price of borrowing to buy one.

After pinning the cost to borrow near 0% for the better part of a decade, the Fed shot rates up overnight. Like a blown-up beachball held under water, the change overshot borrower expectations.

Holdsworth is not alone. People all over the country wonder why they can’t swap the family beater for new wheels every few years anymore. That’s what we did for two decades. We got used to it.

I remember a friend showing off his brand-new Ford Expedition in 2001. That’s about the time the money for nothing era kicked off.

We asked this guy why he bought the new Ford…his other car seemed fine. The answer, “0% financing.” He didn’t actually need a new car. None of us understood at the time how a loan could be free…with respect to the interest rate.

When money is free, people do odd things with it. They get used to it. There was no reason to be thrifty when the new car payment was less than the old one. But those days are over.

50% More Expensive

Barclays says the average cost of a new car jumped ~33% between 2019 and today. On top of that, the cost to insure those wheels rose ~18% last year, and ~12% already this year. The soft costs associated with owning a car add up fast.

Plus, most people don’t walk into the dealership with a checkbook ready to pay for a car on the spot. They need a loan. It means spending more time with the finance manager than the salesman.

Thanks to the Fed’s radical increase in interest rates, the average monthly car payment is ~$730 today. That’s up from only ~$550 in 2019, according to Edmunds. Add all these costs together and the same car is about ~50% more expensive to own and operate compared to just a few years ago.

Meanwhile, the economy chugs along. The old-fashioned capitalist recession never seems to show up. People adjust. They make small sacrifices, hoping the Fed will reverse course soon.

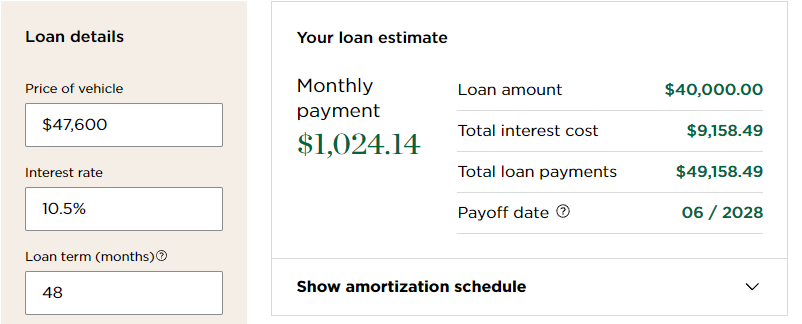

Edmunds also says you’ll pay ~10.5% interest on a new car loan in the state of Georgia for example. That’s for a basic sedan, like a Chevy Cruze.

Plus, the average sales price of a new car is ~$47,600 as of February this year. For an SUV it’s ~$60,000.

The math is not good for buyers. Sky-high interest rates limit what used car buyers can afford. That means trade-ins don’t help. For some owners, it means being “upside down” with their current vehicle worth less than its loan balance.

Considering this, the would-be new car buyer might need to finance most of the purchase. Let’s say a puny trade-in and a tax refund leave ~$40,000 to finance.

The payment on that loan would be ~$1,025 per month. And that’s for an average sedan.

Tack on insurance, taxes, and other costs, you’re looking at upwards of ~$1,500 in monthly expenses before you leave the driveway.

That’s when most people decide to keep driving the car they have…even if they don’t like it.

It means Holdsworth isn’t the only person trying to squeeze a few more years out of a car he’d rather trade.

Older Cars Are The New Normal

When the Fed started tinkering with borrowing costs, we bought cars we didn’t need. Now we’ll drive them longer than planned.

In 2003, the average car on U.S. roads was just over ~9yrs old. Today, it’s ~14.

That’s according to recent data from S&P Global. They also say, “The repair-versus-buy equation changed…” And word on the street backs it up. People still need to get around, even if style suffers.

Up in Michigan, where Mr. Holdsworth pushes his Chevy Cruze beyond the limits of physics, it’s boomtimes for the repair business.

Jay Nuber owns a repair shop focused on Japanese vehicles. He tells the same reporter, “The phone just kept ringing, and the cars just kept coming.”

Overwhelmed with work, he goes on to cite a three week wait for appointments.

New car dealers like AutoNation Inc (AN) and Lithia Motors Inc (LAD) report slow sales. They quickly change the subject to higher revenue and profits from the service center.

These major car dealers have huge lots, filled with cars on loan from the manufacturer. They have armies of salesmen with buzzcuts hovering around cavernous showrooms. The 2021-2022 boom in car demand shot sales to ~17 million vehicles per year.

The company we’ll add to the portfolio today has no lot, no hovering salesmen, and is thrilled to see new vehicle sales falling from ~17 million to 15.8 million in 2023, and an expected ~15.5 million this year.

In fact, it doubles down on excitement relaying the ~3 trillion miles driven by Americans increased 2.1% last year, and 0.6% so far this year. The longer you drive that beater, the more likely you are to walk into one of its 6,131 locations.