Funny things happen when you mess with nature.

Take the aging process for instance. Due to some combination of time, genetics, and the little habits we choose over decades of life, we slowly turn into dried prunes. We all know this. But people go to bizarre lengths to slow, hide, or even reverse the natural process.

Around high school graduation you realize birthdays aren’t what they used to be. Reality slowly sets in. The temptation to appear younger is where people later get in trouble.

From men doing odd things with their hair to people fully reconstructing parts of their face, the desire to control the aging process becomes addictive. These days, we’ve almost normalized it.

And the funny part is, it doesn’t fool anyone. An 80-year-old face that looks like a Labrador with its head out of a moving car window is still 80.

The journey from normal to bizarre seems to start with the first wrinkle. And there’s a whole industry built around selling you a temporary, feel-good fix.

Last year, American people booked and paid for 9.5 million injection appointments in an effort to alter the natural aging process. That’s according to The American Society of Plastic Surgeons.

Botox is the trade name for the most popular “neuromodulator injection” procedure. This essentially disables the nerve signals controlling facial muscles. It slows movement, producing a firm look and feel.

More Juice

Botox is not just for women. While overall annual usage grew at a 9% pace in 2023, the number of men taking injections grew at 5.5%.

Even Gen Z got into the idea of “wrinkle prevention.” The ASPS calls it, “Baby Botox.” If mom gets it, and dad now gets it, the whole family unit can book injection appointments together.

And “unit” is trade lingo for how they price the juice. It’s $10/unit typically. The leading industry trade group reports ~$435 per-visit spent on injections. If that’s straight math it means just shy of 44 units, which sounds like a lot.

Either way, “Baby Botox” is the gateway drug phenomenon people warned us about in the 1980s. A poke, prick, and a few drops of the tox produce a noticeable reaction on a young face. The Gen Z person feels a false sense of control. They come right back at the first sign of new trouble. It’s a never-ending path. Nobody turns back.

Natural aging quickly becomes a bridge too far. By the time the Gen Z’r buys a starter house, injection procedures make up a big portion of fixed monthly spending.

It’s all too easy. The technicians, or estheticians in this case, offer a way out of this universal fact nobody likes. They don’t mention it’s temporary, merely palliative. They gloss over the fact that you’ll be back…and likely needing or at least wanting more and more units to get the same effect.

Fixing that first wrinkle nobody else noticed later turns into the facial equivalent of supporting the walls of a pre-war building.

Only Tangential Experience

I’m not a Botox user. Nothing against the popular procedure, it’s just not for me. But I am very interested in the thought process behind it all. That’s especially true for the people who seem to become chronic users.

Many of my friends regularly take the tox. I’m most amused by the ones who’re otherwise health-minded…or at least aware.

Botox is a toxin. Specifically, it’s a manufactured derivative of Botulinum Toxin. If you’ve ever had horrific food poisoning from bad fish at a down-market restaurant, you’ve technically had Botox. It’s not something you want. Unless it’s injected into your face at one of these trendy beauty clinics.

Imagine, many of these habitual users are the same people who regularly undertake dramatic cleanses, fear germs on doorhandles, and stay up on all the latest health worries. When it comes to wrinkle fighting, the thinking behind the myths and beliefs that cause them fear go right out the window.

Forget about the fact the toxin in larger doses can be fatal, stopping your heart in extreme cases. Afterall, the heart is your most vital muscle. The real danger for these ritualistic users is a thing called “Botox Face.”

As actress Jenny McCarthy demonstrates. You might end up with the look of someone who’s always surprised.

It’s tricky business. Neutralizing some facial nerve endings, and not others. Then managing the long-term nerve damage on top of regular aging in the rest of the body.

At some point you wonder if what started out as just tamping down one wrinkle before a fun getaway weekend requires so much attention it overpowers other natural parts of life.

The First Poke Gets You

It’s easy to see how the false sense of control gets people. Once they taste it, it’s hard to go back to yielding to nature. And it’s not just faces. Anyone who feels they mastered nature has the same trouble giving it up.

Nature, the natural order of systems, always looks for balance. Old people realize what you lose to wrinkles you more than make up in wisdom. At mid-life I already know this. 25-year-old E.B. had more hair, and also ran around in circles at high speed like an unbroken thoroughbred.

Trying to keep some parts of nature and not others doesn’t work. We know it’s true in markets too. Fix the price of oranges and there’s no incentive to grow a premium product. Everyone earns the same. Sure, weaker farmers wouldn’t suffer, but the skilled farmers also wouldn’t win. Set a minimum, and people find it.

But we still talk about a free market system in the U.S. We say it’s the best in the world. Buyers and sellers meet at the market. They haggle, even digitally, and set the price of things. Increasingly, it doesn’t work that way.

Almost thirty years ago we started tinkering with our financial market. At first, to soften the blow from tumult, like regional currency crises. Then tech blow ups, then recessions, like the one in 2002.

The numbers started small, a billion here or there. Secret Fed meetings on a weekend with primary dealers to handle this or that. Small, in the shadows, and relatively boring. But it worked. The Greenspan Fed felt like it managed an otherwise free market. People called him “The Maestro.”

Like the first wrinkle, small injections got big results. Recessions, like the one in 2002, felt shorter with a little nudge from the Fed. Just a sprinkle of extra help went a long way. After 2002 it was unusually low borrowing rates, a boost to homeownership, and easy credit standards.

Over time, it takes more juice to get the same result. The small interventions got bigger in September 2008. When the world froze, financial media told us we’d lose everything from our local bank to our auto insurance provider. The Fed needed to step in.

For context, the Fed balance sheet grew from ~$600 billion around 2000 to ~$800 billion in 2008. It felt big at the time, but small today. That’s only ~33% in eight years. Plus, most of the name-brand tech moguls these days have a net worth higher than that increase which took nearly a decade to accrue.

The 2002-2008 increase looks tiny now. Over time it takes more and more. And there truly is no going back.

In economic terms, once you inflate, you create dependence. Failing to inject when the Botox loses effect means your face collapses.

More Units

Take the September 2008 emergency TARP program for instance. That was the controversial Troubled Asset Relief Program.

Essentially, the program was a safe the western world effort. A blank check, if you will.

The headline number was $700 billion. That later shrunk to $435 billion. The GAO says the true cost was a mere $31 billion. Peanuts by today’s standards.

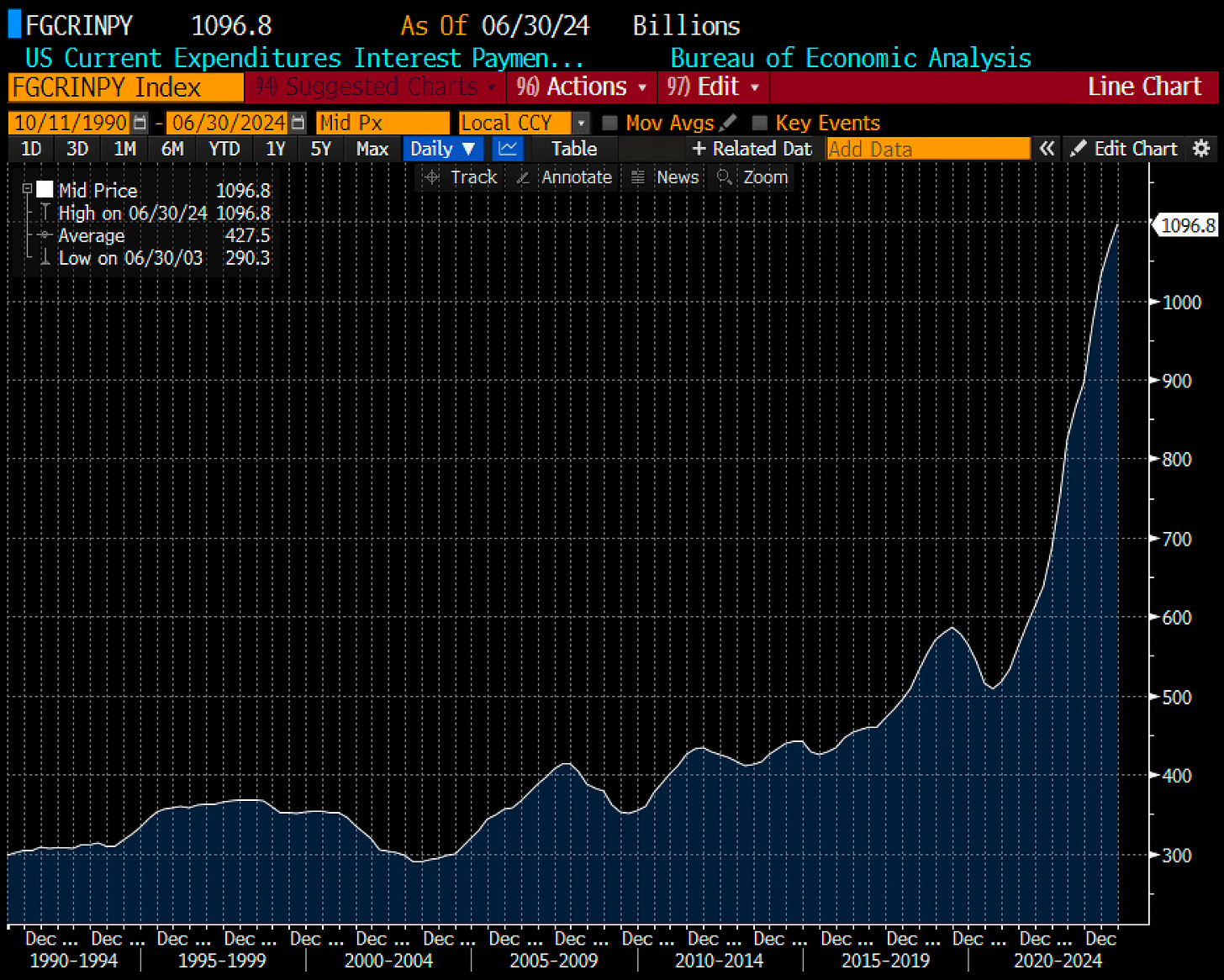

We’ll spend more than thirty-five-times that amount this year on interest payments alone. We’d kill for a fix so cheap it only cost $31 billion.

It’s how the late Joan Rivers must have felt after her first cosmetic procedure. That first wrinkle was nothing. It later felt like filling the Grand Canyon to get results.

And I think the Fed knows exactly what it’s up against. If people saw it for what it is, they’d quit playing. You have to keep playing. If you don’t, the whole thing collapses.

The trouble is, on a personal level, if you think to rationally, you get left behind. $1 million in savings thirty years ago was real money. A middle-class retirement… Now it’s nothing. And the risk you take on to keep up is excessive. But you have to take it.

And it makes sense. U.S. tax receipts tend to track GDP. They manage to always sit at about ~18% of GDP. If you’re the Fed, you want to keep that growing. And it’s not easy. Managing a centrally-controlled economic system means monitoring sentiment across markets at all times.

Too many units injected and things go off kilter. Too few, and they collapse.

It’s good to know Jefferson takes decisions, “meeting-by-meeting.” I’m not sure how else you’d make them. Or, “take them” in his case according to the article.

But he also knows, we absolutely cannot have a recession. People will have real panic attacks…not just the ones they pretend to have on TikTok.

A recession is tightening of business conditions, two quarters of negative GDP growth to be specific. We don’t have that kind of time. Instead, we have brief, but violent panics.

We’re Due for A Panic

The modern slips are outright free fall. It’s not buyers and sellers, it’s computers fighting other computers to see who can sell fastest. They last a few weeks. Then the injection teams coming running with as many units as necessary.

We chose long ago to abandon that natural process. We poked, filled, and juiced every viable piece of skin on our economic face. It’s too late to turn back. We’ve gone to a palace where all we can do is keep injecting.

You really have to wonder, would letting the recession play out naturally be that much worse…but it’s too late.

We have no choice but to watch the Fed. Forget the headlines, it’s about the actions. And there are two indicators to keep on our screen.

The first is the yield curve. We know it’s a problem. No healthy borrower pays 40% more interest to borrow money for a month than for 10-20 years.

To keep this simple… You walk into the Audi dealer and order a brand new S7, fully tricked out. You want to make payments. The finance person says it’s 10% APR if you sign a 1-year loan, or 5% APR if you sign a 6-year loan.

The Fed knows it has wolves circling the market for Treasury debt. That means the derivative markets built on top of that key rate setting market also follow. It’s a mess, and everyone sees it.

That’s why the second indicator is so important. We’ve talked about it for almost two years. We’ve said on repeat, when it gets down to ~$100 billion or so, it means a loaded Fed ready to soothe the next panic.

And until then, there’s a high value on staying ready. In the portfolio review today we’ll note some serious winning with a few of our holdings. Overall, we’re running a few steps ahead of the index pack. That’s how we want to keep it.

But first, BSO Roland almost prevented this issue of TTL from publication.

Canadian Border Services Agency (CBSA)

BSO Roland takes his work seriously. While all Border Services Officers accept a call to duty, he’s on warpath to stamp out freedom entirely.